Quarterly national accounts in Q1 2017 National accounts in base 2010 - Detailed figures

French GDP increased by 0.3% in Q1 2017 Quarterly national accounts - first estimate - first quarter 2017

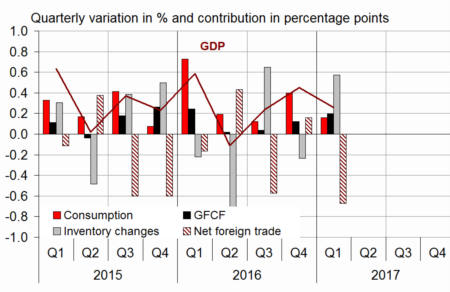

In Q1 2017, GDP in volume terms* slowed down: +0.3%, after +0.5% in Q4 2016. Households' consumption expenditure stalled (+0.1% after +0.6%). However, total gross fixed capital formation (GFCF) accelerated again (+0.9% after +0.6%). All in all, final domestic demand excluding inventory barely slowed: it contributed to GDP growth for +0.4 points after +0.5 points in the previous quarter.

Exports fell back significantly (−0.7% after +1.4%) while imports accelerated (+1.5% after +0.8%). All in all, foreign trade balance weighed down on GDP growth: −0.7 points after +0.2 points in the previous quarter. Conversely, changes in inventories contributed positively (+0.6 points after −0.2 points).

In Q1 2017, GDP in volume terms* slowed down: +0.3%, after +0.5% in Q4 2016. Households' consumption expenditure stalled (+0.1% after +0.6%). However, total gross fixed capital formation (GFCF) accelerated again (+0.9% after +0.6%). All in all, final domestic demand excluding inventory barely slowed: it contributed to GDP growth for +0.4 points after +0.5 points in the previous quarter.

Exports fell back significantly (−0.7% after +1.4%) while imports accelerated (+1.5% after +0.8%). All in all, foreign trade balance weighed down on GDP growth: −0.7 points after +0.2 points in the previous quarter. Conversely, changes in inventories contributed positively (+0.6 points after −0.2 points).

* This growth rate is seasonally and working-day adjusted; volumes are chain-linked previous-year-prices volumes.

graphiqueGraph – GDP and its main components

- Source: INSEE

tableauTab1 – GDP and its main components: chain-linked volumes

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2016 | 2017 (ovhg) | |

|---|---|---|---|---|---|---|

| GDP | -0.1 | 0.2 | 0.5 | 0.3 | 1.1 | 0.7 |

| Imports | -1.5 | 2.6 | 0.8 | 1.5 | 3.5 | 3.0 |

| Household consumption *expenditure | 0.2 | 0.1 | 0.6 | 0.1 | 1.8 | 0.7 |

| General government's *consumption expenditure | 0.4 | 0.3 | 0.3 | 0.4 | 1.4 | 0.8 |

| GFCF | 0.1 | 0.2 | 0.6 | 0.9 | 2.7 | 1.4 |

| *of which Non-financial corporated and unincorporated enterprises | 0.1 | -0.1 | 0.9 | 1.3 | 3.9 | 1.9 |

| Households | 0.5 | 0.7 | 0.9 | 0.9 | 2.1 | 2.1 |

| General government | -0.7 | 0.2 | -1.2 | -0.4 | -0.7 | -1.4 |

| Exports | -0.1 | 0.8 | 1.4 | -0.7 | 1.2 | 0.7 |

| Contributions : | ||||||

| Internal demand excluding inventory changes | 0.2 | 0.2 | 0.5 | 0.4 | 1.9 | 0.9 |

| Inventory changes | -0.8 | 0.6 | -0.2 | 0.6 | -0.1 | 0.6 |

| Net foreign trade | 0.4 | -0.6 | 0.2 | -0.7 | -0.7 | -0.7 |

- Source: INSEE

Total production slowed down

Production in goods and services slowed down in Q1 2017 (+0.3% after +0.6%). It fell back markedly in goods (−0.6% after +1.0%) while it increased almost at the same pace as in the previous quarter in services (+0.6% after +0.5%).

Electricity and gas production shrank. Output in manufactured goods also fell back (−0.5% after +0.7%), mainly due to the coke and refined petroleum branch and to a slowdown in transport equipment. By contrast, production accelerated in construction (+0.6% after +0.2%) and increased in market services almost at the same pace as in the previous quarter (+0.6% after +0.7%).

Household consumption was sluggish

Household consumption expenditure stalled in Q1 2017 (+0.1% after +0.6%): a sharp downturn in goods (−0.4% after +1.0%) dominated a slight acceleration in services (+0.5% after +0.3%).

Particularly, expenditure on energy fell back strongly (−3.8% after +3.7%): temperatures in winter 2017 were rather mild for the season, after a cool autumn 2016. Consumption of engineered goods decelerated (+0.4% after +1.0%), mainly due to a decline in vehicle purchases. By contrast, consumption of food products bounced back slightly (+0.3% after −0.3%).

Corporate investment accelerated, household investment kept on increasing

In Q1 2017, total GFCF rose again sharply (+0.9% after +0.6%), especially that of enterprises (+1.3% after +0.9%) and that of households (+0.9% after +0.9%). Investment in market services increased sharply (+1.2% after +0.7%), particularly in business services. GFCF in construction accelerated slightly (+0.3% after +0.1%), despite a fall in civil engineering. Similarly, investment in manufactured goods was slightly more dynamic (+1.5% après +1.3%), mainly due to equipment goods.

