24 October 2018

2018- n° 274In October 2018, the economic climate remains stable in the building construction

industry Monthly survey of building - October 2018

24 October 2018

2018- n° 274In October 2018, the economic climate remains stable in the building construction

industry Monthly survey of building - October 2018

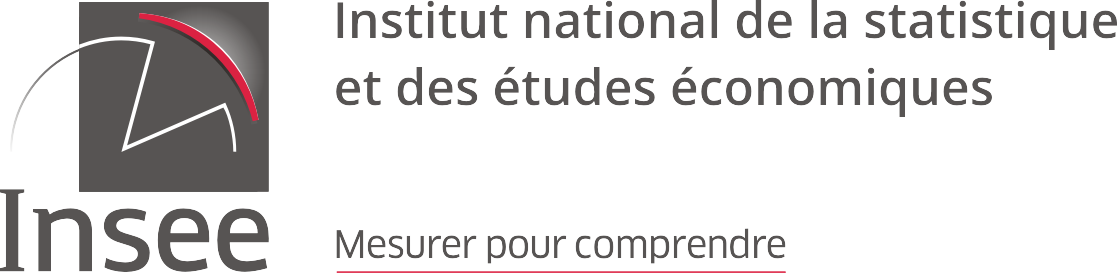

According to the business managers in the building construction industry surveyed in October 2018, the business climate remains stable. The composite indicator stands at 108 for the third consecutive month, well above its long-term average (100).

- Business managers' opinion on past and expected activity is stable

- Fewer business managers plan to increase their expected staff size

- Business managers consider their order books a little less filled

- Production capacity remains more used than in average, recruiting problems intensify

- Far fewer business managers have announced an increase in the repayment periods

According to the business managers in the building construction industry surveyed in October 2018, the business climate remains stable. The composite indicator stands at 108 for the third consecutive month, well above its long-term average (100).

graphiqueGraph1 – Business climate composite indicator

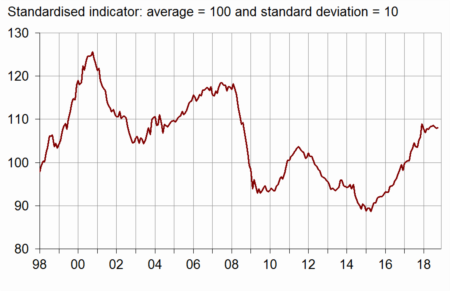

The turning point indicator remains in the favourable outlook area.

graphiqueGraph2 – Turning-point indicator

- Note: close to 1 (respectively –1), it indicates a favourable climate (respectively unfavourable). The uncertainty area is between –0.3 and +0.3

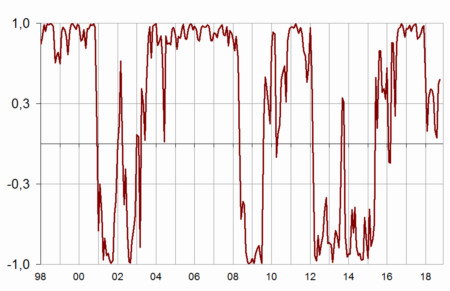

Business managers' opinion on past and expected activity is stable

In October 2018, as many business managers as in September have indicated an increase in their activity over the last three months. The corresponding balance of opinion is stable and stands above its long-term average. Likewise, business managers remain optimistic for the next few months: the balance on expected activity is stable, well above its long-term average. However, business managers are a little less upbeat about the general outlook of the sector. The corresponding balance, which had reached in January 2018 its highest level since October 2000, has decreased for the third consecutive quarter but remains significantly above its long-term average.

