22 September 2016

2016- n° 247In September 2016, the economic climate remains stable in the building construction

industry Monthly survey of building - September 2016

22 September 2016

2016- n° 247In September 2016, the economic climate remains stable in the building construction

industry Monthly survey of building - September 2016

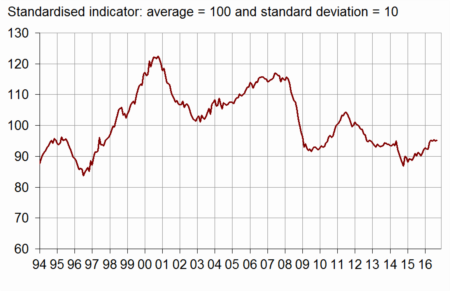

According to the business managers surveyed in September 2016, the business climate remains sluggish in the building construction industry. Since April 2016, the composite indicator has remained at the same level (95), below its long-term average (100).

- Business managers are more optimistic about their activity for the next few months

- Business managers are slightly less pessimistic about their employment prospects

- Despite a slight improvement, the order books stay judged very poorly filled

- Production capacity is less used again

- Prices are still expected to fall rather than to rise

According to the business managers surveyed in September 2016, the business climate remains sluggish in the building construction industry. Since April 2016, the composite indicator has remained at the same level (95), below its long-term average (100).

graphiqueClimate – Business climate composite indicator

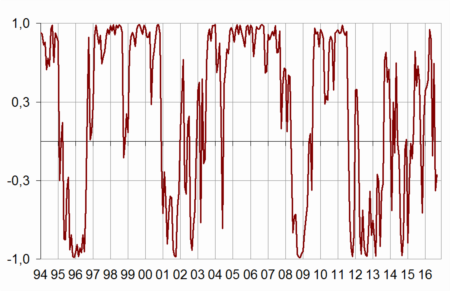

graphiqueTurningPoint – Turning-point indicator

- Note: close to 1 (respectively –1), it indicates a favourable climate (respectively unfavourable). Between +0,3 and –0,3: uncertainty area

The turning point indicator has gone into the uncertainty zone.

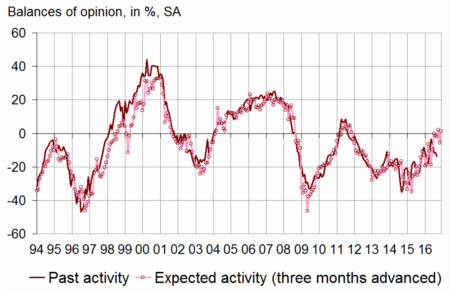

Business managers are more optimistic about their activity for the next few months

In September 2016, more business managers than in August forecast an increase in their activity for the next few months. The corresponding balance remains above its long-term average. In contrast, the balance of opinion on past activity has fell back and has deviated from its long-term average.

graphiqueActivity – Activity tendency in building construction

tableauTableau1 – Building industry economic outlook

| Mean* | June 16 | July 16 | Aug. 16 | Sept. 16 | |

|---|---|---|---|---|---|

| Composite indicator | 100 | 95 | 95 | 95 | 95 |

| Past activity | –4 | –6 | –12 | –11 | –14 |

| Expected activity | –7 | –2 | 2 | –6 | 1 |

| Gen. business outlook | –19 | –6 | |||

| Past employment | –5 | –22 | –21 | –22 | –22 |

| Expected employment | –5 | –16 | –14 | –14 | –11 |

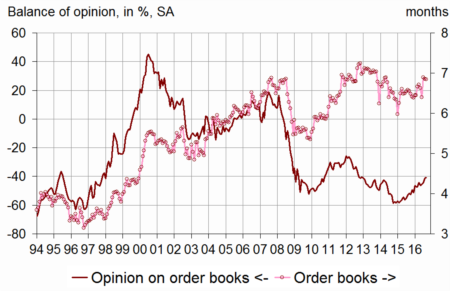

| Opinion on order books | –24 | –45 | –45 | –41 | –41 |

| Order books (in month) | 5,4 | 6,4 | 6,9 | 6,9 | 6,8 |

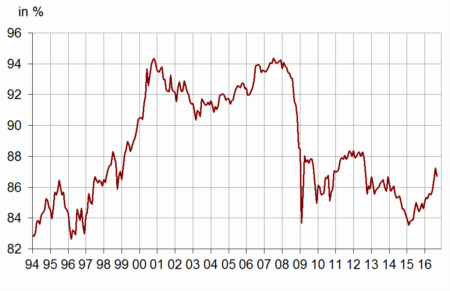

| Production capacity utilization rate | 88,5 | 85,8 | 86,5 | 87,2 | 86,7 |

| Obstacles to production increase (in %) | 32 | 22 | 23 | 25 | 24 |

| - Because of workforce shortage (in %) | 14,1 | 3,3 | 3,9 | 4,3 | 3,8 |

| Recruiting problems (in %) | 57 | 45 | |||

| Expected prices | –15 | –23 | –23 | –21 | –20 |

| Cash-flow position | –10 | –9 | |||

| Repayment period | 29 | 31 |

- * Mean since September 1993.

- Source: INSEE, French business survey in the building industry

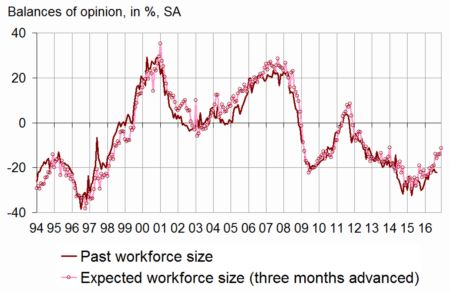

Business managers are slightly less pessimistic about their employment prospects

In September 2016, more business managers than in August plan to increase their staff size the next three months. However, the corresponding balance of opinion remains far below its long-term average. The balance of opinion on past staff size is stable at a level well below its long-term average.

graphiqueWorkforce – Workforce size tendency in building construction

Despite a slight improvement, the order books stay judged very poorly filled

Business managers continue to deem their order books very low: the corresponding balance has recovered slightly since May 2016 but stays far below its long-term average. With their staff size, business managers consider that their order books provide 6.8 months of work, a level slightly lower than the last month but above its long term average (5.4 months).

graphiqueOrderBooks – Order books

Production capacity is less used again

Since 2008, the production capacity utilization rate has been lower than its long-term average (88.5%). While it was recovering gradually since early 2015, it has decreased by 0.5 points in September 2016, to 86.7%. About one business manager out of four has reported difficulties in increasing output, compared to one out of three in average since 1993.

graphiquePcur – Production capacity utilization rate

Prices are still expected to fall rather than to rise

In September 2016, almost as many business managers as in August have announced that they are going to reduce their prices during the next three months. The corresponding balance remains below its long-term average.

Documentation

Methodology (2016) (pdf,170 Ko)