23 January 2014

2014- n° 15In January 2014, the business climate in manufacturing industry is stable Monthly business survey (goods-producing industries) - January 2014

23 January 2014

2014- n° 15In January 2014, the business climate in manufacturing industry is stable Monthly business survey (goods-producing industries) - January 2014

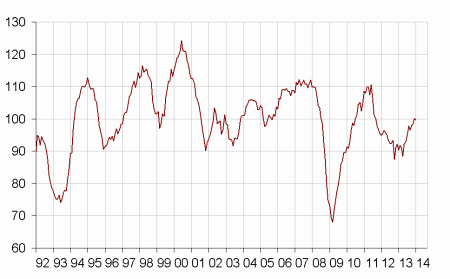

According to the business managers surveyed in January 2014, the business climate in industry has not changed compared to the previous month. The composite indicator is stable and stands at its long-term average.

Manufacturing industry

According to the business managers surveyed in January 2014, the business climate in industry has not changed compared to the previous month. The composite indicator is stable and stands at its long-term average.

graphiqueGraphang1 – Industrial economic climate - Composite indicator

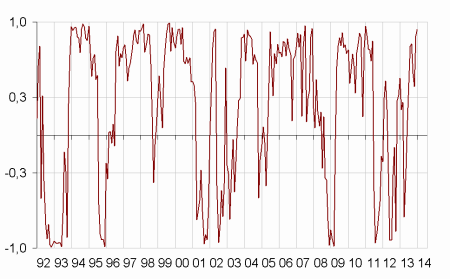

The turning-point indicator is nearly stable compared to December and keeps indicating a favorable economic outlook dynamic.

graphiqueGraphang2 – Turning-point indicator

The balance of opinion on past change in production has weaken markedly and is below its long-term average. On the contrary, the balance of opinion on personal production expectation has improved and stands now at a level above its long-term average.

Global and export order books have improved slightly compared to the previous month. But while the level of the global demand is described now close to the normal level, business managers are still considered the one of the foreign demand low .

The balance on general production expectations, which represents business managers’ opinion on French industry as a whole, has improved again and has reached a level above its long-term average.

Finally, stocks of finished products keep going down and theirs levels are considered as markedly below their normal level.

tableautableau1 – Industrialists ‘opinion on manufacturing industrial activity

| Manufacturing industry | Aver. (1) | Oct. 13 | Nov. 13 | Dec. 13 | Jan. 14 |

|---|---|---|---|---|---|

| Composite indicator (2) | 100 | 98 | 98 | 100 | 100 |

| Past activity | 4 | –1 | 9 | 11 | –1 |

| Finished-goods inventory | 13 | 10 | 13 | 9 | 6 |

| Global order books | –18 | –24 | –23 | –21 | –19 |

| Export order books | –14 | –21 | –21 | –20 | –18 |

| Personal production expectations | 5 | 8 | 1 | 4 | 9 |

| General production expectations | –9 | –6 | –17 | –11 | –5 |

- (1) Average since 1976.

- (2) This indicator is standardized with a mean equal to 100 and a standard-deviation equal to 10.

- Source : Monthly business survey - Insee

Sector-based analysis

MAN. OF FOOD PRODUCTS AND BEVERAGES

In the manufacture of food products and beverages, the balance on past activity has decreased slightly but stands still markedly above its long-term average. Stocks of finished products have gone down again and are considered below their normal level. Export and global order books have improved. The balance on expected activity is stable and remains below its long-term level.

ELECTRICAL AND ELECTRONIC EQUIPMENT; MACHINE EQUIPMENT

In the manufacture of electrical and electronic equipment, machine equipment, industrialists consider that their past activity is better biased but remains weak: the corresponding balance is still below its long-term average. Stocks of finished products have decreased sharply and are considered close to their normal level. The industrialists of this sector consider that their order books are still very low. They remain pessimistic about their production expectations.

MAN. OF TRANSPORT EQUIPMENT

Man. of motor vehicles, trailers and semi trailers

In the manufacture of motor vehicles, trailers and semi trailers, the balance of opinion on past activity has gone up compared to December and stands markedly above its average level. Likewise, the balance of opinion on the expected production is steady and is markedly above its long-term average. While export order books are considered dynamic and above their average level, global order books are almost unchanged and are now considered as unusually low. The finished-goods inventory level has gone up significantly but is still considered slightly below its normal level.

Man. of other transport equipment

In January, in the manufacture of other transport equipment, the balance of opinion on past activity has weaken slightly and stands still at a level below its long-term average. Stocks of finished products have decreased sharply and are now considered close to their normal level. Global and foreign order books have improved compared to December. According to the industrialists from this area, activity is likely to accelerate and will be very dynamic over the next months.

