14 December 2018

2018- n° 327In Q3 2018, the labour cost index (wages and salaries and total labour cost) increased

by 0.6% Labor cost index in industry, construction and services - third quarter 2018

14 December 2018

2018- n° 327In Q3 2018, the labour cost index (wages and salaries and total labour cost) increased

by 0.6% Labor cost index in industry, construction and services - third quarter 2018

In the third quarter of 2018, the labour cost index (LCI) - wages and salaries in the non-farm business sector rose on the same pace as the previous quarter (+0.6% quarter on quarter – seasonally adjusted data). Year on year, it rose by 2.3%, a quicker increase than in the second quarter (+2.0%). The average working time remained stable in the third quarter (0.0% y-o-y).

Warnings

- Since 1st January 2018, the rate of the tax credit for encouraging competitiveness and jobs (CICE) in metropolitan France has decreased from 7% to 6%. The rate remains at 9% in the overseas departments.

- Hirings after 1st July 2017 are no longer entitled to the hiring premium measure in SMEs.

The wages and salary costs increased by 0.6%

In the third quarter of 2018, the labour cost index (LCI) - wages and salaries in the non-farm business sector rose on the same pace as the previous quarter (+0.6% quarter on quarter – seasonally adjusted data). Year on year, it rose by 2.3%, a quicker increase than in the second quarter (+2.0%). The average working time remained stable in the third quarter (0.0% y-o-y).

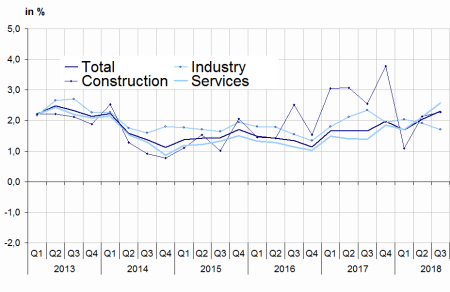

graphiqueGraph1 – LCI - wages and salaries: Year-on-year changes

- Scope: non-agricultural market sector excluding services to households

- Sources: ACOSS, DARES, INSEE

Wages slowed down in industry and construction and kept on rising in services

In Q3 2018, wages in industry were less dynamic quarter on quarter (+0.2% after +0.5% in Q2 2018). This slowdown affected all industrial sectors save the electricity, gas, etc. one in which they rebounded after a decrease on the previous quarter. Year on year, wages in industry were a bit less dynamic: +1.7% after +1.9%.

In Q3 2018, wages in services hardly accelerated over the quarter (+0.7% after +0.6%) but more sharply over the year (+2.6% after +2.1%). Evolutions were different between sectors : quarter on quarter, wages accelerated sharply in accommodation and food service activities and administrative and support service activities, conversely they slowed down significantly in transportation and storage.

Wages in construction increased by 0.6% quarter on quarter after irregular evolutions in the previous two quarters (+1.2% in Q2 2018 after -0.9% in Q1 2018).

tableauTable1 – LCI - wages & salaries

| Quarterly variations (%) | Annual variations (%) | |||

|---|---|---|---|---|

| Q2-2018 | Q3-2018 | Q2-2018 | Q3-2018 | |

| Industry | 0.5 | 0.2 | 1.9 | 1.7 |

| Mining and quarrying | 2.8 | –1.1 | 5.9 | 4.3 |

| Manufacturing | 0.7 | 0.1 | 2.0 | 1.7 |

| Electricity, gas, steam and air conditioning supply | –3.0 | 2.0 | 0.4 | 2.0 |

| Water supply; sewerage, waste management and remediation activities | 1.2 | –0.1 | 2.4 | 1.7 |

| Services | 0.6 | 0.7 | 2.1 | 2.6 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.5 | 0.6 | 2.0 | 2.1 |

| Transportation and storage | 0.7 | 0.0 | 1.7 | 2.0 |

| Accommodation and food service activities | 0.5 | 1.0 | 2.2 | 3.2 |

| Information and communication | 0.2 | 0.3 | 2.9 | 2.5 |

| Financial and insurance activities | 0.5 | 0.6 | 2.6 | 2.5 |

| Real estate activities | 0.5 | 0.3 | 3.5 | 2.7 |

| Professional, scientific and technical activities | 0.9 | 0.5 | 2.8 | 2.7 |

| Administrative and support service activities | 0.4 | 1.1 | 1.5 | 3.2 |

| Construction | 1.2 | 0.6 | 2.1 | 2.3 |

| TOTAL | 0.6 | 0.6 | 2.0 | 2.3 |

- Scope: non-agricultural market sector excluding services to households

- Sources: ACOSS, DARES, INSEE

Slight downward revision of LCI – wages and salary in Q2 2018

The Q2 2018 quarterly variation in LCI - wages and salaries in the non-farm business sector remained unchanged. The year-on-year variation has been revised downward by 0.1 percentage points.

