Informations Rapides ·

12 January 2024 · n° 10

Informations Rapides ·

12 January 2024 · n° 10 Finance lease slowed down in 2022 Annual financial lease survey - year 2022

Finance lease slowed down in 2022 Annual financial lease survey - year 2022

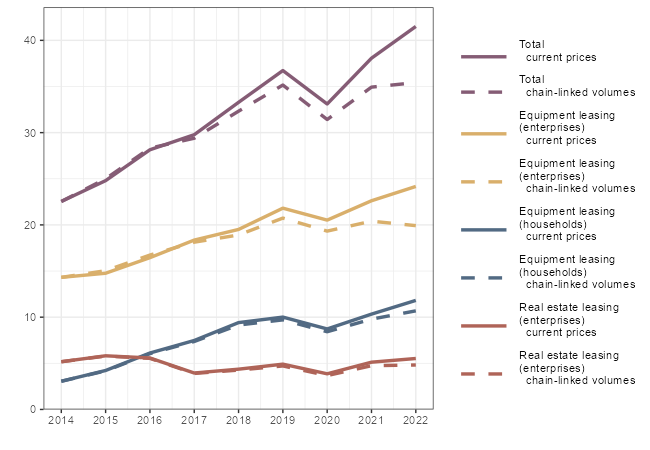

In 2022, the total amount of investments financed by financial lease (i.e. rental with a purchase option) reached 41.5 billion euros (€ bn). It represented 1.6% of gross domestic product (GDP) and 6.2% of gross fixed capital formation (GFCF) in the national economy. In current prices, it rose by 9.0% in 2022 (+€3.4 bn), following the strong rebound of 2021 (+15.0%). Adjusted for price trends, the slowdown (in chain-linked volumes) is even more pronounced: +1.4% after +11.2% in 2021 and +9.3% on average between 2014 and 2019.

Business investment in equipments was the main contributor to the total growth, contributing 4.1 points (for an increase of +6.8%). However, with the sharp rise in GFCF product prices (+9.4%), equipment leasing fell by 2.4% in chain-linked volumes, and thus largely explains the low dynamism of the aggregate in volume. Real estate investment, for its part, grew by 7.8% (a contribution of +1.1 points), following a record rise of 32.6% in 2021. Growth in chain-linked volumes was more moderate, but remained positive (+1.6%). Lastly, household investments were much more dynamic (+14.4% in current prices and +9.2% in volume), with a contribution of +3.9 points in value terms (2.6% in chain-linked volumes).

In 2022, the total amount of investments financed by financial lease (i.e. rental with a purchase option) reached 41.5 billion euros (€ bn). It represented 1.6% of gross domestic product (GDP) and 6.2% of gross fixed capital formation (GFCF) in the national economy. In current prices, it rose by 9.0% in 2022 (+€3.4 bn), following the strong rebound of 2021 (+15.0%). Adjusted for price trends, the slowdown (in chain-linked volumes) is even more pronounced: +1.4% after +11.2% in 2021 and +9.3% on average between 2014 and 2019.

Business investment in equipments was the main contributor to the total growth, contributing 4.1 points (for an increase of +6.8%). However, with the sharp rise in GFCF product prices (+9.4%), equipment leasing fell by 2.4% in chain-linked volumes, and thus largely explains the low dynamism of the aggregate in volume. Real estate investment, for its part, grew by 7.8% (a contribution of +1.1 points), following a record rise of 32.6% in 2021. Growth in chain-linked volumes was more moderate, but remained positive (+1.6%). Lastly, household investments were much more dynamic (+14.4% in current prices and +9.2% in volume), with a contribution of +3.9 points in value terms (2.6% in chain-linked volumes).

