24 November 2015

2015- n° 284In November 2015, the business climate remains good in the retail trade and in the

trade and repair of motor vehicles Monthly survey of retailing - November 2015

24 November 2015

2015- n° 284In November 2015, the business climate remains good in the retail trade and in the

trade and repair of motor vehicles Monthly survey of retailing - November 2015

Warning: the results of this survey take into account answers until 19 November inclusive. The large majority of responses were registered before the attacks of 13 November.

Warning: the results of this survey take into account answers until 19 November inclusive. The large majority of responses were registered before the attacks of 13 November.

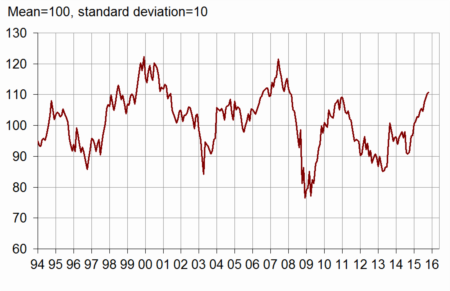

According to the managers surveyed in November 2015, the business climate remains good in the retail trade and in the trade and repair of motor vehicles. The composite indicator which measures it has risen by one point and stands at 111. It is significantly above its long term average (100).

graphiquegraph_indsynt_en – Business climate synthetic indicator

Dynamic business outlook

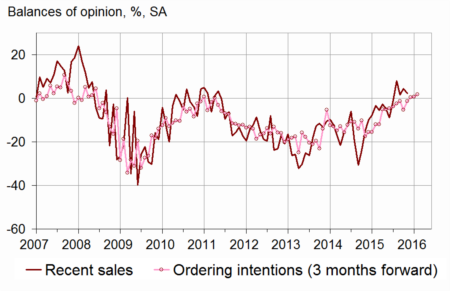

In retail trade and trade and repair of motor vehicles, slightly fewer managers than in October have declared an increase in their past activity, but the corresponding balance is still above its long term average. They are optimistic about their prospects: each of both balances concerning expected sales and ordering intentions stands significantly over its average. The general business outlook has improved continuously for one year now: the corresponding balance is at the level of the end of 2007.

Stocks are still estimated below their standard level.

Fewer business leaders than in September have indicated falls in past selling prices: the corresponding balance has come back to its average, never reached in three years. The balance on expected prices stands at its mean level.

The opinion concerning cash position has slightly improved.

graphiqueGraph_ventes_ic_en – Recent sales and ordering intentions

tableautab1_en – Overall data

| Ave. (1) | Aug. 15 | Sept. 15 | Oct. 15 | Nov. 15 | |

|---|---|---|---|---|---|

| Business climate | 100 | 107 | 109 | 110 | 111 |

| General business outlook | –30 | –19 | –18 | –13 | –10 |

| Recent sales | –7 | 8 | 1 | 4 | 2 |

| Expected sales | –3 | 1 | 11 | 7 | 9 |

| Ordering intentions | –9 | –1 | 1 | 1 | 2 |

| Stocks | 10 | 7 | 7 | 6 | 6 |

| Past selling prices (2) | –6 | –18 | –5 | ||

| Expected selling prices | –3 | –9 | –8 | –4 | –3 |

| Cash position (2) | –15 | –16 | –14 | ||

| Workforce size: recent trend | 0 | –5 | –2 | –2 | –4 |

| Workforce size: future trend | –3 | –7 | –4 | –3 | –5 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Employment forecasts near average

Both balances concerning recent and future trends on workforce size have moderatly decreased and are slightly below their average.

Retail trade

Optimism about expected activity in non-specialised trade

Fewer non-specialised retailers than in October have noted a rise in their past sales; however the balance remains above its average. Anticipations are still optimistic: the balances concerning expected sales and ordering intentions remain high.

