23 April 2012

2012- n° 103In April 2012, the economic climate in services remains sluggish but improves slightly Monthly survey of services - April 2012

23 April 2012

2012- n° 103In April 2012, the economic climate in services remains sluggish but improves slightly Monthly survey of services - April 2012

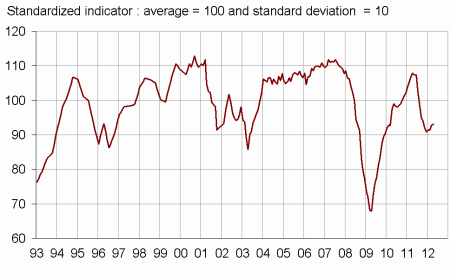

According to the business leaders surveyed in April 2012, the economic situation in services remains sluggish. After a slight improvement in March, the business climate synthetic indicator stabilizes in April, and is 93, still below its long-term average (100).

According to the business leaders surveyed in April 2012, the economic situation in services remains sluggish. After a slight improvement in March, the business climate synthetic indicator stabilizes in April, and is 93, still below its long-term average (100).

Business leaders consider that their activity slow down the last few months but their activity expectations for the months to come are recovering. They expect demand to be more favourable in the next few months.

They consider that their operating balance result decreased in the last few months and anticipate a further decline in the coming months.

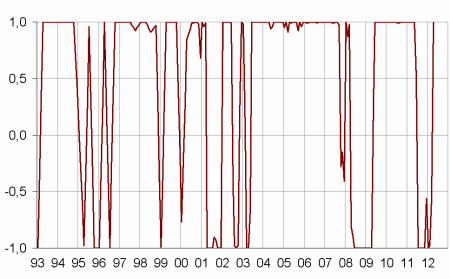

The general outlook has risen by three points compared with March. The turning point indicator indicates a favourable economic situation.

Job creations remain scarce

In services except temporary employment agencies, business leaders consider that the number of job creations decreased in the last few months. According to business leaders, they should be more numerous in the coming months.

graphiqueGraph1 – Business climate synthetic indicator

graphiquegraph_retourn – Turning point indicator

- Note: close to 1 (respectively -1), this indicator indicates a favourable short-term economic situation (respectively unfavourable).

tableauTable_quarter – Economic outlook in the services sector

| Average* | Jan. 12 | Feb. 12 | Mar. 12 | Apr. 12 | |

|---|---|---|---|---|---|

| Business climate synthetic indicator | 100 | 91 | 91 | 93 | 93 |

| General outlook | –5 | –19 | –18 | –15 | –12 |

| Past activity | 4 | 2 | 1 | 3 | 0 |

| Expected activity | 4 | –7 | –6 | –5 | –4 |

| Expected demand | 1 | –13 | –14 | –11 | –5 |

| Business situation | 0 | –5 | –6 | –5 | –7 |

| Past selling prices | –2 | –3 | –3 | –1 | –3 |

| Expected selling prices | –1 | 1 | –3 | 0 | –2 |

| Past employment | 4 | 8 | 7 | 1 | –3 |

| except temporary work agencies | 1 | –2 | 2 | 1 | –4 |

| Expected employment | 3 | –3 | –5 | –2 | –3 |

| except temporary work agencies | 0 | –3 | –4 | –3 | –1 |

| Investments | |||||

| Past investments | 2 | 2 | 4 | 1 | 3 |

| Expected investments | 2 | 3 | 1 | 3 | –3 |

| Operating balance result | |||||

| Past result | –1 | 0 | –7 | ||

| Expected result | –1 | –9 | –10 | ||

| Cash position | –10 | –11 | –10 | ||

| Difficulties of supply and demand | |||||

| difficulties of supply and demand | 9 | 10 | 12 | ||

| difficulties of supply only | 23 | 23 | 19 | ||

| difficulties of demand only | 29 | 30 | 30 | ||

| Difficulties in recruitment | 30 | 21 | 23 |

- * Average of the balances of opinion since 1988

- Source: Insee

Documentation

Methodology (2016) (pdf,158 Ko)

Pour en savoir plus

Time series : Economic outlook surveys – Services