28 January 2015

2015- n° 21In January 2015, households’ confidence is stable Monthly consumer confidence survey - January 2015

28 January 2015

2015- n° 21In January 2015, households’ confidence is stable Monthly consumer confidence survey - January 2015

In January 2015, households’ confidence is stable. The synthetic confidence index remains at its December level (90). It stays below its long-term average (100).

In January 2015, households’ confidence is stable. The synthetic confidence index remains at its December level (90). It stays below its long-term average (100).

Personal situation

Financial situation: edging down

So far this month, households’ opinion of their past financial situation and their appreciation on their future financial situation have deteriorated slightly (–2 points).

In spite of that, more households consider it to be a suitable time to make major purchases (+4 points).

However, all three balances remain below their long-term average.

Saving capacity and savings intentions: slipping

In January, households’ opinion of their current saving capacity, as well as their opinion of their future saving capacity, has dipped (–3 points). These two balances remain nevertheless above their long-term average.

Following a substantial gain in December, the share of households thinking it has been an opportune time to save has dropped (–11 points), and thus moves back to a level slightly below the one in November. As a result, the balance returns below its long-term average.

graphiquegraph1_english – Consumer confidence synthetic index

tableauTab_eng – CONSUMER OPINION: synthetic index and opinion balances

| 2014 | 2015 | ||||

|---|---|---|---|---|---|

| Av. (1) | Oct. | Nov. | Dec. | Jan. | |

| Synthetic index (2) | 100 | 86 | 88 | 90 | 90 |

| Financial sit., past 12 m. | –19 | –31 | –33 | –27 | –29 |

| Financial sit., next 12 m. | –4 | –20 | –17 | –15 | –17 |

| Current saving capacity | 8 | 15 | 13 | 17 | 14 |

| Expected saving capacity | –10 | –3 | –4 | –2 | –5 |

| Savings intentions, next 12 m. | 18 | 19 | 17 | 27 | 16 |

| Major purchases intentions, next 12 m. | –14 | –25 | –21 | –22 | –18 |

| Standard of living, past 12 m. | –43 | –74 | –68 | –68 | –68 |

| Standard of living, next 12 m. | –23 | –50 | –47 | –43 | –41 |

| Unemployment, next 12 m. | 32 | 63 | 65 | 67 | 63 |

| Consumer prices, past 12 m. | –13 | –37 | –36 | –45 | –47 |

| Consumer prices, next 12 m. | –34 | –30 | –37 | –42 | –45 |

- (1) Average value between January 1987 and December 2013

- (2) This indicator is normalised in such a way that its average equals 100 and standard error equals 10 over the estimation period (1987-2013).

- Source: INSEE, monthly consumer confidence survey

Economic situation in France

Standard of living in France: picking up

In January, households’ opinion of the past standard of living in France is stable for the third consecutive month. Their appreciation on the future standard of living has been improving for the third month in a row: +2 points compared to December 2014 and +9 points since October. These two balances remain however far below their long-term average.

Unemployment: fears receding

Fewer households think that unemployment will rise. The corresponding balance has fallen by 4 points in January and has returned to its October 2014 level. However, it remains distinctly above its long-term average.

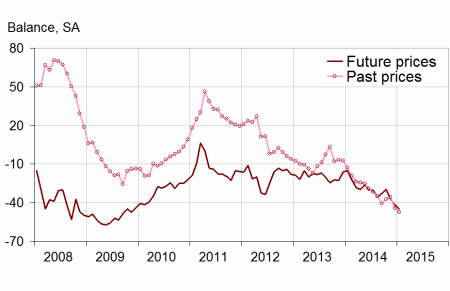

Inflation: weakening again

Households have been less numerous again to expect a rise in prices: in January, the corresponding balance has decreased by 3 points compared to December 2014, and by 15 points in comparison to October. It reaches its lowest level since November 2009, below its long-term average.

Similarly, the share of households thinking that prices increased has eased back (–2 points), thereby reaching its lowest level since the end of 1999. It remains therefore clearly below its long-term average.

graphiquegraph2_english – Balances on personal financial situation and standard of living

graphiquechomage_en – Households' unemployment expectations

graphiqueprix_en – Households' perception of prices