OTHER MANUFACTURING

According to business managers, the past activity keeps improving in the manufacture of rubber and plastic products, stays good biased in the manufactures of chemicals and basic metals, and has decreased sharply in the manufacture of pharmaceutical products. The production expectations over the next months have improved significantly in the manufacture of pharmaceutical, slightly in that of basic metals and have deteriorated in the manufactures of rubber and plastic products and chemicals . The levels of global and export order books are described again as low in all sectors, excepted in that of basic metals, where the balance on the foreign demand has reached its long-term average. Finally, the finished-goods inventory has increased in the manufacture of chemicals and are nearly stable in the three other sectors. In the manufacture of basic metals, the level of inventories is considered almost normal, while it is described as below the normal level in the three other sectors.

tableautableau2 – Industrialists' opinion in a sector-based approach

| NA* : (A17) et [A 38 et A 64] | Aver.** | Nov. 13 | Dec. 13 | Jan. 14 |

|---|---|---|---|---|

| (C1) Man. of goods products and beverages | ||||

| Past activity | 6 | 15 | 19 | 16 |

| Finished-goods inventory | 12 | 17 | 8 | 6 |

| Global order books | –18 | –18 | –18 | –14 |

| Export order books | –13 | –15 | –18 | –16 |

| Personal production expectations | 7 | 5 | 0 | 0 |

| (C3) Electrical and electronic equipment; machine equipment | ||||

| Past activity | 5 | 1 | –12 | –5 |

| Finished-goods inventory | 17 | 22 | 34 | 15 |

| Global order books | –23 | –40 | –36 | –37 |

| Export order books | –21 | –42 | –40 | –44 |

| Personal production expectations | 3 | –2 | –13 | –15 |

| (C4) Man. of transport equipment | ||||

| Past activity | 7 | 21 | 18 | 11 |

| Finished-goods inventory | 14 | 25 | 11 | 9 |

| Global order books | –14 | –3 | –20 | –15 |

| Export order books | –12 | –12 | –17 | 0 |

| Personal production expectations | 7 | 34 | 19 | 39 |

| Man. of motor vehicules, trailers and semi-trailers [CL1] | ||||

| Past activity | 2 | 26 | 27 | 36 |

| Finished-goods inventory | 10 | –1 | –23 | 2 |

| Global order books | –20 | 6 | –46 | –44 |

| Export order books | –13 | –12 | –14 | 13 |

| Personal production expectations | 2 | 48 | 51 | 50 |

| Man. of other transport equipment [CL2] | ||||

| Past activity | 15 | 8 | 13 | 9 |

| Finished-goods inventory | 20 | 51 | 45 | 16 |

| Global order books | –6 | –12 | 6 | 13 |

| Export order books | –9 | –12 | –21 | –12 |

| Personal production expectations | 14 | 37 | 8 | 33 |

| (C5) Other manufacturing | ||||

| Past activity | 1 | 11 | 10 | 3 |

| Finished-goods inventory | 11 | 3 | 4 | 4 |

| Global order books | –20 | –26 | –25 | –25 |

| Export order books | –13 | –19 | –17 | –16 |

| Personal production expectations | 4 | –8 | 1 | 5 |

| Man. of chemicals and chemical products [CE] | ||||

| Past activity | 6 | 11 | 8 | 6 |

| Finished-goods inventory | 7 | 5 | –1 | 4 |

| Global order books | –13 | –21 | –21 | –18 |

| Export order books | –8 | –21 | –20 | –12 |

| Personal production expectations | 14 | 13 | 19 | 10 |

| Man. of basic pharmaceutical products [CF] | ||||

| Past activity | 17 | 53 | 47 | –40 |

| Finished-goods inventory | 10 | 3 | 7 | 6 |

| Global order books | 4 | –3 | –4 | –7 |

| Export order books | 10 | –6 | –7 | –7 |

| Personal production expectations | 15 | –35 | –29 | 57 |

| Man. of rubber and plastics products [CG] | ||||

| Past activity | –3 | –8 | –7 | 1 |

| Finished-goods inventory | 11 | 8 | 6 | 5 |

| Global order books | –24 | –39 | –39 | –37 |

| Export order books | –18 | –27 | –30 | –28 |

| Personal production expectations | –1 | –11 | –7 | –26 |

| Man. of basic metals and fabricated metal products [CH] | ||||

| Past activity | –1 | 12 | 16 | 11 |

| Finished-goods inventory | 7 | 0 | 10 | 8 |

| Global order books | –20 | –32 | –25 | –26 |

| Export order books | –16 | –16 | –8 | –15 |

| Personal production expectations | 1 | –4 | 6 | 9 |

- * NA: agragated manufacture, based on the NAF rév.2. The describe

- of the NA is available in the web-page of this indicator.

- ** Long-term average.

- Source : Monthly business survey - Insee

Documentation

Methodology (pdf,133 Ko)

Pour en savoir plus

Time series : Industry - Activity and demand