25 April 2017

2017- n° 108In Q1 2017, production capacity was slightly less used in the manufacturing industry Quarterly business survey (goods-producing industries) - April 2017

25 April 2017

2017- n° 108In Q1 2017, production capacity was slightly less used in the manufacturing industry Quarterly business survey (goods-producing industries) - April 2017

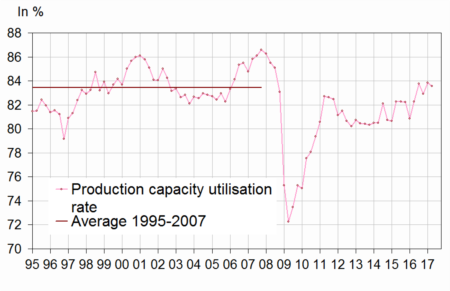

In April 2017, the industrialists have reported that they used slightly less their machinery and equipment. The production capacity utilisation rate has decreased by 0.2 points compared to the previous quarter, to 83.6%. It still slightly exceeds its average between 1995 and 2007.

As industrialists as in the previous quarter consider that they could produce more if they received more orders: the indicator on production bottlenecks is stable above normal. The proportion of industrialists indicating difficulties of supply remains close to normal, that of industrialists reporting difficulties of demand only remains below its long-term average.

Slight decrease in the use of production capacity

In April 2017, the industrialists have reported that they used slightly less their machinery and equipment. The production capacity utilisation rate has decreased by 0.2 points compared to the previous quarter, to 83.6%. It still slightly exceeds its average between 1995 and 2007.

As industrialists as in the previous quarter consider that they could produce more if they received more orders: the indicator on production bottlenecks is stable above normal. The proportion of industrialists indicating difficulties of supply remains close to normal, that of industrialists reporting difficulties of demand only remains below its long-term average.

graphiqueGraph 1 – Production capacity utilisation rate

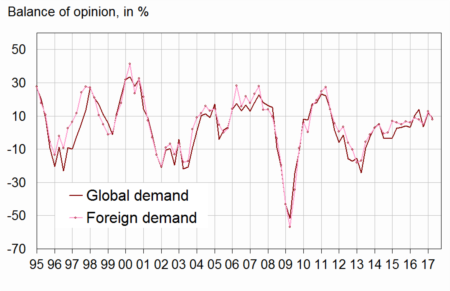

Industrialists are less upbeat on demand

Compared to the previous quarter, fewer industrialists judge that demand, whether global or foreign, increased in the past months. However, the corresponding balances remain above their mean level. Industrialists are also less upbeat than in January on global and foreign demand over the next three months; the corresponding balances of opinion also remain above average.

graphiqueGraph 2 – Balance of opinion of past change in demand

tableauTable 1 – Industrialists' opinion: demand and production factors

| Manufacturing industry | Mean | July 16 | Oct. 16 | Jan. 17 | April 17 |

|---|---|---|---|---|---|

| Global demand | |||||

| Past change | 0 | 14 | 3 | 12 | 9 |

| Future change | 1 | 5 | 8 | 9 | 6 |

| Foreign demand | |||||

| Past change | 2 | 8 | 4 | 13 | 8 |

| Future change | 4 | 5 | 7 | 10 | 8 |

| Production factors | |||||

| Production bottlenecks (in %) | 22 | 26 | 27 | 29 | 29 |

| Assessment of productive capacity | 14 | 11 | 12 | 7 | 1 |

| Production capacity utilisation rate (in %) | 82.9 | 83.8 | 82.9 | 83.8 | 83.6 |

| Difficulties of supply and demand (in %) | |||||

| Difficulties of supply and demand | 8 | 7 | 10 | 9 | 8 |

| Difficulties of supply only | 20 | 18 | 18 | 19 | 20 |

| Difficulties of demand only | 44 | 39 | 36 | 35 | 32 |

- * : Long-term average since 1976, except for questions on difficulties of supply and demand.

- The results of the last survey are preliminary.

- Source: INSEE - Quarterly business survey in industry

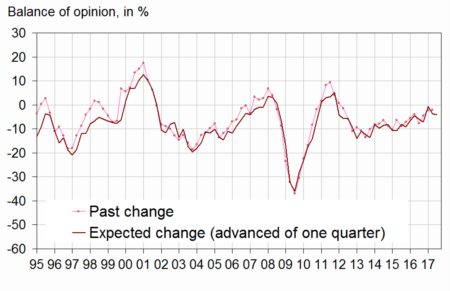

As industrialists as in January report staff cuts

In April 2017, as industrialists as in January have reported that they reduced workforce in the past three months and as many as before forecast job losses. Nevertheless, both balances are above their long-term average since October 2013.

Almost one out of three industrialists has experienced hiring difficulties; this part has recovered in April and is now just above its long-term average.

graphiqueGraph 3 – Workforce size in the manufacturing industry

Virtual stabilisation in past selling prices

According to industrialists, selling prices in the manufacturing industry were virtually stable in Q1 2017 (−0.1%). Business managers forecast a further virtual stability in Q2 2017 (+0.1%).

The proportion on industrialists that have experienced cash-flow problems has been stable at 11% since July 2016, below its mean level (14%).

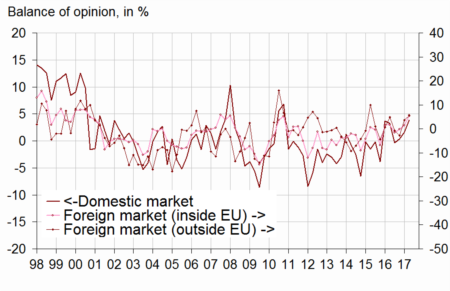

General exportation expectations have slumped

In April 2017, the industrialists' opinion on their competitive position on domestic market, foreign markets inside EU or outside EU has improved. These three balances were already above their long-term average in January. Nevertheless, industrialists are much less upbeat than in January on general exportation prospects: the corresponding balance has fallen to its lowest level since Q4 2014, just above normal.

graphiqueGraph 4 – Competitive position

tableauTable 2 – Industrialists' opinion: employment, competitive position, cash-flow and selling prices

| Manufacturing industry | Mean | July 16 | Oct. 16 | Jan. 17 | April 17 |

|---|---|---|---|---|---|

| Workforce size | |||||

| Past change | –11 | –8 | –5 | –2 | –2 |

| Expected change | –12 | –7 | –1 | –4 | –4 |

| Difficulties hiring (in %) | 28 | 31 | 34 | 27 | 30 |

| Selling prices and cash-flow | |||||

| Past change on selling prices | 0.1 | 0.0 | –0.1 | 0.6 | –0.1 |

| Expected change on selling prices | 0.2 | –0.1 | 0.3 | 0.3 | 0.1 |

| Cash-flow problems (in %) | 14 | 11 | 11 | 11 | 11 |

| Competitive position | |||||

| On domestic market | 1 | 0 | 0 | 2 | 4 |

| On foreign markets inside EU | –1 | –1 | 0 | 1 | 6 |

| On foreign markets outside EU | –2 | –1 | –3 | 4 | 6 |

| General exportation expectations | –10 | –1 | 0 | 5 | –9 |

- * : Long-term average since 1976, except for workforce change (since 1976) and for competitive position by market (since 1997).

- The results of the last survey are preliminary.

- A quantitative question is asked about selling prices.

- Source: INSEE - Quarterly business survey in industry

Documentation

Abbreviated methodology (pdf,174 Ko)

Pour en savoir plus

Time series : Industry