25 February 2015

2015- n° 41In February 2015, households’ confidence improves (+2 points) Monthly consumer confidence survey - February 2015

25 February 2015

2015- n° 41In February 2015, households’ confidence improves (+2 points) Monthly consumer confidence survey - February 2015

In February 2015, households’ confidence improves; the synthetic confidence index gains 2 points and reaches its highest value since May 2012. However, it remains distincly below its long-term average.

In February 2015, households’ confidence improves; the synthetic confidence index gains 2 points and reaches its highest value since May 2012. However, it remains distincly below its long-term average.

Personal situation

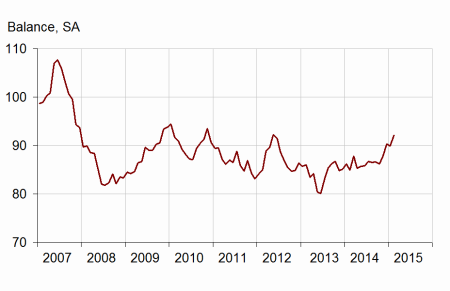

Financial situation: rising

So far this month, households’ opinion of their past financial situation and their appreciation on their future financial situation have improved slightly (+2 points). These two balances stay nevertheless below their long-term average.

Likewise, more households consider it is a suitable time to make major purchases (+3 points). The balance, at its highest value since October 2007, is close to its long-term average.

Savings intentions: slipping

In February, households’ opinion of their current saving capacity is stable, as well as their opinion of their future saving capacity. These two balances remain above their long-term average.

The share of households thinking it is an opportune time to save decreases again (–2 points). The balance deviates a bit more from its long-term average.

graphiquegraph1_english – Consumer confidence synthetic index

tableauTab_eng – CONSUMER OPINION: synthetic index and opinion balances

| 2014 | 2015 | ||||

|---|---|---|---|---|---|

| Av. (1) | Nov. | Dec. | Jan. | Feb. | |

| Synthetic index (2) | 100 | 88 | 90 | 90 | 92 |

| Financial sit., past 12 m. | –19 | –33 | –27 | –29 | –27 |

| Financial sit., next 12 m. | –4 | –17 | –15 | –17 | –15 |

| Current saving capacity | 8 | 13 | 17 | 14 | 14 |

| Expected saving capacity | –10 | –4 | –2 | –5 | –5 |

| Savings intentions, next 12 m. | 18 | 17 | 26 | 16 | 14 |

| Major purchases intentions, next 12 m. | –14 | –21 | –22 | –18 | –15 |

| Standard of living, past 12 m. | –43 | –67 | –67 | –67 | –62 |

| Standard of living, next 12 m. | –23 | –47 | –43 | –41 | –37 |

| Unemployment, next 12 m. | 32 | 64 | 67 | 63 | 61 |

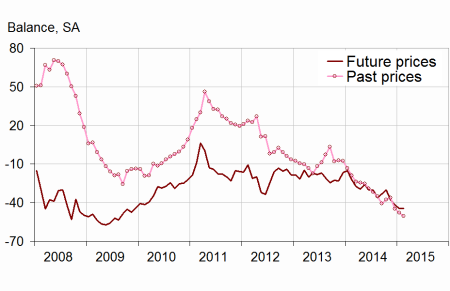

| Consumer prices, past 12 m. | –13 | –36 | –45 | –48 | –50 |

| Consumer prices, next 12 m. | –34 | –38 | –42 | –45 | –44 |

- (1) Average value between January 1987 and December 2014

- (2) This indicator is normalised in such a way that its average equals 100 and standard error equals 10 over the estimation period (1987-2014).

- Source: INSEE, monthly consumer confidence survey

Economic situation in France

Standard of living in France: picking up

In February, households’ opinion of the past standard of living in France improves distinctly (+5 points) after three months of stability; their appreciation on the future standard of living improves for the fourth month in a row (+4 points in February), and reaches its highest value since June 2012. These two balances remain however far below their long-term average.

Unemployment: fears slightly receding

Fewer households think that unemployment will rise: the corresponding balance decreases by 2 points in February (after -4 points in January). However, it remains distinctly above its long-term average.

Past inflation: at the lowest since 1999

The share of households thinking that prices increased eases back (–2 points), thereby reaching its lowest level since the end of 1999. It remains therefore clearly below its long-term average.

Households are almost as numerous in February as in January to expect a rise in prices: the corresponding balance increases by 1 point compared to January, after losing 15 points since October. It remains at its lowest level since December 2009, below its long-term average.

graphiquegraph2_english – Balances on personal financial situation and standard of living

graphiquechomage_en – Households' unemployment expectations

graphiqueprix_en – Households' perception of prices