graphiqueInvestments financed by type of lease

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2023

Automotive investments slowed down in 2022

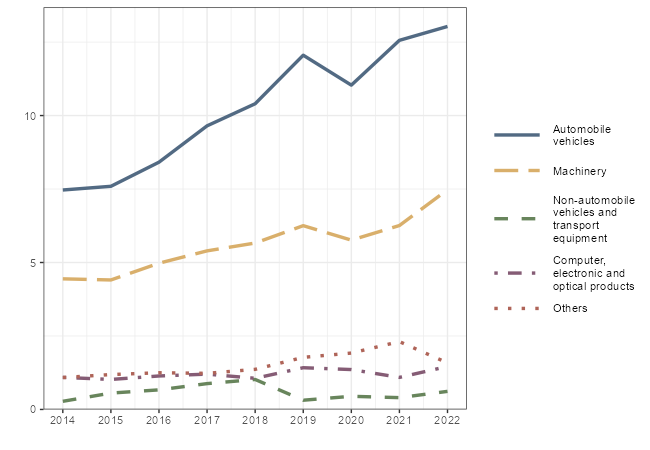

Equipment leasing was still mainly used by companies to invest in motor vehicles (53.9% of total investments), or in machinery and equipment (30.9%). Investment slowed down for motor vehicles (+3.8% after +13.8% in 2021), while it accelerated sharply in machinery and equipment (+19.5% after +8.6%). Investments in computer, electronic and optical products and “other vehicles and transport equipment” grew strongly in 2022 (+34.1% and +53.2% respectively).

graphiqueEquipment leasing investments : main products

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2023

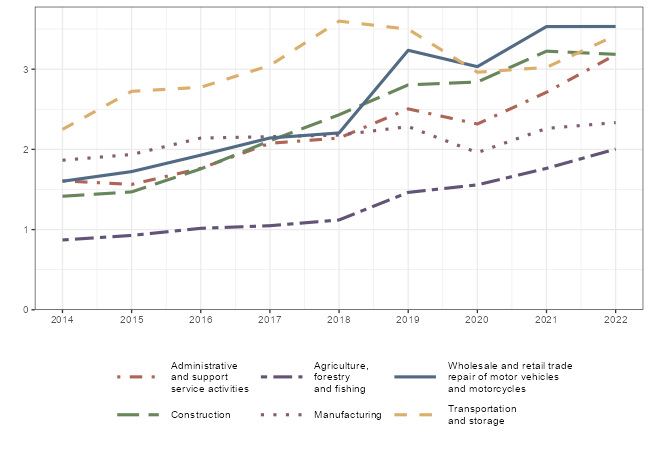

Equipment leasing continued to grow in most sectors

In 2022, the total amount invested by businesses in equipment reached €24.2 bn, i.e. an increase of +6.8% compared with 2021. This growth is most visible in the sector of administrative and support services (+17.3%), in agriculture (+13.6%) and in the transport and storage sector, which had a delayed post-Covid rebound (+13.2% after +2.0% in 2021). On the contrary, in the two main sectors who rely on equipment leasing, investment was stable (+0.0% for retail) or contracted slightly (-1.2% for construction).

graphiqueEquipment leasing investments : main clients by sector of activity

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2023

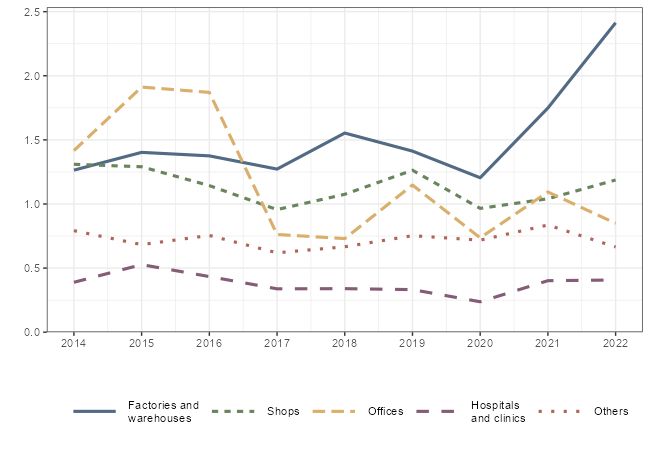

In 2022, real estate leasing is supported by factories

Investments in factories and warehouses maintained in 2022 the strong momentum (+38.0% after +45.2% in 2021). Investments in stores and retail outlets also increased (+14.1%). Conversely, investment in office buildings fell (-22.3%), as did investment in other buildings, including hotels and auditoriums (-20.5%). Finally, investment in hospitals and clinics rose slightly (+1.3%).

