22 June 2017

2017- n° 167In June 2017, the business climate continues to improve in retail trade and in trade

and repair of motor vehicles Monthly survey of retailing - June 2017

22 June 2017

2017- n° 167In June 2017, the business climate continues to improve in retail trade and in trade

and repair of motor vehicles Monthly survey of retailing - June 2017

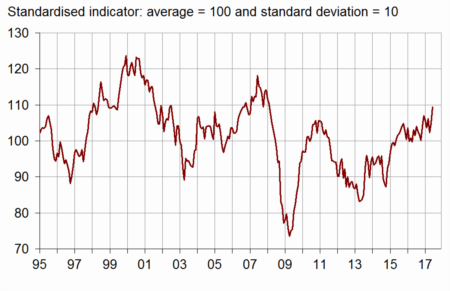

According to the managers in retail trade and in trade and repair of motor vehicles, the business climate has continued to improve in June 2017. The composite indicator that measures it has gained four points compared to May and stands at 109, its highest point since the beginning of 2008. It has remained above its long-term average (100) or equal to it since May 2015.

According to the managers in retail trade and in trade and repair of motor vehicles, the business climate has continued to improve in June 2017. The composite indicator that measures it has gained four points compared to May and stands at 109, its highest point since the beginning of 2008. It has remained above its long-term average (100) or equal to it since May 2015.

graphiqueChart_1 – Business climate synthetic indicator

Even more favourable general business outlook

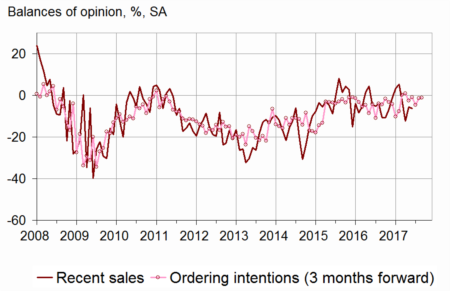

As many managers as in May have declared a rise in their recent sales, the corresponding balance standing practically at its average. The balance concerning ordering intentions is stable above its mean level. By contrast, the balances about expected sales and general business outlook have increased, the second one having never been so high in the last ten years.

The balance concerning the level of stocks is stable, slightly below its standard level.

Less traders than in May have expected falls in prices. The corresponding balance has reached its average.

tableauTable_1 – Tendency in retail trade and in trade and repair of motor vehicles

| Ave. (1) | Mar. 17 | Apr. 17 | May 17 | Jun. 17 | |

|---|---|---|---|---|---|

| Business climate | 100 | 106 | 102 | 105 | 109 |

| General business outlook | –29 | –21 | –18 | –15 | –5 |

| Recent sales | –7 | –2 | –12 | –6 | –6 |

| Expected sales | –2 | 4 | 4 | 1 | 6 |

| Ordering intentions | –8 | –1 | –5 | –1 | –1 |

| Stocks | 11 | 11 | 16 | 9 | 9 |

| Past selling prices (2) | –6 | 0 | –5 | ||

| Expected selling prices | –3 | 0 | –3 | –9 | –3 |

| Cash position (2) | –15 | –14 | –13 | ||

| Workforce size: recent trend | 1 | 2 | –1 | 0 | 2 |

| Workforce size: future trend | –3 | –1 | –5 | –3 | 0 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in retail trade and in trade and repair of motor vehicles

graphiqueChart_2 – Recent sales and ordering intentions

Improvement in the balances concerning employment

The balances concerning employment, past as well as expected, have continued to rise slightly. Each of them is above its average from now on.

Revisions

The business climate of May 2017 has been revised upward by one point since its first estimate for the whole sector (one point in retail trade and two points in motor vehicles trade). This revision is due to late answers from businesses which have been taken into account.

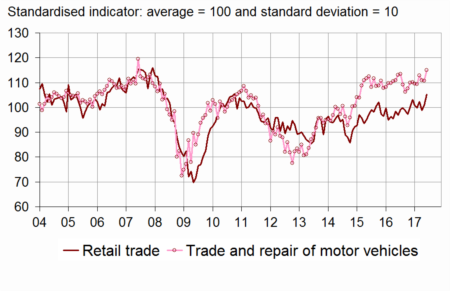

In retail trade, the business climate significantly improves

In retail trade, the business climate has improved: the composite indicator that measures it has gained four points, to 105, and is higher than it has been since 2008.

In non-specialised retail trade, the balance concerning recent sales has slightly faltered while remaining above its average. In specialised trade, this balance has risen but still stands below its mean level.