graphiqueGraph3 – Activity tendency in building construction

tableauTable1 – Building industry economic outlook

| Mean* | July 18 | Aug. 18 | Sept. 18 | Oct. 18 | |

|---|---|---|---|---|---|

| Composite indicator | 100 | 109 | 108 | 108 | 108 |

| Past activity | –4 | 10 | 10 | 2 | 2 |

| Expected activity | –5 | 6 | 0 | 10 | 10 |

| Gen. business outlook | –17 | 9 | 7 | ||

| Past employment | –5 | 4 | 3 | 4 | 5 |

| Expected employment | –4 | 16 | 15 | 15 | 9 |

| Opinion on order books | –23 | –8 | –9 | –11 | –12 |

| Order books (in month) | 5.6 | 7.3 | 7.3 | 7.2 | 7.1 |

| Production capacity utilisation rate | 88.5 | 90.0 | 90.2 | 90.4 | 90.4 |

| Obstacles to production increase (in %) | 32 | 36 | 37 | 38 | 39 |

| - Because of workforce shortage (in %) | 13.8 | 15.3 | 17.2 | 17.5 | 18.5 |

| Recruiting problems (in %) | 58 | 73 | 78 | ||

| Expected prices | –14 | 8 | 6 | 5 | 4 |

| Cash-flow position | –10 | –16 | –15 | ||

| Repayment period | 30 | 36 | 31 |

- * Mean since April 1975 for the composite indicator and since

- September 1993 for the balances of opinion.

- Source: INSEE, French business survey in the building industry

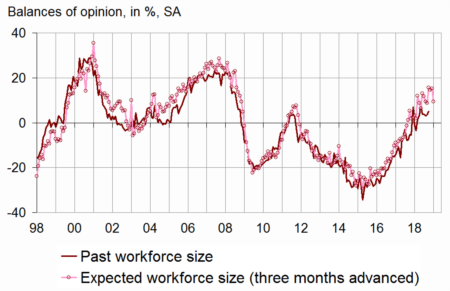

Fewer business managers plan to increase their expected staff size

In October 2018, a few more business managers than in September have indicated an increase in their staff size over the last three months. The corresponding balance has increased slightly and has exceeded more largely its long-term average. However, the balance of opinion on expected employment has decreased sharply after being stable in September. It stands nevertheless above its long-term average.

graphiqueGraph4 – Workforce size tendency in building construction

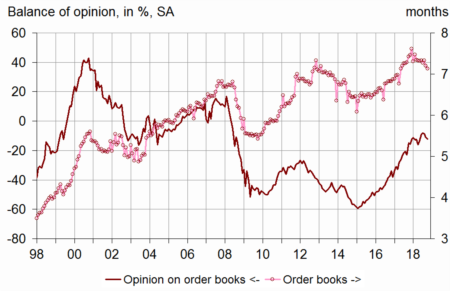

Business managers consider their order books a little less filled

In October 2018, slightly fewer business managers than in September 2018 consider that their order books are well filled for the period. The corresponding balance of opinion has decreased for the third consecutive month while remaining above its long-term average. With their present staff size, business managers consider that their order books provide 7.1 months of work, slightly less than in the previous month but largely above the long-term average (5.6 months).

graphiqueGraph5 – Order books

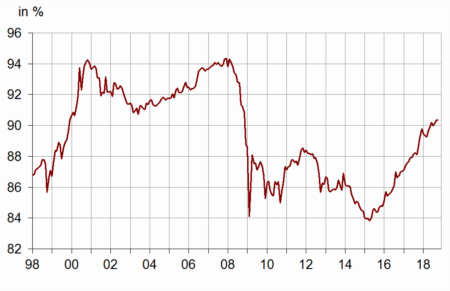

Production capacity remains more used than in average, recruiting problems intensify

The production capacity utilisation rate is stable in October 2018, at its highest level since December 2008 (90.4%). At the same time, 39% of business managers have indicated production bottlenecks, more than in long-term average, with a growing share due to workforce shortage. Otherwise, the share of business managers encountering recruiting problems has increased continuously for two years. It has risen sharply in October 2008 and has reached 78%, its highest level since July 2008, well above its long-term average (58%).

graphiqueGraph6 – Production capacity utilisation rate

Far fewer business managers have announced an increase in the repayment periods

In October 2018, practically as many business managers as in July 2018 have indicated a deterioration in their cash-flow position. The corresponding balance, virtually stable, stands below its long-term average. At the same time, far fewer business managers have reported that their customers' repayment period has been lengthened. The balance of opinion has fallen back markedly after a sharp increase in the previous quarter. It has almost returned to its long-term average.

Otherwise, slightly fewer business managers than in September 2018 have announced that they will increase their prices during the next three months. The corresponding balance has decreased slightly since August but remains well above its long-term average.

Documentation

Abbreviated methodology (pdf,177 Ko)