24 April 2017

2017- n° 74Financial lease investments increased yet again in 2015 Annual financial lease survey - year 2015

24 April 2017

2017- n° 74Financial lease investments increased yet again in 2015 Annual financial lease survey - year 2015

In 2015, new financial lease contracts reached 25.1 billion euros in value terms, up 10.1% from 2014 (after +8.6% in 2014). New leases with an option to buy contributed most to this rise: at 6.9 billion euros, they were up 23.2% from 2014. At 5.8 billion euros, real estate leases also stayed vigorous, increasing by 11.5% (after +13.1% in 2014). Last but not least, equipment leasing was also on the rise, even though more subdued: at 12.4 billion euros, it remained the major form of leasing but only grew by 3.3% (after +4.4%).

- New contracts for transport equipments other than motor vehicles rose significantly

- The transportation and storage sector remained the first client of equipment leasing

- Real estate leasing was most often used for existing buildings, especially offices

- Real estate leasing was still mostly used by the eponymous sector

- Lease with an option to buy soared

In 2015, new financial lease contracts reached 25.1 billion euros in value terms, up 10.1% from 2014 (after +8.6% in 2014). New leases with an option to buy contributed most to this rise: at 6.9 billion euros, they were up 23.2% from 2014. At 5.8 billion euros, real estate leases also stayed vigorous, increasing by 11.5% (after +13.1% in 2014). Last but not least, equipment leasing was also on the rise, even though more subdued: at 12.4 billion euros, it remained the major form of leasing but only grew by 3.3% (after +4.4%).

New contracts for transport equipments other than motor vehicles rose significantly

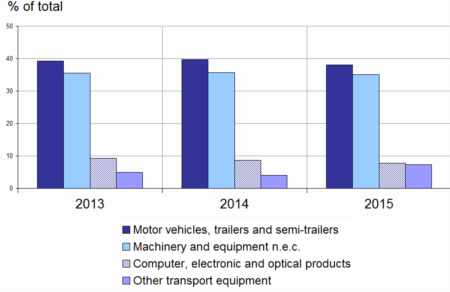

In 2015, the rise in equipment leasing was mainly due to soaring investments in transport equipment other than automobiles (+83.8%, reaching 887 millions euros). Conversely, fundings of automobiles sagged (−2.0% after +5.1%).

Nevertheless, products of the motor vehicles industry (38.0%) and machinery and equipment n.e.c. (35.1%) still amounted for nearly three quarters of the new contracts of the year, just like the two previous years.

graphiqueGraph1 – Main products financed by equipment leasing

- Source: INSEE - Annual leasing survey of 2016

The transportation and storage sector remained the first client of equipment leasing

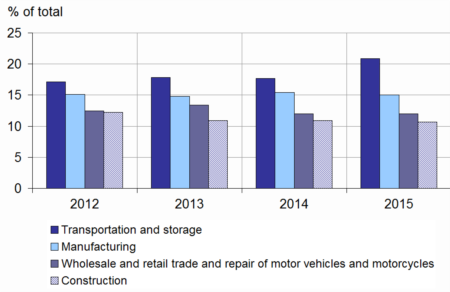

In 2015, equipment leasing rose in particular thanks to the demand from the transportation and storage sector. Indeed, the latter was responsible for 20.9% of the year's new investments, up 3.2 points from 2014. Wholesale and retail trade and repair of motor vehicles and motorcycles also significantly increased their resort to equipment leasing, maintaining their share at 12.0%. The four main client sectors ranking has remained unchanged since 2009.

graphiqueGraph2 – Main client sectors for equipment leasing

- Source: INSEE - Annual leasing survey of 2016

Real estate leasing was most often used for existing buildings, especially offices

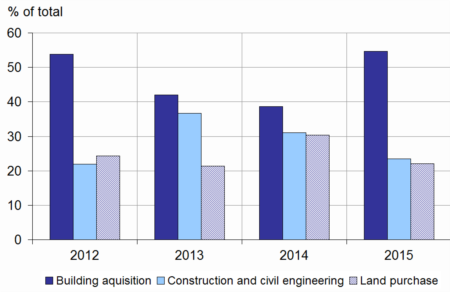

In 2015, new real estate leasing contracts only increased when purchasing existing buildings (+58.8%), which came to represent 54.6% of the total. Conversely, purchases of land (−18.6% after +59.1%) and investment in construction and civil engineering (−15.1% after −5.9%) decreased sharply.

In 2015 just as in 2014, these investments were mainly directed towards offices. Indeed, the latter amounted for a third of all new real estate leasing funding, all uses

considered, and contributed most to the overall increase. The other uses played a minor role in said increase, despite the rebound in hospital funding (+35.4% after −13.9%) and in factories and warehouses (+11.0% after −6.6%).

graphiqueGraph3 – Main real estate Investissements

- Source: INSEE - Annual leasing survey of 2016

Real estate leasing was still mostly used by the eponymous sector

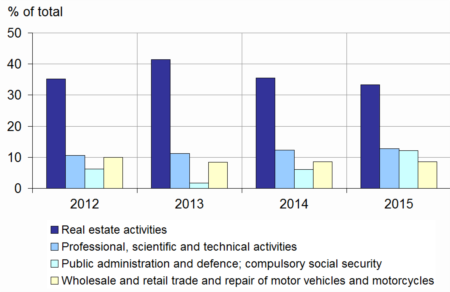

In 2015, the increase in real estate leasing (+11.5%) was yet again driven by public administrations, whose investments rose from 6.2% to 12.1% of the total. The water supply, sewage, waste management and remediation sector was the second largest contributor to the overall increase even though it only accounted for 3.8% of the new contracts. By contrast, funding decreased in the electricity, gas, steam and air conditioning sector (1.5% of the new contracts, down 3.3 points).

graphiqueGraph4 – Main sectors using real estate leasing

- Source: INSEE - Annual leasing survey of 2016

In value terms, the real state sector remained by far the first client of this kind of leasing. However, its share declined to 33.4%, down 1.9 points from 2014 and 8.1 points from 2013.

Lease with an option to buy soared

In 2015, new lease contracts with an option to buy reached 6.9 billion euros, up 23.2% from 2014. This was the result of the surge in investments aimed at households: they rose by 38.7% (after +10.7%) and totaled 4.3 billion euros. Enterprises still signed leases with a purchase option for themselves but their enthusiasm was largely tempered (+4.0% after +19.0% in 2014).

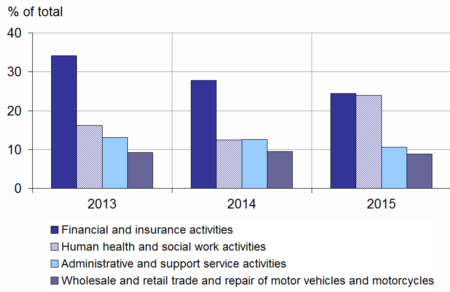

Among firms, investments from the human health and social work sector drastically increased (+126.6%). They rose strongly in the professional, scientific and technical sector (+19.8%) as well as in the wholesale and retail trade and repair of motor vehicles and motorcycles sector (+11.5%). The use of purchasing options slackened in the financial and insurance activities (+4.2%). Conversely, investments fell by 29.1% in the transportation and storage sector.

In 2015, the main sector using leasing with an option to buy remained the financial and insurance activities (24.4%), followed by the human health and social work sector (23.9%).

graphiqueGraph5 – Main sectors using leasing with a purchase option

- Excluding individuals

- Source: INSEE - Annual leasing survey of 2016