24 May 2016

2016- n° 132In May 2016, the economic climate is stable in the building construction industry Monthly survey of building - May 2016

24 May 2016

2016- n° 132In May 2016, the economic climate is stable in the building construction industry Monthly survey of building - May 2016

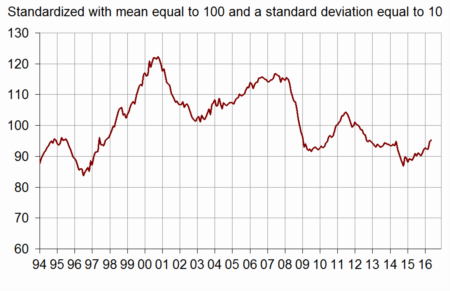

According to the business managers surveyed in May 2016, the business climate is stable in the building construction industry after having recovered in the last month. The composite indicator stands at 95, below its long-term average (100).

According to the business managers surveyed in May 2016, the business climate is stable in the building construction industry after having recovered in the last month. The composite indicator stands at 95, below its long-term average (100).

graphiqueClimate – Business climate composite indicator

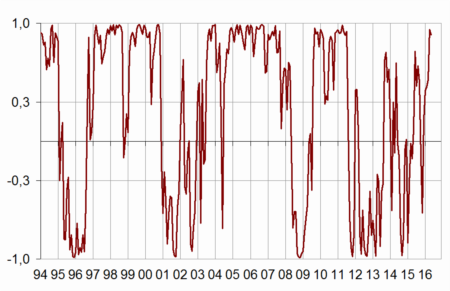

graphiqueTurningPoint – Turning-point indicator

- Note: close to 1 (respectively −1), it indicates a favourable climate (respectively unfavourable). Between +0,3 and −0,3: uncertainty area

The turning point indicator remains in the zone indicating a favourable short-term economic climate.

Revisions

The business climate in April 2016 has been revised upward by one point since its first estimate, because of late businesses' answers that have been taken into account.

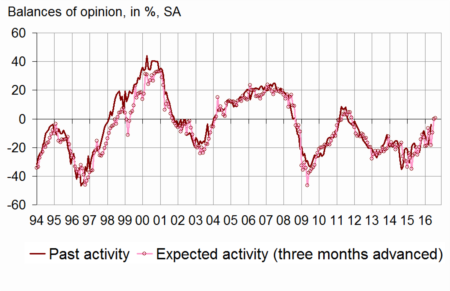

Business managers' opinion about past activity has improved

In May 2016, significantly fewer business managers than in April indicate a fall in their past activity. The corresponding balance of opinion has returned to its long-term average, a level not seen since February 2012. The balance of opinion on expected activity is virtually stable above its long-term average, after a strong recovery in April.

graphiqueActivity – Activity tendency in building construction

tableauTableau1 – Building industry economic outlook

| Mean* | Feb. 16 | Mar. 16 | April 16 | May 16 | |

|---|---|---|---|---|---|

| Composite indicator | 100 | 92 | 92 | 95 | 95 |

| Past activity | –4 | –15 | –18 | –12 | –4 |

| Expected activity | –7 | –19 | –10 | 0 | 1 |

| Gen. business outlook | –19 | –14 | |||

| Past employment | –5 | –24 | –25 | –22 | –22 |

| Expected employment | –5 | –22 | –20 | –19 | –13 |

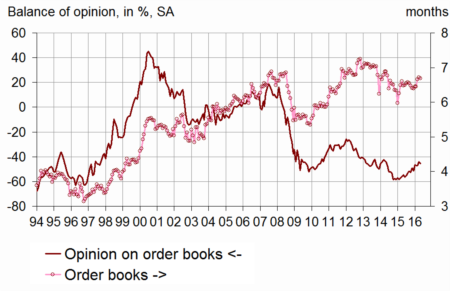

| Opinion on order books | –24 | –47 | –47 | –44 | –45 |

| Order books (in month) | 5,4 | 6,5 | 6,7 | 6,7 | 6,7 |

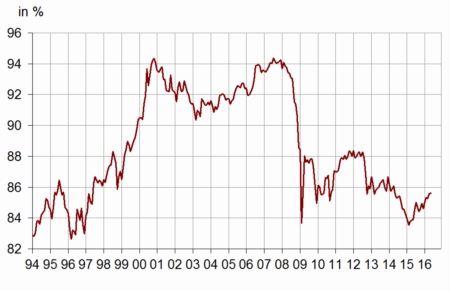

| Production capacity utilisation rate | 88,5 | 85,3 | 85,3 | 85,6 | 85,6 |

| Obstacles to production increase (in %) | 32 | 20 | 21 | 21 | 21 |

| - Because of workforce shortage (in %) | 14,2 | 2,8 | 2,9 | 2,8 | 2,9 |

| Recruiting problems (in %) | 57 | 40 | |||

| Expected prices | –15 | –30 | –27 | –26 | –25 |

| Cash-flow position | –10 | –11 | |||

| Repayment period | 29 | 30 |

- * Mean since September 1993.

- Source: INSEE, French business survey in the building industry

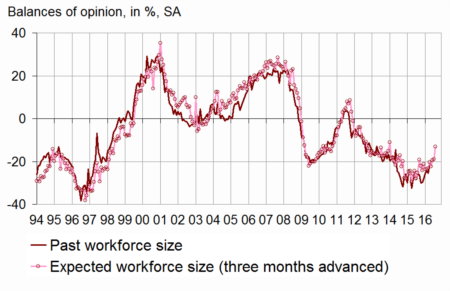

Business managers are less pessimistic about employment prospects

In May 2016, fewer business managers than in April forecast a fall in their staff size for the next three months. Nonetheless, as many business managers as in April point out that their staff size fell during the last three months. The two balances of opinion on past and expected employment stand below their long-term average.

graphiqueWorkforce – Workforce size tendency in building construction

Order books still judged very low

Business managers continue to deem their order books much lower than normal. The corresponding balance is virtually stable in May, far below its long-term average. With their staff size, business managers consider that their order books provide 6.7 months of work, a level stable and above its long term average (5.4 months).

graphiqueOrderBooks – Order books

- Source: INSEE, French business survey in the building industry

Production capacity remain underused

Since 2008, the production capacity utilisation rate has stood below its long-term average. In May 2016, it is stable at 85.7 %. Almost one business manager out of five has reported difficulties in increasing output, against one out of three in average since 1993.

graphiquePcur – Production capacity utilisation rate

Prices mostly reported as falling

In May 2016, almost as many business managers as in March forecast price falls. The corresponding balance remains substantially below its long-term average.

Documentation

Methodology (2016) (pdf,170 Ko)