In specialised trade, the situation has barely changed: the three balances concerning past and expected sales and ordering intentions are roughly stable; those on sales stand at their average, the one on orders is above.

In both kinds of trade, stocks are still estimated below their standard level.

In both non-specialised and specialised trade, the balance on past prices has significantly increased, while the one on expected prices is practically stable. Each of the two is near its average from now on.

Trade and repair of motor vehicles

Activity balances at a high level

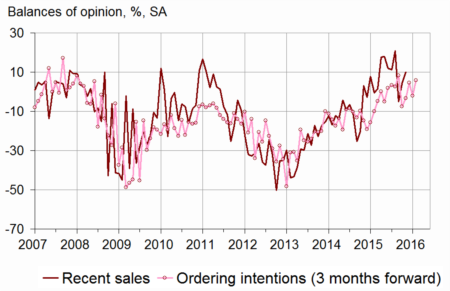

According to motor vehicles business leaders, past activity has progressed again, the corresponding balance reaching a level significantly above its average.

Concerning forecasts, the expected sales balance has been stable and the ordering intentions one has increased: both of them stand now at an elevated level.

graphiquegraph_ventes_ic_auto_en – Recent sales and ordering intentions in motor vehicles

Stocks are estimated practically stable, below their standard level for nine months now.

Each of the two balances concerning past and expected prices is slightly below its average.

tableautab2_en – Detailed data

| Ave. (1) | Aug. 15 | Sept. 15 | Oct. 15 | Nov. 15 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Recent sales | –6 | 3 | 4 | 5 | –1 |

| Expected sales | 0 | 3 | 7 | 8 | 9 |

| Ordering intentions | –7 | 0 | –2 | 2 | 1 |

| Stocks | 9 | 6 | 4 | 4 | 4 |

| Past selling prices (2) | –8 | –25 | –8 | ||

| Expected selling prices | –5 | –11 | –11 | –6 | –5 |

| Cash position (2) | –13 | –16 | –15 | ||

| Workforce size: recent trend | 1 | –4 | –3 | –1 | –4 |

| Workforce size: future trend | –2 | –8 | –3 | –2 | –7 |

| Non-specialised retail trade | |||||

| Recent sales | –2 | 10 | 19 | 17 | 7 |

| Expected sales | 6 | 12 | 19 | 19 | 23 |

| Ordering intentions | 1 | 12 | 11 | 11 | 9 |

| Stocks | 7 | 3 | 2 | 4 | 3 |

| Past selling prices (2) | –9 | –31 | –9 | ||

| Expected selling prices | –5 | –9 | –15 | –4 | –4 |

| Cash position (2) | –7 | –11 | –7 | ||

| Specialised retail trade | |||||

| Recent sales | –11 | –5 | –13 | –10 | –10 |

| Expected sales | –8 | –7 | –10 | –5 | –7 |

| Ordering intentions | –17 | –13 | –18 | –11 | –10 |

| Stocks | 13 | 10 | 7 | 4 | 5 |

| Past selling prices (2) | –8 | –16 | –7 | ||

| Expected selling prices | –5 | –14 | –7 | –7 | –6 |

| Cash position (2) | –22 | –24 | –23 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Recent sales | –10 | 21 | –5 | 4 | 10 |

| Expected sales | –8 | –1 | 16 | 6 | 6 |

| Ordering intentions | –13 | –3 | 5 | –2 | 6 |

| Stocks | 15 | 8 | 13 | 10 | 12 |

| Past selling prices (2) | 1 | –1 | –1 | ||

| Expected selling prices | 4 | 0 | 1 | 4 | 1 |

| Cash position (2) | –25 | –15 | –16 | ||

| Workforce size: recent trend | –9 | –6 | –1 | –8 | –10 |

| Workforce size: future trend | –7 | 0 | –6 | –4 | –4 |

- (1) Average since 1991 (2003 for trade and repair of motor vehicles and 2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Documentation

Methodology (pdf,129 Ko)