24 October 2018

2018- n° 278In October 2018, the industrialists' opinion on recent demand has further deteriorated Quarterly business survey (goods-producing industries) - October 2018

24 October 2018

2018- n° 278In October 2018, the industrialists' opinion on recent demand has further deteriorated Quarterly business survey (goods-producing industries) - October 2018

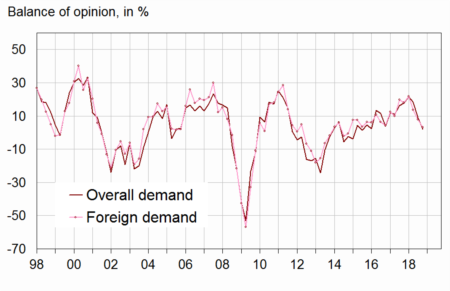

In October 2018, the balances of industrialists' opinion on overall and foreign demand in the last three months have dropped again sharply – they had reached at the beginning of the year their highest level in seven years, before dropping back in the April survey. They stand in October slightly above their long term average. Regarding future demand, business managers' opinion does not vary much compared to July – the balances of opinion on overall and foreigh demand over the next three months remain above their long term average but at a lower level than early 2018.

Warning: The weights used to aggregate the responses of the business managers have been updated. The seasonal coefficients have also been updated. Consequently, the set of results previously published from this quarterly survey is subject to slight revisions.

Past demand has been assessed less brisk again

In October 2018, the balances of industrialists' opinion on overall and foreign demand in the last three months have dropped again sharply – they had reached at the beginning of the year their highest level in seven years, before dropping back in the April survey. They stand in October slightly above their long term average. Regarding future demand, business managers' opinion does not vary much compared to July – the balances of opinion on overall and foreigh demand over the next three months remain above their long term average but at a lower level than early 2018.

graphiqueGraph 1 – Balance of opinion of past change in demand

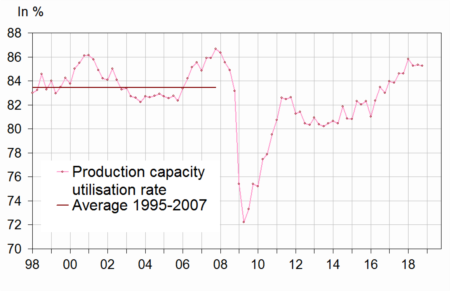

Pressure on production equipment slightly loosens but remains high

The production capacity utilisation rate stands at 85.2%, down by 0.1 points compared to July 2018. It had reached in January its highest level in ten years. As many industrialists as in July consider that they could not produce more if they received more orders: production bottlenecks remain more significant than their long term average. The proportion of industrialists indicating difficulties of supply exclusively has been hovering around 30% since the beginning of the year, far above its average. The share of business managers reporting difficulties of demand exclusively is stable, well below its average.

graphiqueGraph 2 – Production capacity utilisation rate

tableauTable 1 – Industrialists' opinion: demand and production factors

| Manufacturing industry | Mean | Jan. 18 | April 18 | July 18 | Oct. 18 |

|---|---|---|---|---|---|

| Overall demand | |||||

| Past change | 0 | 22 | 18 | 9 | 2 |

| Future change | 2 | 17 | 14 | 9 | 7 |

| Foreign demand | |||||

| Past change | 2 | 22 | 14 | 8 | 3 |

| Future change | 4 | 17 | 13 | 11 | 12 |

| Production factors | |||||

| Production bottlenecks (in %) | 22 | 36 | 31 | 32 | 32 |

| Assessment of productive capacity | 14 | –2 | –4 | –3 | –2 |

| Production capacity utilisation rate (in %) | 83,0 | 85,8 | 85,3 | 85,3 | 85,2 |

| Difficulties of supply and demand (in %) | |||||

| Difficulties of supply and demand | 8 | 9 | 8 | 10 | 10 |

| Difficulties of supply only | 20 | 29 | 30 | 31 | 30 |

| Difficulties of demand only | 43 | 26 | 27 | 25 | 25 |

- *: Long-term average since 1976, except for questions on difficulties of supply and demand.