Foreign trade balance weighed down on GDP growth

Exports fell back in Q1 2017 (−0.7% after +1.4%), especially in transport equipment. At the same time, imports increased (+1.5% after +0.8%). Particularly, sales in refined petroleum products bounced back and those in other industrial goods increased vigorously. All in all, foreign trade balance weighed down on GDP growth by −0.7 points, after a contribution of +0.2 points in the previous quarter.

Changes in inventories increased significantly

In Q1 2017, the contribution of changes in inventories to GDP growth amounted to +0.6 points (after −0.2 points at the end of 2016). They increased especially in transport equipment and other industrial goods (chemicals, pharmaceuticals and plastic products).

Revisions

GDP growth estimate for Q4 2016 is revised upward by +0.1 points, from +0.4% to +0.5%. On average over the year, it is confirmed at +1.1% in 2016. Slight revisions in different aggregates offset each other; they are mainly due to the revision of indicators and to the update of seasonal adjustment coefficients.

tableauTab3 – Production, consumption and GFCF: main components

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2016 | 2017 (ovhg) | |

|---|---|---|---|---|---|---|

| Production of branches | -0.2 | 0.5 | 0.6 | 0.3 | 1.4 | 1.0 |

| Goods | -0.7 | 0.1 | 1.0 | -0.6 | 0.1 | 0.0 |

| Manufactured Industry | -1.0 | 0.6 | 0.7 | -0.5 | 0.6 | 0.0 |

| Construction | -0.4 | 0.9 | 0.2 | 0.6 | 0.7 | 1.1 |

| Market services | 0.0 | 0.7 | 0.7 | 0.6 | 2.2 | 1.5 |

| Non-market services | 0.3 | 0.2 | 0.2 | 0.3 | 1.2 | 0.6 |

| Household consumption | 0.2 | 0.1 | 0.6 | 0.1 | 1.8 | 0.7 |

| Food products | -0.5 | 0.8 | -0.3 | 0.3 | 0.8 | 0.3 |

| Energy | 1.5 | -1.4 | 3.7 | -3.8 | 1.8 | -1.5 |

| Engineered goods | 0.3 | -0.9 | 1.0 | 0.4 | 2.4 | 0.8 |

| Services | -0.1 | 0.5 | 0.3 | 0.5 | 1.5 | 1.0 |

| GFCF | 0.1 | 0.2 | 0.6 | 0.9 | 2.7 | 1.4 |

| Manufactured goods | 0.1 | -2.3 | 1.3 | 1.5 | 5.5 | 1.3 |

| Construction | -0.2 | 0.6 | 0.1 | 0.3 | 0.8 | 0.7 |

| Market services | 0.4 | 1.3 | 0.7 | 1.2 | 3.4 | 2.5 |

- Source: INSEE

tableauTab2 – Sectoral accounts

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| Profit ratio of NFCs* (level) | 31.6 | 31.6 | 31.7 | 31.4 | 31.7 | |

| Households' purchasing power | 0.3 | 0.6 | 0.1 | 1.6 | 1.9 |

- *NFCs: non-financial corporations

- Source: INSEE

tableauTab4 – Households' disposable income and ratios of households' account

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| HDI | 0.3 | 0.8 | 0.4 | 1.4 | 1.9 | |

| Household purchasing power | 0.3 | 0.6 | 0.1 | 1.6 | 1.9 | |

| HDI by cu* (purchasing power) | 0.2 | 0.5 | 0.0 | 1.2 | 1.4 | |

| Adjusted HDI (purchasing power) | 0.3 | 0.6 | 0.2 | 1.6 | 1.8 | |

| Saving rate (level) | 14.4 | 14.9 | 14.5 | 14.5 | 14.5 | |

| Financial saving rate (level) | 5.3 | 5.8 | 5.3 | 5.5 | 5.5 |

- *cu: consumption unit

- Source: INSEE

tableauTab5 – Ratios of non-financial corporations' account

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| Profit share | 31.6 | 31.6 | 31.7 | 31.4 | 31.7 | |

| Investment ratio | 23.5 | 23.4 | 23.4 | 22.9 | 23.4 | |

| Savings ratio | 20.6 | 20.8 | 20.7 | 19.7 | 20.8 | |

| Self-financing ratio | 88.0 | 88.9 | 88.4 | 86.3 | 89.0 |

- Source: INSEE

tableauTab6 – Expenditure, receipts and net borrowing of public administrations

| 2016 Q2 | 2016 Q3 | 2016 Q4 | 2017 Q1 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| In billions of euros | ||||||

| Total expenditure | 313.9 | 315.6 | 314.7 | 1244.0 | 1256.7 | |

| Total receipts | 294.9 | 294.6 | 296.9 | 1165.3 | 1180.5 | |

| Net lending (+) or borrowing (-) | -19.0 | -21.1 | -17.8 | -78.7 | -76.2 | |

| In % of GDP | ||||||

| Net lending (+) or borrowing (-) | -3.4 | -3.8 | -3.2 | -3.6 | -3.4 |

- Source: INSEE

Avertissement

Quarterly national accounts

Quarterly debt of the general government

Sources

Quarterly national accounts

Quarterly accounts are a consistent set of indicators which provides a global overview of recent economic activity.

Time series of the main aggregates of quarterly national accounts can be accessed through the "Summary". They are classified into eight categories:

- Gross domestic product (GDP) and main economic aggregates ;

- Goods and services ;

- Households' consumption ;

- Foreign trade ;

- Activities ;

- Institutional sectors ;

- Households' income and purchasing power ;

- Public finances.

For each category, are available :

- synthetic files displaying from the accounts the relevant information for economic analysis ,

- sometimes, one or two files displaying all the data available.

Documentation

Abbreviated methodology (pdf, 140 Ko )

Methodology - First estimate at 30 days (pdf, 112 Ko )