In the whole retail trade, the balance concerning expected sales has been virtually stable for five months, and the one about ordering intentions has slightly decreased, but each of them stay above its average. The balance on general outlook has gone up sharply ans has reached its highest level for ten years.

The level of stocks remains considered lower than its standard level. Less retailers than on the last month have expected a decline in their prices.

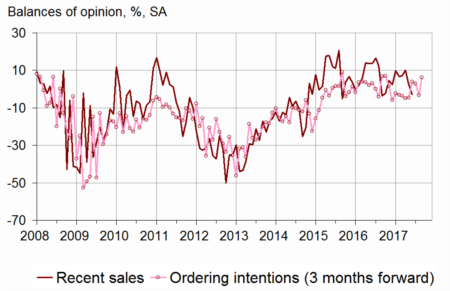

In trade and repair of motor vehicles, the business climate has reached his highest point since 2007

In trade and repair of motor vehicles and motor cycles, the business climate indicator has gained four points and stands at 115, its highest level for ten years, significantly above its average.

The balance concerning recent sales has decreased again, whereas those on expected sales, general business outlook and ordering intentions have significantly increased, each of the four standing above its mean level. The level of stocks is estimated above its standard level for the fifth month in a row. Slightly more motor vehicles traders than in May have expected falls in prices.The balances on employment have risen again and are higher than they have been since the beginning of the survey (2003).

graphiqueChart_3 – Recent sales and ordering intentions in trade and repair of motor vehicles

graphiqueChart_4 – Business climate synthetic indicator in retail trade and in trade and repair of motor vehicles

tableauTable_2 – Detailed data

| Ave. (1) | Mar. 17 | Apr. 17 | May 17 | Jun. 17 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Business climate | 100 | 102 | 99 | 101 | 105 |

| Gener. busin. outlook | –30 | –23 | –20 | –17 | –5 |

| Recent sales | –6 | –6 | –21 | –9 | –8 |

| Expected sales | 0 | 3 | 3 | 4 | 4 |

| Ordering intentions | –7 | –3 | –7 | 0 | –2 |

| Stocks | 10 | 7 | 13 | 5 | 6 |

| Past selling prices (2) | –9 | –4 | –8 | ||

| Expected selling prices | –5 | –2 | –5 | –12 | –5 |

| Cash position (2) | –13 | –13 | –13 | ||

| Workforce size: recent trend | 2 | 3 | 0 | 1 | 2 |

| Workforce size: future trend | –2 | –2 | –5 | –4 | –2 |

| Non-specialised retail trade | |||||

| Recent sales | –2 | 7 | –20 | 5 | 3 |

| Expected sales | 6 | 15 | 14 | 15 | 11 |

| Ordering intentions | 1 | 9 | 2 | 13 | 9 |

| Stocks | 7 | 3 | 16 | 4 | 4 |

| Past selling prices (2) | –9 | –2 | –8 | ||

| Expected selling prices | –5 | 3 | –1 | –13 | –1 |

| Cash position (2) | –7 | –6 | –6 | ||

| Specialised retail trade | |||||

| Recent sales | –12 | –22 | –24 | –25 | –21 |

| Expected sales | –8 | –12 | –10 | –9 | –3 |

| Ordering intentions | –17 | –19 | –17 | –18 | –15 |

| Stocks | 13 | 12 | 8 | 5 | 8 |

| Past selling prices (2) | –8 | –6 | –7 | ||

| Expected selling prices | –5 | –9 | –9 | –11 | –9 |

| Cash position (2) | –23 | –22 | –21 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Business climate | 100 | 113 | 111 | 111 | 115 |

| Gener. busin. outlook | –28 | –11 | –13 | –9 | –1 |

| Recent sales | –8 | 7 | 10 | 2 | –3 |

| Expected sales | –7 | 7 | 3 | –6 | 7 |

| Ordering intentions | –11 | 4 | 3 | –3 | 6 |

| Stocks | 15 | 19 | 20 | 20 | 18 |

| Past selling prices (2) | 1 | 8 | 3 | ||

| Expected selling prices | 4 | 6 | 1 | 2 | 0 |

| Cash position (2) | –24 | –13 | –15 | ||

| Workforce size: recent trend | –9 | –2 | –3 | 0 | 4 |

| Workforce size: future trend | –7 | 5 | 0 | 3 | 6 |

- (1) Average since 1991 (2003 for trade and repair of motor vehicles and 2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in retail trade and in trade and repair of motor vehicles

Documentation

Methodology (pdf,129 Ko)