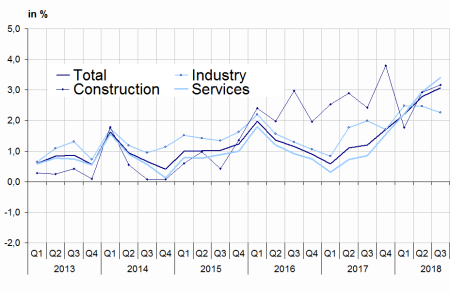

The total labour cost index increased by 0.6%

In the third quarter of 2018, the total labour cost index in the non-farm business sector kept on slowing down over the quarter (+0.6%, after +0.8% – seasonally adjusted data) but accelerated over the year (+3.1% after +2.8%).

Without tax credit for encouraging competitiveness and jobs (CICE), the rise would have been smaller (+2.6%). The rate of CICE has indeed been lowered by 1 percentage point (from 7% to 6%) in metropolitan France since 1st January 2018.

graphiqueGraph2 – LCI - total labour cost: year-on-year changes

- Scope: non-agricultural market sector excluding services to households

- Sources: ACOSS, DARES, INSEE

No revision of LCI – total labour cost in Q2 2018

Both Q2 2018 year-on-year and quarter-on-quarter variations in total labour cost index in the non-farm business sector remained unchanged.

tableauTable2 – LCI - total labour cost

| Quarterly variations (%) | Annual variations (%) | |||

|---|---|---|---|---|

| Q2-2018 | Q3-2018 | Q2-2018 | Q3-2018 | |

| Industry | 0.6 | 0.2 | 2.5 | 2.3 |

| Mining and quarrying | 2.9 | –1.2 | 6.6 | 5.0 |

| Manufacturing | 0.9 | 0.1 | 2.6 | 2.3 |

| Electricity, gas, steam and air conditioning supply | –3.0 | 2.0 | 0.7 | 2.3 |

| Water supply; sewerage, waste management and remediation activities | 1.4 | –0.1 | 3.2 | 2.4 |

| Services | 0.8 | 0.7 | 2.9 | 3.4 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.9 | 0.7 | 3.1 | 3.2 |

| Transportation and storage | 0.9 | 0.0 | 2.5 | 2.8 |

| Accommodation and food service activities | 1.0 | 1.0 | 3.9 | 4.6 |

| Information and communication | 0.3 | 0.3 | 3.3 | 2.9 |

| Financial and insurance activities | 0.6 | 0.6 | 2.9 | 2.8 |

| Real estate activities | 0.6 | 0.3 | 4.1 | 3.3 |

| Professional, scientific and technical activities | 1.0 | 0.5 | 3.3 | 3.3 |

| Administrative and support service activities | 0.8 | 1.0 | 2.9 | 4.5 |

| Construction | 1.3 | 0.7 | 2.9 | 3.2 |

| TOTAL | 0.8 | 0.6 | 2.8 | 3.1 |

- Scope: non-agricultural market sector excluding services to households

- Sources: ACOSS, DARES, INSEE

tableauTable3 – LCI - total labour cost (without CICE)

| Quarterly variations (%) | Annual variations (%) | |||

|---|---|---|---|---|

| Q2-2018 | Q3-2018 | Q2-2018 | Q3-2018 | |

| Industry | 0.6 | 0.2 | 2.1 | 1.9 |

| Mining and quarrying | 2.9 | –1.2 | 6.2 | 4.5 |

| Manufacturing | 0.9 | 0.1 | 2.2 | 1.9 |

| Electricity, gas, steam and air conditioning supply | –3.0 | 2.0 | 0.5 | 2.1 |

| Water supply; sewerage, waste management and remediation activities | 1.4 | –0.1 | 2.7 | 2.0 |

| Services | 0.8 | 0.7 | 2.5 | 3.0 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.9 | 0.7 | 2.6 | 2.6 |

| Transportation and storage | 0.9 | 0.0 | 1.9 | 2.2 |

| Accommodation and food service activities | 1.0 | 1.0 | 3.2 | 3.9 |

| Information and communication | 0.3 | 0.3 | 3.0 | 2.6 |

| Financial and insurance activities | 0.6 | 0.6 | 2.7 | 2.6 |

| Real estate activities | 0.6 | 0.3 | 3.8 | 3.0 |

| Professional, scientific and technical activities | 1.0 | 0.5 | 3.1 | 3.0 |

| Administrative and support service activities | 0.8 | 1.0 | 2.3 | 3.9 |

| Construction | 1.3 | 0.7 | 2.4 | 2.6 |

| TOTAL | 0.7 | 0.6 | 2.4 | 2.6 |

- Scope: non-agricultural market sector excluding services to households

- Sources: ACOSS, DARES, INSEE