Indexation of contracts

Insee publishes various indices which can be used to index-link contracts.

The choice of indices and formulae used for indexing purposes in contracts remains the sole responsibility of the contracting parties. The contracting parties’ freedom of choice is the guiding principle here.

Where can I find indices to index-link a contract ?

Indexation formulae generally depend either on a producer sale price index for the product in question, used to neutralise inflationary risk for the buyer, or one or more indices measuring the costs borne by the supplier, most often the producer sale price indices for the products purchased by the supplier, in order to neutralise inflationary risk for the vendor. This latter solution is generally preferable in terms of the economic optimum (eliminating the ‘inflationary risk premium’ from the supplier’s prices).

Further details regarding Insee indices, if the following elements feature in your contracts :

Producer sale prices

Producer price indices for products sold at market prices are given in the ‘prices and price indices’ section, covering different segments of the economy in accordance with the economic classification of activities and products: agriculture, industry, services, construction. More detailed products, sometimes more precise than the four-figure classes, are available in the groups ‘Divisions, groups and classes levels in CPF Rev. 2’.

Producer price indices

The wholesale food price index (IGPA)

Producer price indices for French industrial goods sold in the French market (2010 base) – Market prices

Price index for the sale of French services to French businesses (BtoB) – Market prices

Producer price index for construction

Supplier’s costs

Only agricultural and construction (buildings, civil engineering etc.) activities have price indices which take all cost dimensions into account (materials, labour, energy, services, transportation, waste management).

Agricultural means of production purchasing price index

Cost of production indices for construction

- The Building Index (BT)

- The Civil Engineering Index (TP)

- Various other indices (EV, FD, FG, FV, ING, PMR, TR)

For other activities, the components which make up suppliers’ costs are generally covered by the producer price indices for sales at market prices of products purchased by suppliers (see above).

Raw materials and imported products

For contracts involving the supply of raw materials which have been mostly imported, there are specific indices and price measurements which are more suitable than the producer sale price indices, available in the following section:

International price indices and prices for raw materials

- International price indices for imported raw materials – 2000 base

- International prices for raw materials

- International price indices in Euros for raw materials – 2010 base

- Exchange rates for foreign currencies used to measure the prices of imported raw materials

Industrial goods which are primarily imported can also be evaluated using ‘domestic supply’ indices, combining producer price indices and import price indices:

Price indices for the domestic supply of industrial products (2010 base)

The import price indices for industrial goods may also be used, but they are more liable to subsequent revision.

Wages – labour costs

Labour cost indices have their own dedicated section in the chapter ‘wages, income, social security contributions and the cost of labour’. Find the segment of activity corresponding to the product in question.

Cost of labour and hourly cost of labour

- Revised hourly cost of labour ICHTrev-TS (2008 base) – Mechanical and electrical industries

- Revised hourly cost of labour ICHTrev-TS (2008 base) – By detailed sector of activity and frequency

What should I do in the e vent of a break in the index series ?

Contracts may explicitly define the method to be used to replace an old series with a new one. The following advice is therefore only of use in the absence of such explicit instructions.

Linking methods

When a chronological series is ‘broken’, the ‘corresponding series’ link in the macroeconomic databank will almost always give a new series of identical (change of base) or very similar scope (generally a subset or superset), with a linking coefficient and date. The linking date corresponds to the last period for which the old series provides a ‘definitive’ value. Up to and including this date, there is no need to substitute the new series for the old one. After this date, however, it is important to use the new series and to transform it into a series consistent with the old one by multiplying the values by the linking coefficient, calculated as the ratio between the old and new series as of the linking date. The linking coefficient is rounded to 4 decimal places, but the product should generally be rounded to 1 decimal place: as with the old series published on the Insee website.

The double fraction method

In the event that a broken time series has no designated corresponding series, or if this new series appears ill-suited to the needs of the contracting parties, the parties must agree on which new series to use, amending their contract accordingly. The method to be applied here is known as the double fraction method, and consists of breaking down the development of this series into discrete, homogenous series for two time periods: an old series up to the stoppage date, then a new series.

Equivalence of these two methods

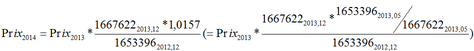

These two methods are equivalent, rounded to the nearest decimal place. Taking as an example the idbank code series 001653396, replaced in May 2013 by the idbank code series 001667622 with a linking coefficient of 1.0157, the first method gives :

Solving the equation numerically gives Price2013 * 0.963 (rounding each operation to 3 decimal places).

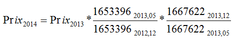

And the second :

i.e. the same values, but solving the equation numerically gives Price 2013 * 0.962 (rounding each operation to 3 decimal places), because the values are not rounded off in the same order.

The Macro-economic database(BDM): over 170.000 series and indices covering all economic and social fields.