23 April 2015

2015- n° 97In April 2015, the business managers are less pessimistic about their activity in

the building construction industry Monthly survey of building - April 2015

23 April 2015

2015- n° 97In April 2015, the business managers are less pessimistic about their activity in

the building construction industry Monthly survey of building - April 2015

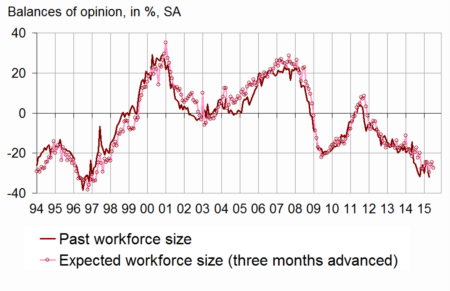

According to the business managers surveyed in April 2015, the business climate remains deteriorated in the building construction industry. The composite indicator is almost stable, and stays well below its long-term average. The turning point indicator remains in the neutral zone.

According to the business managers surveyed in April 2015, the business climate remains deteriorated in the building construction industry. The composite indicator is almost stable, and stays well below its long-term average. The turning point indicator remains in the neutral zone.

Business managers' opinion about activity is less deteriorated

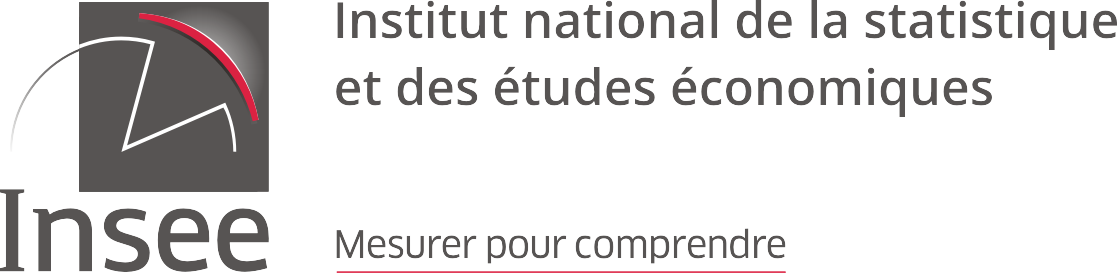

In April 2015, fewer business managers declare a fall in their activity on the recent period and for the next few months. However, the two corresponding balances remain far below their long-term average. The balance of opinion of the general business outlook has increased compared to January, but it stays below its long-term average.

graphiqueActivity – Activity tendency in the building industry

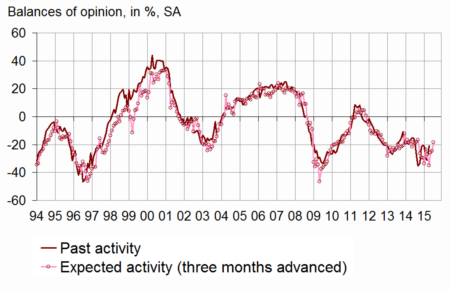

Increased pessimism about employment

In April, more business managers than in March indicate a fall in their staff size in the recent period and for the next few months. The corresponding balances remain substantially below their long-term average.

graphiqueWorkforce – Workforce size tendency in the building industry

graphiqueClimate – Composite indicator

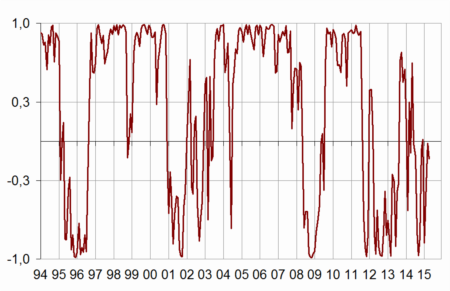

graphiqueTurningPoint – Turning-point indicator

- Note: close to 1 (respectively -1), it indicates a favorable climate (respectively unfavorable).

tableauTableau1 – Building industry economic outlook

| Mean* | Jan. 15 | Feb. 15 | March 15 | April 15 | |

|---|---|---|---|---|---|

| Composite indicator | 100 | 88 | 89 | 89 | 88 |

| Past activity | –4 | –21 | –30 | –31 | –21 |

| Expected activity | –6 | –35 | –26 | –25 | –18 |

| Gen. business outlook | –19 | –50 | –35 | ||

| Past employment | –4 | –30 | –24 | –25 | –32 |

| Expected employment | –4 | –30 | –26 | –24 | –27 |

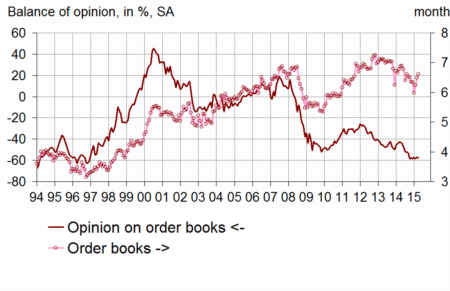

| Opinion on order books | –22 | –57 | –58 | –57 | –58 |

| Order books (in month) | 5.4 | 6.0 | 6.2 | 6.5 | 6.6 |

| Productive capacity utilisation rate | 88.7 | 84.0 | 83.6 | 83.8 | 83.8 |

| Obstacles to production increase (in %) | 33 | 20 | 19 | 21 | 21 |

| - Because of workforce shortage (in %) | 14,8 | 2,8 | 3,0 | 2,4 | 2,7 |

| Recruiting problems (in %) | 58 | 39 | 37 | ||

| Expected prices | –14 | –35 | –36 | –34 | –34 |

| Cash-flow position | –10 | –26 | –23 | ||

| Repayment period | 29 | 47 | 43 |

- * Mean since September 1993.

- Source: French business survey in the building industry - INSEE

Order books are still considered lower than normal

Business managers’ opinion about their order books remains deteriorated. The corresponding balance has fluctuated little around the same low level since October 2014. However, the number of months covered by these order books continue to rise slightly

graphiqueOrderBooks – Order books

Productive capacity still largely underused

In April 2015, the productive capacity utilisation rate is stable at its lowest level since 2009, after a sharp decline since early 2014. At the same time, one business manager out of five has reported difficulties to increase its output, against one out of three in average since 1993. Only 37% of construction firms still have difficulties in recruiting labor force, against 58% in average.

graphiquePcur – Productive capacity utilization rate

Prices remain very tight

In April, as many business managers as in March indicate price falls for the next few months. The corresponding balance remains substantially below its long-term average. According to business managers, the cash-flow position of the overall sector is a little less deteriorated than in the previous quarter and the repayment period is reduced slightly.

Documentation

Methodology (2016) (pdf,170 Ko)