2 January 2019

2019- n° 335In 2017, real estate leasing plummeted Annual financial lease survey - year 2017

2 January 2019

2019- n° 335In 2017, real estate leasing plummeted Annual financial lease survey - year 2017

In 2017, new financial lease contracts rose yet again, reaching 30.0 billion euros in value terms (+5.6% after +13.1% in 2016). However, this overall growth was the result of two very different evolutions, depending on the type of client: demand from individuals kept on increasing (+22.2% after +47.6%), reaching 7.6 billion euros, but new contracts signed by companies stalled in value (+0.9% after +6.2%). The latter amounted to 22.4 billion euros in 2017.

The divergence in these evolutions was due to the plunge of real estate leasing (-29.5% after -3.4%). In 2017, this type of contract only represented 3.9 billion euros, after 5.6 billion in 2016. This decline was only about compensated for by the rise in equipment leasing and, most importantly, in companies' leasing with an option to buy. With 14.9 billion euros worth of new contracts, equipment leasing stayed dynamic (+9.8% after +9.7%) and leasing with an option to buy expand sharply (+3.5 billion euros, or +17.5% after +11.1%).

- The rise in equipment easing is still due to the demand in motor vehicles, trailers and semi-trailers

- Equipment leasing was boosted by the administrative and support services as well as the construction sector

- The sharp fall of real estate leasing was mainly due to land contracts

- Administrative and support service activities as well as the real estate sector cut their real estate investments

- Leasing with an option to buy stayed popular, among households as well as companies

In 2017, new financial lease contracts rose yet again, reaching 30.0 billion euros in value terms (+5.6% after +13.1% in 2016). However, this overall growth was the result of two very different evolutions, depending on the type of client: demand from individuals kept on increasing (+22.2% after +47.6%), reaching 7.6 billion euros, but new contracts signed by companies stalled in value (+0.9% after +6.2%). The latter amounted to 22.4 billion euros in 2017.

The divergence in these evolutions was due to the plunge of real estate leasing (-29.5% after -3.4%). In 2017, this type of contract only represented 3.9 billion euros, after 5.6 billion in 2016. This decline was only about compensated for by the rise in equipment leasing and, most importantly, in companies' leasing with an option to buy. With 14.9 billion euros worth of new contracts, equipment leasing stayed dynamic (+9.8% after +9.7%) and leasing with an option to buy expand sharply (+3.5 billion euros, or +17.5% after +11.1%).

The rise in equipment easing is still due to the demand in motor vehicles, trailers and semi-trailers

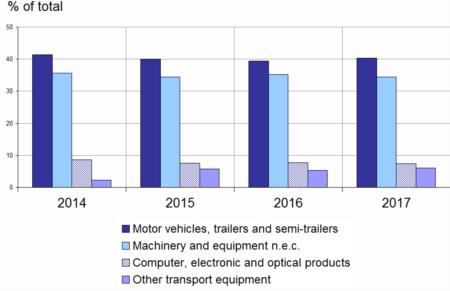

In 2017, investment via equipment leasing increased for nearly all products (+9.8%). Yet, the demand was most dynamic for motor vehicles, trailers and semi-trailers (+12.9% after +7.8%) and machinery and equipments (+7.3% after +12.2%). In value, these two types of products represented 71% of equipment leasing. The strongest positive contributions to the growth were those of other transport materials (+26.4% after +2.5%) and computers, electronic and optical products (+6.0% after +10.7%).

graphiqueGraph1 – Main products financed by equipment leasing

- Source: INSEE - Annual leasing survey of 2018

Equipment leasing was boosted by the administrative and support services as well as the construction sector

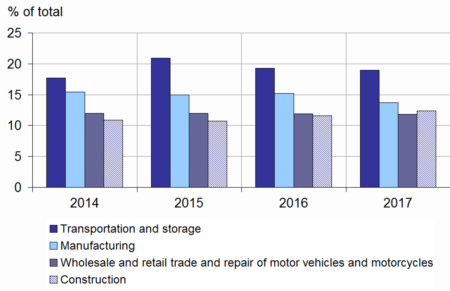

In 2017, just like in 2016, equipment leasing rose thanks to the demand from administrative and support service activities (+21.9%) and construction (+17.6%). These two sectors bore more than half the global growth. Other dynamic sectors included professional, scientific and technical activities (+15.3% after +4.9%), wholesale and retail trade and repair of motor vehicles and motorcycles (+8.6% after +8.9%), as well as transportation and storage (+8.0% after +1.2%).

