4 January 2017

2017- n° 2In December 2016, households' confidence remains just below normal Monthly consumer confidence survey - December 2016

4 January 2017

2017- n° 2In December 2016, households' confidence remains just below normal Monthly consumer confidence survey - December 2016

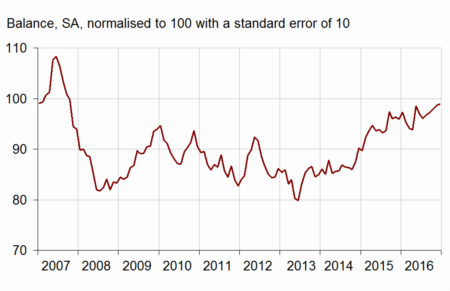

In December 2016, households' confidence was stable: the synthetic confidence index has remained at 99, just below its long-term average (100)

In December 2016, households' confidence was stable: the synthetic confidence index has remained at 99, just below its long-term average (100)

graphiqueGraph1 – Consumer confidence synthetic index

- Source: INSEE

Personal situation

Past financial situation: improving slightly

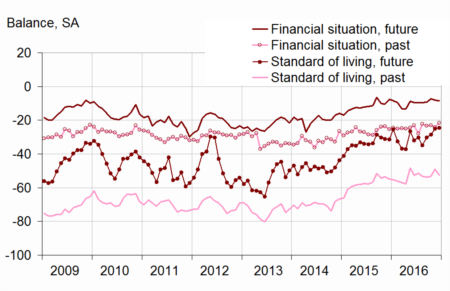

In December, households' opinion of their past personal financial situation improved slightly: the corresponding balance has gained 2 points. It returned closer to its long-term average. Households' opinion of their future personal financial situation was stable. The corresponding balance is slightly below its long-term average.

In December, the share of household considering it has been a suitable time to make major purchases was virtually stable (+1 point), well above its long-term average.

Saving capacity: virtually stable

In December, households' balance of opinion on their expected saving capacity was virtually stable (−1 point): for four months it has stayed slightly above its long-term average. The balance concerning their current saving capacity of opinion was stable, barely lower than its long-term average.

Households were less numerous to consider it has been a suitable time to save: the corresponding balance lost 5 points in December. Thus, it deviated further from its long-term average.

graphiqueGraph2 – Balances on personal financial situation and standard of living in France

- Source: INSEE

Economic situation in France

Past standard of living: less optimism

In December, households' opinion of their past standard of living in France worsened after an improvement in November: the corresponding balance lost 4 points and deviated anew from its long-term average. Their opinion of the expected standard of living in France was virtually stable (+1 point). The balance stands at its highest level since October 2007, just above its long-term average.

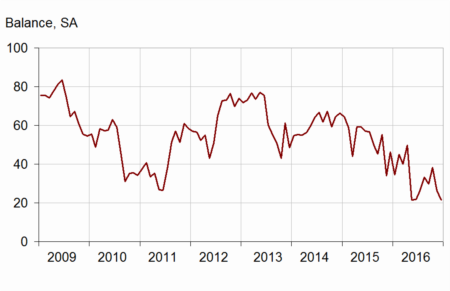

Unemployment: fears falling again

Households' fears concerning unemployment faded again in December (−5 points), after a sharp fall in November. The balance, fallen below its long-term average in November, deviated further from it. Its level is lower than it has been since June 2008.

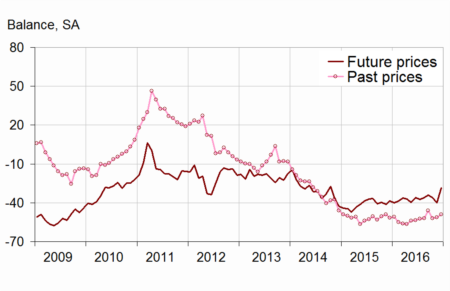

Expected inflation: rising sharply

In December, households were many more numerous than in November to consider that prices should increase during the next 12 months: the balance gained 11 points and went back above its long-term average. Likewise, household were a little more numerous than in November to consider that prices increased during the past 12 months: the corresponding balance rose by 2 points. However, the balance has remained far below its long-term average.

graphiqueGraph3 – Households' unemployment expectations

- Source: INSEE

graphiqueGraph4 – Households' perception of prices

- Source: INSEE

tableauTable – CONSUMER OPINION: synthetic index and opinion balances

| 2016 | |||||

|---|---|---|---|---|---|

| Av. (1) | Sept. | Oct. | Nov. | Dec. | |

| Synthetic index (2) | 100 | 97 | 98 | 99 | 99 |

| Financial sit., past 12 m. | –21 | –23 | –23 | –24 | –22 |

| Financial sit., next 12 m. | –5 | –9 | –7 | –8 | –8 |

| Current saving capacity | 8 | 9 | 6 | 7 | 7 |

| Expected saving capacity | –9 | –7 | –7 | –6 | –7 |

| Savings intentions, next 12 m. | 18 | 1 | –3 | –2 | –7 |

| Major purchases intentions, next 12 m. | –14 | –6 | –5 | –5 | –4 |

| Standard of living, past 12 m. | –45 | –54 | –53 | –49 | –53 |

| Standard of living, next 12 m. | –25 | –30 | –28 | –25 | –24 |

| Unemployment, next 12 m. | 35 | 30 | 38 | 26 | 21 |

| Consumer prices, past 12 m. | –16 | –46 | –52 | –51 | –49 |

| Consumer prices, next 12 m. | –34 | –34 | –36 | –40 | –29 |

- (1) Average value between January 1987 and December 2016

- (2) This indicator is normalised in such a way that its average equals 100 and standard error equals 10 over the estimation period (1987-2016).

- Source: INSEE, monthly consumer confidence survey