10 November 2009

2009- n° 291According to business managers, investment in manufacturing industry would decrease

in 2009 and, less markedly, in 2010 Industrial investment survey - October 2009

10 November 2009

2009- n° 291According to business managers, investment in manufacturing industry would decrease

in 2009 and, less markedly, in 2010 Industrial investment survey - October 2009

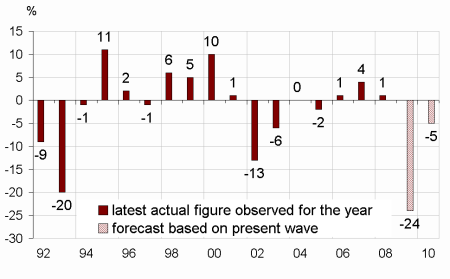

Surveyed in October 2009, business managers always forecast a drop in the investment for 2009: –24% in manufacturing industry and –22% in the industry as a whole. The decrease in investment would be especially sharp in the intermediate goods industry (–33%). The decrease would be less strong in the consumer-goods (–13%) and capital goods (–11%) industries.

- In 2010, investment would decrease again

- Investment would still decrease during H1 2010

- In 2009 and 2010, investment would be more aimed at the maintenance than at the extension of productive capacities

- According to the business leaders, most of the supports of investment decisions remain unfavorable for 2010

- The investment revision indicator is still negative in October

Surveyed in October 2009, business managers always forecast a drop in the investment for 2009: –24% in manufacturing industry and –22% in the industry as a whole. The decrease in investment would be especially sharp in the intermediate goods industry (–33%). The decrease would be less strong in the consumer-goods (–13%) and capital goods (–11%) industries.

In comparison with the July 2009 survey, business leaders’ expectations were revised 1 point downwards for the manufacturing industry and the industry as a whole.

graphiqueGraph1_ang – Annual nominal change in investment in manufacturing industry

In 2010, investment would decrease again

Surveyed for the first time on their investment’s estimates for 2010, business leaders forecast a decrease in their equipment expenditures. Yet, this decrease would be more moderate than in 2009: –5% in manufacturing industry and –3% in industry as a whole. In manufacturing industry, investment is expected to decrease in the intermediate goods industry (–11%), while it would stabilize in consumer-goods and capital goods industries.

tableauTableau 1 – Real annual investment growth

| In 2009 | In 2010 | ||

|---|---|---|---|

| forecast Jul.09 | forecast Oct.09 | forecast Oct.09 | |

| Food industry | -15 | -16 | -11 |

| Manufacturing industry | -23 | -24 | -5 |

| Consumer-goods industry | -10 | -13 | 0 |

| Motor-vehicle industry | -18 | -23 | -2 |

| Capital-goods industry | -9 | -11 | 0 |

| Intermediate-goods industry | -33 | -33 | -11 |

| All industry | -21 | -22 | -3 |

- How to read this table : In food industry, firms surveyed in October 2009 forecast nominal investment decrease of 16% in 2009 comparing to 2008 and of 15% in 2010 comparing to 2009.

Investment would still decrease during H1 2010

Between H1 and H2 2009 investment should decrease in manufacturing industry, according to business managers. This decrease is however less strong than anticipated in the April 2009 survey.

In H1 2010, business managers still anticipate a decrease in their equipment expenditures comparatively to the previous half-year.

graphiqueGraph2_ang – Six-month change in investment

In 2009 and 2010, investment would be more aimed at the maintenance than at the extension of productive capacities

According to the business managers of manufacturing industry, half of their investment would be aimed at maintenance of their productive capacity in 2010 : 28% for replacement (+1 point compared to 2009), 22% for investment connected with safety, environnement, working conditions (same as in 2009). On the contrary, a fewer proportion of investment would be allocated to increase the productive capacity: 14% in 2009 and 13% in 2010.

tableauTableau 2 – Share of purposes of investment

| Average | in 2009 | in 2010 | |

|---|---|---|---|

| 1991-2008 | (forecast) | (forecast) | |

| Replacement | 26 | 27 | 28 |

| Modernisation, streamlining | 24 | 22 | 22 |

| of which : automation | 11 | 7 | 7 |

| new production methods | 8 | 7 | 7 |

| energy savings | 6 | 8 | 8 |

| Increase in productive capacity | 16 | 14 | 13 |

| Introduction of new products | 15 | 15 | 15 |

| Other purposes (safety, environnement, working conditions…) | 19 | 22 | 22 |

According to the business leaders, most of the supports of investment decisions remain unfavorable for 2010

Business managers indicate that the factors influencing their investment decision will not improve much in 2010.

For example, domestic-demand outlook and foreign-demand outlook stay largely under their long-term average.

Moreover, the financial situation of industrial firms seems more and more unfavorable: balances of opinion concerning the cash flow and the indebtness sharply deteriorated. Yet, business leaders’ opinion about overall financing conditions and interest rates improved.

tableauTableau 3 – Factors influencing investment decisions

| Average | in 2009 | in 2010 | |

|---|---|---|---|

| 1991-2009 | (observation) | (prediction) | |

| Domestic-demand outlook | 49 | 20 | 17 |

| Foreign-demand outlook | 54 | 17 | 17 |

| Expected profits from new investment | 83 | 66 | 64 |

| Cash flow | 13 | -4 | -8 |

| Indebtness | -6 | -14 | -16 |

| Interest rates | 1 | 9 | 12 |

| Overall financing conditions | 7 | 0 | 1 |

| Technical factors (1) | 62 | 51 | 53 |

| Other factors (such as tax incentives) | 21 | 26 | 27 |

- (1) Technologicals developments and need for labour to adjust to these new technologies

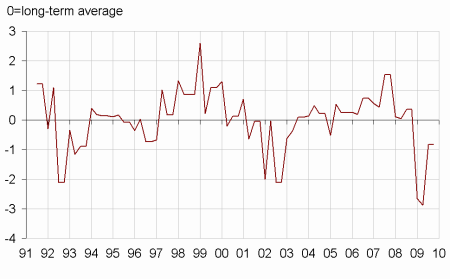

The investment revision indicator is still negative in October

The investment revision indicator is still negative in October, although far less than the indicator calculated in April. Based on investment amounts filled in at each survey, this indicator is well-correlated with quarterly growth of gross fixed capital formation of non-financial enterprises. That suggests that investment will decrease at the end of 2009.

graphiqueGraphIR_ang – Investment revision indicator in manufacturing industry

Documentation

Methodology (pdf,34 Ko)

Pour en savoir plus

Time series : Industry – Investment