25 July 2014

2014- n° 173In July 2014, the demand for new dwellings decreases again Quaterly business survey in the real-estate development - July 2014

25 July 2014

2014- n° 173In July 2014, the demand for new dwellings decreases again Quaterly business survey in the real-estate development - July 2014

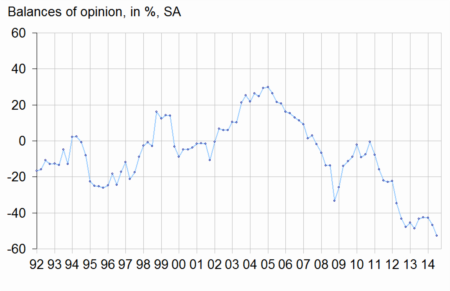

In July 2014, substantially more developers than in April indicate a fall in the demand for new housing. The corresponding balance of opinion remains significantly below its long-term average and has reached its lowest level since the series is (1991). Business managers forecast a decline in housing starts for sale and for rent for the next three months.

The demand for new dwellings decreases

In July 2014, substantially more developers than in April indicate a fall in the demand for new housing. The corresponding balance of opinion remains significantly below its long-term average and has reached its lowest level since the series is (1991). Business managers forecast a decline in housing starts for sale and for rent for the next three months.

Unsold dwelling stock increase

More developers than in April indicate a rise of unsold dwelling stock. So the balance of opinion is still sharply above its long-term average.

More developers indicate a drop in prices

In July, sharply more developers than in April indicate a fall in average prices of new housing; the corresponding balance of opinion is again significantly below its long-term average. Their opinion about the downpayment to acquire a new dwelling has degraded compared to the previous quarter. Far fewer developers than in April forecast a decrease in the financing capacity to purchase a new housing.

tableautableau1 – Building construction economic outlook

| Mean* | Oct. 13 | Jan. 14 | April 14 | July 14 | |

|---|---|---|---|---|---|

| New dwelling demand | –8 | –43 | –43 | –47 | –53 |

| Expected housing starts | –6 | –24 | –18 | –24 | –38 |

| - for sale | –15 | –30 | –27 | –36 | –52 |

| - for rent | 1 | –9 | –8 | –6 | –17 |

| Unsold dwelling stock tendency | –27 | –19 | –13 | –15 | –9 |

| Housing average price for sale | 6 | –21 | –24 | –22 | –31 |

| Downpayment | –21 | –46 | –41 | –39 | –47 |

| Financing capacity | –23 | –48 | –42 | –55 | –40 |

- * Mean since July 1991.

- Source: French business survey real-estate development - Insee

graphiqueDemand – New dwelling demand tendency