graphiqueReal estate leasing investments : main usages

- Source: INSEE - Annual leasing survey of 2023

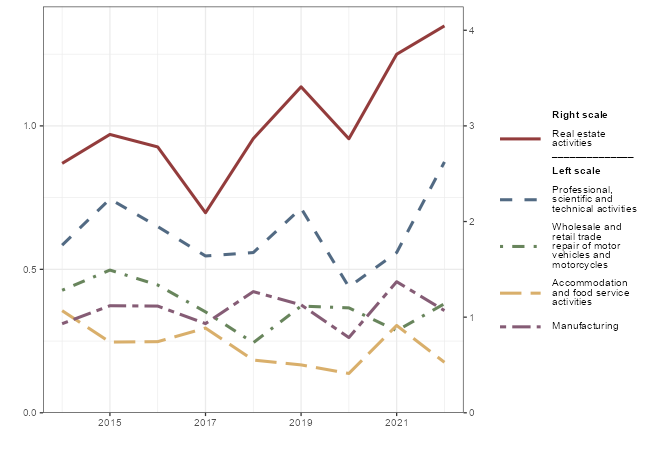

The sector of real estate activities slowed its investment

Investment in land and buildings in the sector of real estate activities slowed down in 2022 (+7.9%), following a 30.8% rebound in 2021 and a very strong momentum prior to 2020. This sector alone still accounted for almost half of all real estate leasing investments. Professionals in the specialized, scientific and technical activities sector have significantly increased their real estate leasing investments (+56.6%, i.e. a contribution of +6.2 points to total growth). In contrast, leasing fell sharply in the manufacturing (-22.0%) and accommodation and catering (-42.2%) sectors.

graphiqueReal estate leasing investments : main clients by sector of activity

- Note : Right scale for real estate activities

- Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2023

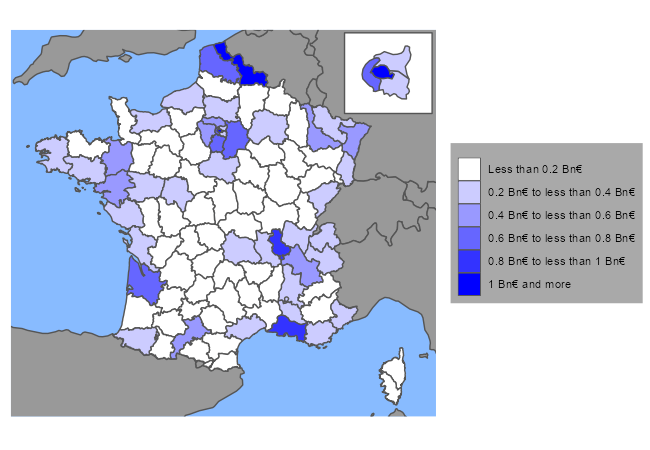

The territorial trends were contrasted

Companies in the Nord department invested nearly €1.1 billion (in value) in leasing in 2022, an increase of 32.0% compared with the previous year. This department alone accounted for +1.1 points of the 6.8% increase in investment nationwide (equipment and real estate leasing combined). However, Paris remained the department making the greatest use of leasing, with almost €1.2 billion invested. The next highest levels of investment are in the departments hosting major metropolitan areas (Marseille, Lyon, Bordeaux, etc.) and on the outskirts of the capital. Lease financing was generally dynamic in these areas, with the exception of Seine-Saint-Denis, Yvelines and Val-de-Marne, where investment fell by almost €0.1 billion.

graphiqueFinancial lease investments of enterprises by department

- Source: INSEE - Annual leasing survey of 2023

For more information

The annual financial lease survey measures the breakdown of financial lease contracts by institutional sector and sector of activity, knowledge of which is necessary for the economic analysis of company accounts.

Additional information (simplified and detailed methodology, nomenclatures, etc.) is available through the “Documentation” tab of the web page of this publication.