graphiqueGraph2 – Main client sectors for equipment leasing

- Source: INSEE - Annual leasing survey of 2018

The sharp fall of real estate leasing was mainly due to land contracts

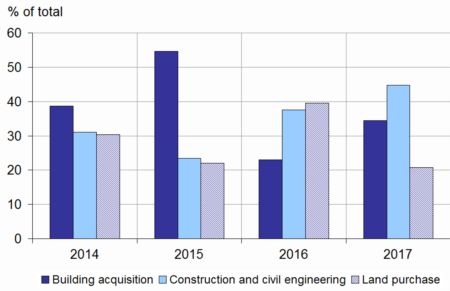

In 2017, the decrease of investment via real estate leasing continued: after two years of dynamic growth in 2014 and 2015, the total value of new contracts dropped by 29.2% (after -4.1% in 2016) to its lowest level since 1997 (3.9 billion euros). This fall was mainly due to the plunge of land acquisitions (-62.7%), after having more than doubled in 2016. In 2017, the corresponding contracts amounted to 0.8 billion euros (2.2 billion euros in 2016). Investments in construction and civil engineering also significantly shrunk, to 1.8 billion euros, (-15.6% after +54.0%). Conversely, building acquisitions edged up (+6.1% after -59.7%).

In 2017, like in 2016, real estate leasing slowed down for all usages. This was particularly the case for offices, whose expansion had been very dynamic in 2014 and 2015. However, in 2017, they shrunk by 59.3%, only amounting to 0.8 billion euros, that is 19.3% of all realestate contracts of the year. In 2017, more than half real estate investments were directed towards warehouses (1.3 billion euros, or -7.5%) or commercial premises (1.0 billion euros, or -16.4%).

graphiqueGraph3 – Main real estate investments

- Source: INSEE - Annual leasing survey of 2018

Administrative and support service activities as well as the real estate sector cut their real estate investments

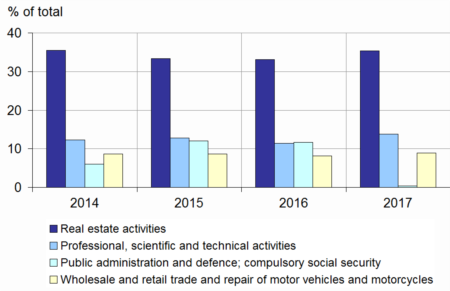

In 2017, nearly 75% of the real estate leasing plunge was mainly due to administrative and support service activities (who only invested 17.8 millions, that is -97.4% from 2016), whose use of this type of contract is legally restricted, as well as the real estate sector (1.4billion invested in 2017, that is -24.4%). Investment was also dull in the service activities.

Despite its lesser investment, the real estate sector remained by far the first client of real estate leasing (35.3% of new contracts), followed by scientific and technical activities (13.8%).

graphiqueGraph4 – Main sectors using real estate leasing

- Source: INSEE - Annual leasing survey of 2018

Leasing with an option to buy stayed popular, among households as well as companies

In 2017, new leasing with an option to buy contracts reached 11.1 billion euros (+20.6%). Households remained enthusiastic (7.6 billion euros, or +22.2% after +47.6%) and companies confirmed their interest (3.5 billion euros, or +17.6% after +13.9%).

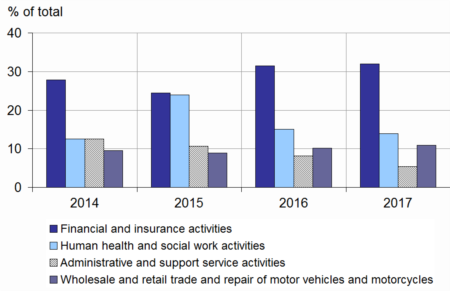

The companies of the financial and insurance sector (+19.5%), wholesale, retail trade and reparation of motor vehicles and motorcycles (+24.8%), the construction sector (+29.6%), transportation and storage (+36.4%) as well as professional, scientific and technical activities (+17.6%) increased their investments. Demand was also revitalised in the human health and social work activities sector (+8.9% after -28.2%). Finally, administrative and support service activities kept on reducing their use of leasing with an option to buy (-23.3% after -11.7%). Nevertheless, this sector remains the second largest user of this sort of contract, after the financial and insurance sector.

graphiqueGraph5 – Main sectors using leasing with a purchase

- Excluding individuals

- Source: INSEE - Annual leasing survey of 2018