29 March 2018

2018- n° 84In 2016, households' appetite for lease with an option to buy boosted financial lease

investments Annual financial lease survey - year 2016

29 March 2018

2018- n° 84In 2016, households' appetite for lease with an option to buy boosted financial lease

investments Annual financial lease survey - year 2016

In 2016, new financial lease contracts reached 28.4 billion euros in value terms, up 13.1% from 2015 (after +10.1% in 2015). New leases with an option to buy contributed most to this rise: they were responsible for 9.3 points of the overall growth. At 9.2 billion euros, they increased by a third from 2015, nearly exclusively thanks to the demand from individuals. In second place, equipment leasing rose by 9.6% (after +3.3% in 2015), amounting to 13.6 billion euros and contributing to 4.7 points of the overall growth. Conversely, real estate leasing decreased slightly after two years of significant expansion (−3.4% after +11.5% in 2015 and +13.1% in 2014).

- New contracts for machinery and equipment rose significantly

- The administrative and support services and the construction sector increased their investments via equipment leasing

- Real estate leasing was most often used to purchase land and build new offices

- Real estate leasing slowed down

- Lease with an option to buy is driven by households

In 2016, new financial lease contracts reached 28.4 billion euros in value terms, up 13.1% from 2015 (after +10.1% in 2015). New leases with an option to buy contributed most to this rise: they were responsible for 9.3 points of the overall growth. At 9.2 billion euros, they increased by a third from 2015, nearly exclusively thanks to the demand from individuals. In second place, equipment leasing rose by 9.6% (after +3.3% in 2015), amounting to 13.6 billion euros and contributing to 4.7 points of the overall growth. Conversely, real estate leasing decreased slightly after two years of significant expansion (−3.4% after +11.5% in 2015 and +13.1% in 2014).

New contracts for machinery and equipment rose significantly

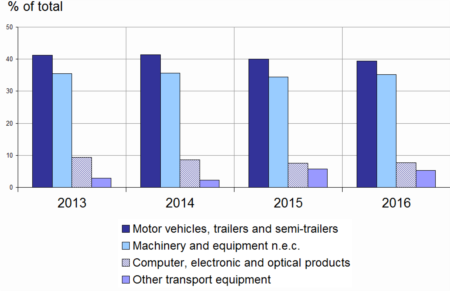

In 2016, the rise in equipment leasing was mainly due to the 12.2% increase in machinery and equipment (n.e.c.) investments, as well as the 7.8% growth of demand for products from the manufacture of motor vehicles, trailers and semi-trailers. Like in the past few years, these two sectors gather around 75% of the total investment in equipment.

Investment in computers, electronic and optical products picked up after two years of slowdown (+10.7% after −7.7% in 2015 and −3.3% in 2014).

graphiqueGraph1 – Main products financed by equipment leasing

- Source: INSEE - Annual leasing survey of 2017

The administrative and support services and the construction sector increased their investments via equipment leasing

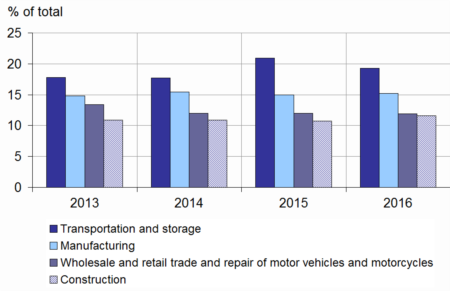

In 2016, equipment leasing rose in particular thanks to the demand from administrative and support service activities (+20.6%), construction (+19.1%), the manufacturing industry (+11.4%) and the wholesale, retail trade and repair of motor vehicles and motorcycles (+8.9%). With 2.6 billion euros of new contracts signed in 2016, the transportation and storage sector remained the biggest user of equipment leasing.

The four main client sectors ranking has remained unchanged since 2009.

graphiqueGraph2 – Main client sectors for equipment leasing

- Source: INSEE - Annual leasing survey of 2017

Real estate leasing was most often used to purchase land and build new offices

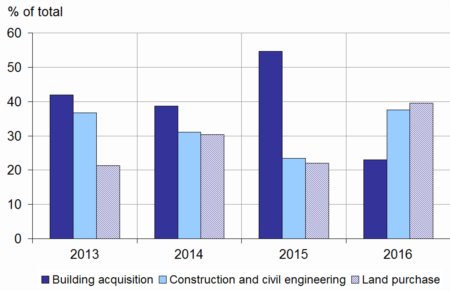

In 2016, land acquisition via real estate leasing recovered very strongly (+72.4% after −19.6% in 2015 and +59.1% in 2014) and reached 2.2 billion euros. Investments in construction and civil engineering also picked up (+54.0% after −15.1%), amounting for 2.1 billion euros. However, these improvements were balanced out by the cuts in building acquisitions (−59.7%). At 1.3 billion euros, they were down 1.9 billions euros from 2015.

In 2016, the main use of real estate leasing remained offices. These still amounted for a third of all new real estate leasing funding, all uses considered. They were down 2,2%, while funding shrunk for warehouses (−11.4% after +11.0%) as well as hospitals (−17.6% after +35.4%).

graphiqueGraph3 – Main real estate investments

- Source: INSEE - Annual leasing survey of 2017

Real estate leasing slowed down

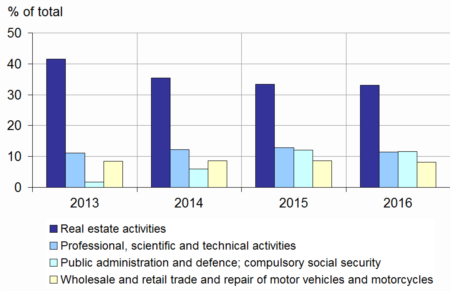

In 2016, the slight decrease in real estate leasing (−3.4% after +11.5%) was mainly due to the following sectors: professional, scientific and technical activities (−14.7%), real estate activities (−5.0%) and the construction sector (−43.2%). Nevertheless, real estate remained the first investor for this type of financial leasing (a third of new contracts).

On the contrary, the other service activities sector increased its investments. It now represents 3.8% of new contracts, after 0.9%.

graphiqueGraph4 – Main sectors using real estate leasing

- Source: INSEE - Annual leasing survey of 2017

Lease with an option to buy is driven by households

In 2016, new lease contracts with an option to buy reached 9.2 billion euros (+33.3%), two thirds of which came from households.

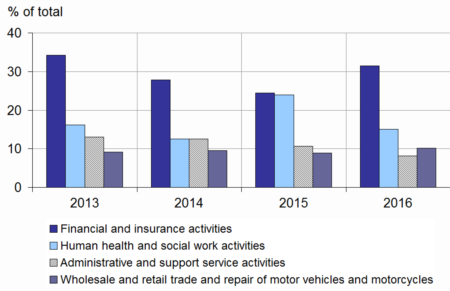

As for the enterprises, the financial and insurance sector raised their investments by 47.1%, strengthening their first position. They now represent 31.5% of the total lease with an option to buy contracts. Conversely, the human health and social work activities sector strongly reduced its resort to leasing with an option to buy (−28.2%). They nonetheless remain the second biggest client of this type of financial leasing.

The other notable changes were raises: +33.2% in construction, +30.3% in wholesale, retail trade and reparation of motor vehicles and motorcycles, and +17.6% in professional, scientific and technical activities.

graphiqueGraph5 – Main sectors using leasing with a purchase option

- Excluding individuals

- Source: INSEE - Annual leasing survey of 2017