Informations Rapides ·

7 January 2022 · n° 5

Informations Rapides ·

7 January 2022 · n° 5 Leasing declines sharply in 2020 Annual financial lease survey - year 2020

Leasing declines sharply in 2020 Annual financial lease survey - year 2020

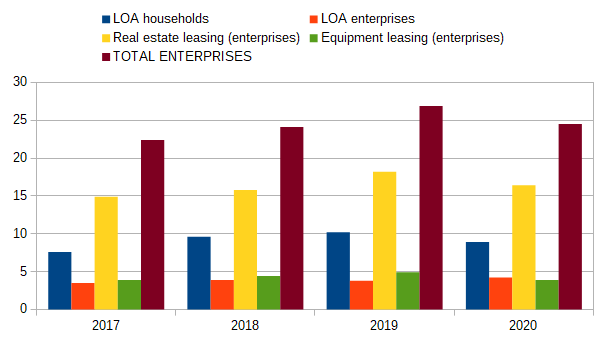

In 2020, new investments financed by leasing and by lease with purchase option (LOA) fell by 10.0% over one year (−3.7 billion €). They are thus down to 33.4 billion euros (€ bn), or 1.45% of gross domestic product (GDP), or 6.3% of total gross fixed capital formation for the national economy.

The decline in activity results mainly from a contraction in equipment leasing (−1.8 billion, i.e. −10,1% and −5.0 percentage points in relation to the change in the total), and to a lesser extent from the LOA (rental with purchase option) from individuals (−1.3 billion, i.e. −3.4 percentage points to the change in the total) and from real estate leasing (−1.0 billion, i.e. −2,8 percentage points to the change in the total). On the other hand, the amount of LOA with companies increased (+0.5 billion, or +1.2 percentage points to the change in the total).

- Reduced investments in automotive products entail a fall in equipment leasing

- Contrasting sectoral developments for equipment leasing

- The fall in real estate leasing stems from reduced land purchase

- Contrasting developments in real estate leasing according to customer activity

- Buoyant activity in the health sector for LOA contracts

- For more information

In 2020, new investments financed by leasing and by lease with purchase option (LOA) fell by 10.0% over one year (−3.7 billion €). They are thus down to 33.4 billion euros (€ bn), or 1.45% of gross domestic product (GDP), or 6.3% of total gross fixed capital formation for the national economy.

The decline in activity results mainly from a contraction in equipment leasing (−1.8 billion, i.e. −10,1% and −5.0 percentage points in relation to the change in the total), and to a lesser extent from the LOA (rental with purchase option) from individuals (−1.3 billion, i.e. −3.4 percentage points to the change in the total) and from real estate leasing (−1.0 billion, i.e. −2,8 percentage points to the change in the total). On the other hand, the amount of LOA with companies increased (+0.5 billion, or +1.2 percentage points to the change in the total).

graphiqueNew investments financed by leasing and by lease with purchase option (LOA)

- Source: INSEE - Annual leasing survey of 2021

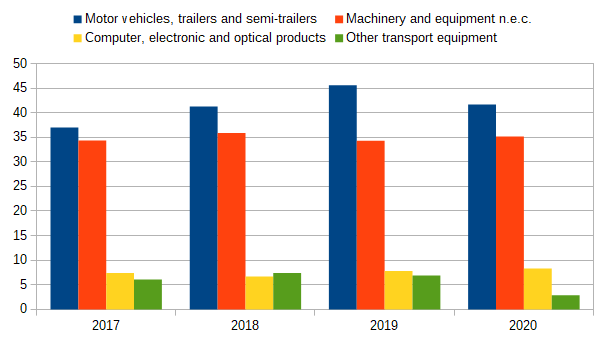

Reduced investments in automotive products entail a fall in equipment leasing

Automotive products and machinery and equipment represent more than three-quarters of investments in equipment leasing (41.7% and 35.2% respectively). Investment in automobiles, which fell by 17.7%, was the main factor behind the decline in investment in equipment leasing. Investment in machinery and equipment fell 7.8%. In contrast, investment in computer, electronic and optical products resisted the crisis better, with a smaller decrease of 4.5%.

