26 January 2018

2018- n° 19In January 2018, households' confidence is virtually stable Monthly consumer confidence survey - January 2018

26 January 2018

2018- n° 19In January 2018, households' confidence is virtually stable Monthly consumer confidence survey - January 2018

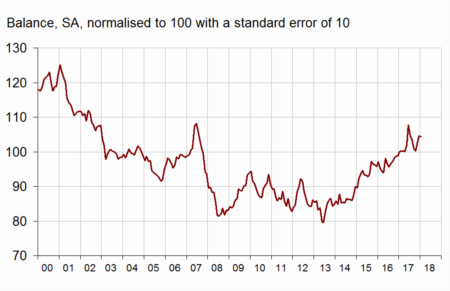

In January 2018, households' confidence in the economic situation decreased slightly: the synthetic index lost 1 point and reached 104. However, it remains above its long-term average (100).

In January 2018, households' confidence in the economic situation decreased slightly: the synthetic index lost 1 point and reached 104. However, it remains above its long-term average (100).

graphiqueGraph1 – Consumer confidence synthetic index

- Source: INSEE

Personal situation

Expected financial situation: slight deterioration

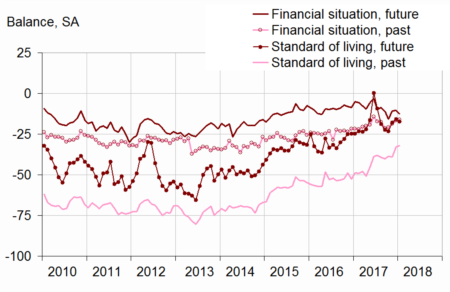

In January, households' opinion on their future financial situation worsened slightly: the corresponding balance lost 2 points staying below its long term average. Households' opinion on their past financial situation was virtually stable (+1 point). The corresponding balance thus remains above its long term average.

The proportion of households considering it is a suitable time to make major purchases was unchanged in January. The corresponding balance thus remains clearly above its long term average.

Savings intentions: noticeable improvement

The share of households considering it is a suitable time to save increased noticeably in January (+4 points). However, the corresponding balance clearly stands below its long-term average.

In January, households' balance of opinion on their expected saving capacity lost 2 points, while the one on their current saving capacity was virtually stable. Both stand above their long term average.

graphiqueGraph2 – Balances on personal financial situation and standard of living in France

- Source: INSEE

Economic situation in France

Past and future standard of living in France: virtual stability

In January, households' balances of opinion on the past standard of living and on the future standard of living in France were almost unchanged. Both balances stayed clearly above their long-term balances.

Unemployment: fears decreasing

Households' fears about unemployment decreased in January: the corresponding balance lost 5 points; therefore remaining below its long term average.

graphiqueGraph3 – Households' unemployment expectations

- Source: INSEE

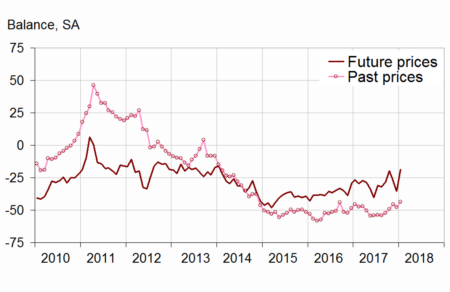

Expected inflation: households expect an increase in prices

In January, households were significantly more numerous than in December to expect prices to increase during the next twelve months: the balance gained 16 points, and has reached its highest level since January 2014. It now stands clearly above its long terme average.

Households were also more numerous than in December to consider that prices were on the rise during the last twelve months: the corresponding balance gained 4 points, while remaining below its long-term average.

graphiqueGraph4 – Households' perception of prices

- Source: INSEE

tableauTable – CONSUMER OPINION: synthetic index and opinion balances

| Avg. (1) | Oct. 17 | Nov. 17 | Dec. 17 | Jan. 18 | |

|---|---|---|---|---|---|

| Synthetic index (2) | 100 | 100 | 103 | 105 | 104 |

| Financial sit., past 12 m. | –21 | –21 | –19 | –17 | –16 |

| Financial sit., next 12 m. | –5 | –16 | –11 | –11 | –13 |

| Current saving capacity | 8 | 11 | 12 | 11 | 12 |

| Expected saving capacity | –9 | –9 | –2 | –1 | –3 |

| Savings intentions, next 12 m. | 17 | –4 | 5 | 4 | 8 |

| Major purchases intentions, next 12 m. | –14 | –6 | –4 | –3 | –3 |

| Standard of living, past 12 m. | –45 | –39 | –39 | –33 | –32 |

| Standard of living, next 12 m. | –25 | –23 | –18 | –16 | –17 |

| Unemployment, next 12 m. | 34 | 12 | 5 | 8 | 3 |

| Consumer prices, past 12 m. | –17 | –49 | –45 | –48 | –44 |

| Consumer prices, next 12 m. | –34 | –20 | –28 | –35 | –19 |

- (1) Average value between January 1987 and December 2017

- (2) The indicator is normalised in such a way that its average equals 100 and standard error equals 10 over the estimation period (1987-2017).

- Source: INSEE, monthly consumer confidence survey