- The results of the last survey are preliminary.

- Source: INSEE - Quarterly business survey in industry

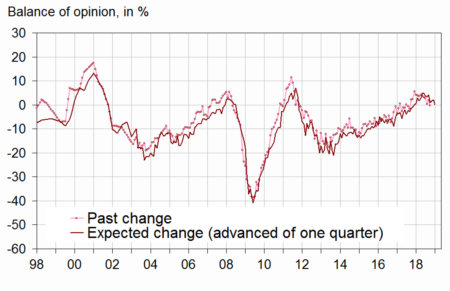

The balances of opinion on workforce size trends have slightly dwindled

In October 2018, again slightly fewer industrialists have reported an increase in their workforce size rather than a decrease in the last three months. Also fewer have forecast job growth rather than job cuts over the next three months. After reaching their highest level since July 2011, both corresponding balances remain significantly above their long-term average.

The share of industrialists experiencing hiring difficulties has slightly decreased, back to its April level. It had reached in July its highest level since October 2001.

graphiqueGraph 3 – Workforce size in the manufacturing industry

Slight increase in selling prices

According to industrialists, selling prices in the manufacturing industry have continued to increase, at a slightly slower pace than in Q2 2018 (+0.3% after +0.4%). Business managers forecast a small increase in Q4 2018 (+0.2%).

Only 10% of the industrialists have experienced cash-flow problems, a level virtually stable since April 2017, below its long-term mean (14%).

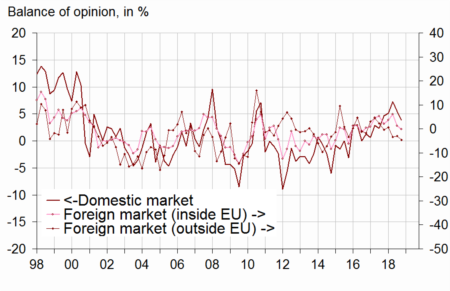

Industrialists' opinion on their competitive position has further deteriorated

Industrialists' opinion on their competitive position has gradually weakened, whether it is for the domestic or foreign markets.

The balance on general export prospects is virtually stable in October after drastically falling in July. It remains above its long-term average.

graphiqueGraph 4 – Competitive position

tableauTable 2 – Industrialists' opinion: employment, competitive position, cash-flow and selling prices

| Manufacturing industry | Mean | Jan. 18 | April 18 | July 18 | Oct. 18 |

|---|---|---|---|---|---|

| Workforce size | |||||

| Past change | –11 | 4 | 4 | 3 | 0 |

| Expected change | –13 | 3 | 4 | 1 | 0 |

| Difficulties hiring (in %) | 29 | 41 | 42 | 44 | 42 |

| Selling prices and cash-flow | |||||

| Past change on selling prices | 0,1 | 0,8 | 0,2 | 0,4 | 0,3 |

| Expected change on selling prices | 0,2 | 0,2 | 0,1 | 0,1 | 0,2 |

| Cash-flow problems (in %) | 14 | 10 | 10 | 10 | 10 |

| Competitive position | |||||

| On domestic market | 1 | 5 | 7 | 5 | 4 |

| On foreign markets inside EU | –1 | 4 | 6 | 1 | 0 |

| On foreign markets outside EU | –2 | 1 | –3 | –3 | –5 |

| General exportation expectations | –8 | 22 | 17 | 3 | 2 |

- *: Long-term average since 1976, except for workforce change (since 1976) and for competitive position by market (since 1997).

- The results of the last survey are preliminary.

- A quantitative question is asked about selling prices.

- Source: INSEE - Quarterly business survey in industry

Documentation

Abbreviated methodology (pdf,174 Ko)

Pour en savoir plus

Time series : Industry