graphiqueMain products financed by equipment leasing

- Source: INSEE - Annual leasing survey of 2021

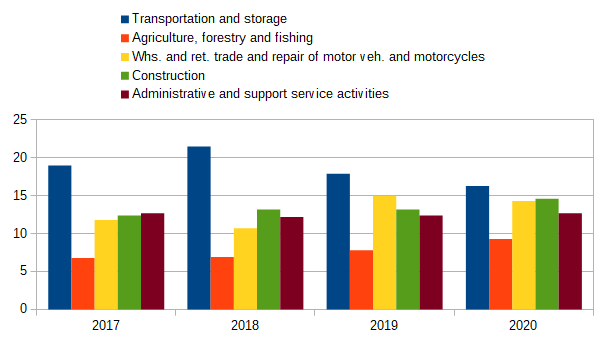

Contrasting sectoral developments for equipment leasing

Demand for leasing has fallen sharply in transport and warehousing (−18.2%) and wholesale and retail trade and repair of automobiles and motorcycles (−13.6%). These two sectors, which account for 30.5% of investment in equipment leasing, also account for more than half of the decline in investment in that category. Investment in leasing stagnated in the construction sector (−0.1%) while it rose 6.8% in agriculture, forestry and fishing.

graphiqueMain client sectors for equipment leasing

- Source: INSEE - Annual leasing survey of 2021

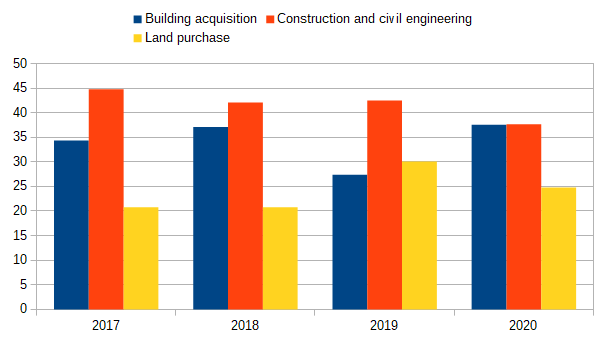

The fall in real estate leasing stems from reduced land purchase

In 2020, developments in real estate leasing are very contrasted depending on the type of investment: land purchases and new construction and civil engineering contracts plunged resp. by 35.3% and 30.3%, while building acquisition rose by 8.0%. The purposes of the financing are just as contrasted: the financing of offices by leasing fell sharply (−35.9%), whereas that of factories decreased more moderately (−14.7%).

graphiqueMain client sectors for equipment leasing

- Source: INSEE - Annual leasing survey of 2021

Contrasting developments in real estate leasing according to customer activity

Companies in the real estate sector carry out almost half of real estate leasing. Their investment fell by 15.9% (compared to 21.4% for all sectors). Among the other major customer sectors, real estate leasing fell by 38.5% in specialized, scientific and technical activities, by 1.7% in wholesale and retail trade and repair of motor vehicles and motorcycles, and rose by 5.5% in the production and distribution of electricity and gas.

graphiqueMain sectors using real estate leasing

- Source: INSEE - Annual leasing survey of 2021

Buoyant activity in the health sector for LOA contracts

In 2020, the amount of LOA contracts with companies increased (+0.5 billion €, i.e. +12.1% compared to 2019). The largest increase is in the health sector (+58.0%) which now represents 17% of total LOA investment. LOA investment also increased in wholesale and retail trade and repair of motor vehicles and motorcycles (+29.8%), construction (+8.9%) and professional, scientific and technical activities (+8.2%). On the other hand, it fell in financial and insurance activities (−11.5%)

graphiqueMain sectors using leasing with a purchase option

- Excluding individuals

- Source: INSEE - Annual leasing survey of 2021

For more information

The annual financial lease survey measures the breakdown of financial lease contracts by institutional sector and sector of activity, knowledge of which is necessary for the economic analysis of company accounts.

To prepare the national accounts data, the breakdown by institutional sector, in particular by general government sub-sector, is performed on the basis of the annual financial lease survey.

https://www.insee.fr/en/metadonnees/source/serie/s1217