27 April 2015

2015- n° 98In April 2015, the expected demand for new dwellings improves Quaterly business survey in the real-estate development - April 2015

27 April 2015

2015- n° 98In April 2015, the expected demand for new dwellings improves Quaterly business survey in the real-estate development - April 2015

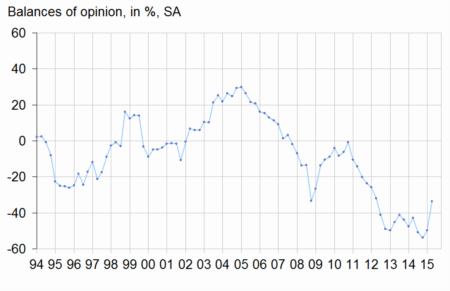

In April 2015, sharply fewer developers than in January indicate a decrease in the demand for new housing. The corresponding balance of opinion, which reached in October 2014, its lowest level since the series exists, gets better but is still significantly below its long-term average. In the same way, expected housing starts for the next three months are less deteriorated than in 2014. They have improved sharply in particular for new dwelling for sale.

The expected demand for new dwellings upturns

In April 2015, sharply fewer developers than in January indicate a decrease in the demand for new housing. The corresponding balance of opinion, which reached in October 2014, its lowest level since the series exists, gets better but is still significantly below its long-term average. In the same way, expected housing starts for the next three months are less deteriorated than in 2014. They have improved sharply in particular for new dwelling for sale.

Unsold dwelling stocks reduce

Clearly more developers than in January indicate a fall of unsold dwelling stocks. The balance of opinion returns to its long-term average.

Prices remain tight

Even if fewer developers than in January indicate a fall in average prices of new housing, the corresponding balance of opinion is still significantly below its long-term average. Fewer developers than in January concider that downpayment to acquire a new dwelling has decreased. In the same way, fewer developers than the previous quarter deem that the financing capacity to purchase a new housing will fall off during the next quarter.

tableautableau1 – Real-estate development economic outlook

| Mean* | July 14 | Oct. 14 | Jan. 15 | April 15 | |

|---|---|---|---|---|---|

| New dwelling demand | –9 | –51 | –54 | –50 | –34 |

| Expected housing starts | –7 | –34 | –33 | –30 | –17 |

| - for sale | –16 | –42 | –44 | –37 | –21 |

| - for rent | 0 | –15 | –13 | –16 | –14 |

| Unsold dwelling stock tendency | –27 | –10 | –14 | –15 | –27 |

| Housing average price for sale | 5 | –31 | –32 | –31 | –27 |

| Downpayment | –21 | –46 | –41 | –35 | –25 |

| Financing capacity | –23 | –41 | –39 | –41 | –20 |

- * Mean since July 1991.

- Source: French business survey on real-estate development - INSEE

graphiqueDemand – New dwelling demand tendency