5 May 2017

2017- n° 123In Q1 2017, tourist nights further increased (+1.1% y-o-y) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - first quarter 2017

5 May 2017

2017- n° 123In Q1 2017, tourist nights further increased (+1.1% y-o-y) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - first quarter 2017

In the first quarter of 2017, throughout metropolitan France, the recovery of overnight stays in tourist collective accomodation continued: +1.1% compared to the same period in 2016, after a rally of +3.8% in the fourth quarter. However, the tourism professionals were impacted by a less favorable schedule than in the first quarter of 2016, which included a 29 February and an Easter Monday. The rise was more significant for foreign customers (+2.7%) than for french customers (+0.5%). Occupancy advanced sharply in hotels, while it fell back in holiday and other short-stay accomodation (HOSSA).

Tourist nights continued to grow in metropolitan France

In the first quarter of 2017, throughout metropolitan France, the recovery of overnight stays in tourist collective accomodation continued: +1.1% compared to the same period in 2016, after a rally of +3.8% in the fourth quarter. However, the tourism professionals were impacted by a less favorable schedule than in the first quarter of 2016, which included a 29 February and an Easter Monday. The rise was more significant for foreign customers (+2.7%) than for french customers (+0.5%). Occupancy advanced sharply in hotels, while it fell back in holiday and other short-stay accomodation (HOSSA).

The foreign customers returned to hotels in the agglomeration of Paris

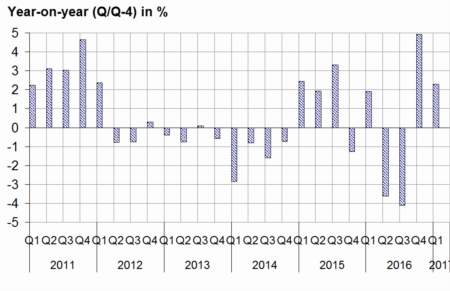

The overnight stays in hotels continued to increase in the first quarter of 2017 (+2.3% year on year after +4.9% at the end of 2016), reaching an unprecedented level for a first quarter. Customer growth, both French and foreign ones, mainly benefited high-range hotels (4 and 5 stars). The return of customers went on in the hotels of the agglomeration of Paris (+9.9%), buoyed particularly by a strong increase in foreign customers (+12.6%). To a lesser extent, overnight stays in hotels also rose in other urban areas (+1.4%). However, they declined sharply in hotels in mountain area (−6.5%), because a lack of snowing, especially at the beginning of the season.

Occupancy went up sharply in hotel chains (+4.1%), mainly due to an increase in supply.

Throughout metropolitan France, the increase of overnight stays translated into a rise in occupancy rate of 2.1 points year on year to 53.1%.

graphiqueGraph1 – Overnight stays in hotels

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

tableauTable2 – Average length of stay and occupancy

| Average length of stay (days) | Occupancy rate ** in % | |||

|---|---|---|---|---|

| 2016 | 2017 | 2016 | 2017 | |

| Q1 | Q1 * | Q1 | Q1 * | |

| Hotels | 1.8 | 1.8 | 51.0 | 53.1 |

| HOSSA | 4.3 | 4.3 | 56.8 | 60.1 |

- Reference area : Metropolitan France

- * provisional data

- Data not available for campsites, questioning concerns only the months of May to September

- ** The occupancy rate is calculated for hotels in rooms, in pitches for campsites and in lodging units (rooms, apartments, dormitories) for holliday and other short-stay accommodation

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

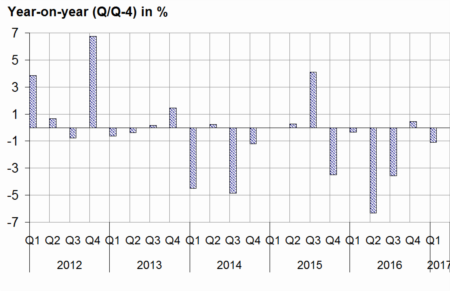

Overnight stays in holiday and other short-stay accomodation fell back

In HOSSA, overnight stays shrank in the first quarter of 2017 (−1.1% year on year after +0.5%). Indeed, occupancy slumped in mountain areas (−6.1%) due to inclement weather but also to a further decline in supply.

Conversely, occupancy jumped in the agglomeration of Paris, offsetting its sharp downturn the year before.

graphiqueGraph2 – Overnight stays in HOSSA

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

Increase in ocupancy in January and February

In hotels, occupancy rose mostly in January and to a lesser extent in February. In HOSSA, it was higher in February. This year, besides the schedule effects mentioned above, the winter school holidays for the academies of Paris, Creteil and Versailles were only in February unlike 2016, where they included one week in March.

tableauTable1 – Overnight stays in Q1 2017 *

| Nights of the quarter | Year-on-year (%) (Q/Q-4) | ||||

|---|---|---|---|---|---|

| Total nights (millions) | % of foreign nights | Total | Foreign | French | |

| Total | 61.0 | 28.2 | 1.1 | 2.7 | 0.5 |

| Hotels | 40.1 | 31.4 | 2.3 | 4.5 | 1.3 |

| Unclassified | 3.8 | 22.1 | –2.3 | –5.8 | –1.3 |

| 1 and 2 stars | 11.4 | 20.2 | –0.8 | 1.2 | –1.3 |

| 3 stars | 14.6 | 31.7 | 0.6 | 1.6 | 0.2 |

| 4 and 5 stars | 10.3 | 46.8 | 10.6 | 11.4 | 10.0 |

| hotel chain | 21.5 | 30.4 | 4.1 | 6.7 | 3.0 |

| independent hotel | 18.6 | 32.6 | 0.3 | 2.2 | –0.6 |

| Agglo. of Paris | 14.0 | 51.0 | 9.9 | 12.6 | 7.2 |

| coastlines | 4.9 | 20.1 | –0.5 | –8.1 | 1.6 |

| mountain | 6.6 | 28.9 | –6.5 | –10.1 | –4.9 |

| other urban area | 12.6 | 18.0 | 1.4 | 2.4 | 1.2 |

| other rural area | 2.0 | 15.0 | –2.2 | –1.9 | –2.3 |

| Holiday and other short-stay accomodation | 20.9 | 22.1 | –1.1 | –2.0 | –0.9 |

| Tourism residences | 16.6 | 22.4 | –1.0 | ND | ND |

| Holiday villages | 3.5 | 20.1 | –3.3 | ND | ND |

| Other | 0.9 | 25.4 | 7.2 | ND | ND |

| Agglo. of Paris | 2.2 | 27.8 | 25.2 | 4.8 | 35.3 |

| coastlines | 2.1 | 11.8 | –9.6 | –7.4 | –9.9 |

| mountain | 12.2 | 25.7 | –6.1 | –4.0 | –6.8 |

| other urban area | 2.9 | 16.2 | 8.4 | 11.5 | 7.9 |

| other rural area | 1.6 | 11.1 | 8.9 | –10.3 | 11.8 |

- Reference area : Metropolitan France

- * provisional data

- Data not available for campsites, questioning concerns only the months of May to September

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

Revisions

Compared to the previous publication, the overall variation in the number of overnight stays in Q4 2016 has been lowered by 0.1 points (+3.8% instead of +3.9%) due to the integration of data known in the meantime. The increase has been lowered by 0.2 points in HOSSA (+0.5% instead of +0.7%). It is unchanged for hotels (+4.9% in Q4 2016).

Pour en savoir plus

Time series: Tourism