Informations Rapides ·

9 November 2022 · n° 294

Informations Rapides ·

9 November 2022 · n° 294 In Q3 2022, collective tourist attendance exceeded its pre-sanitary crisis level Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - third quarter 2022

In Q3 2022, collective tourist attendance exceeded its pre-sanitary crisis level Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - third quarter 2022

In the third quarter of 2022, occupancy in collective accommodation, measured in overnight stays, was 3.2% higher than its Q3 2019 level. Attendance was significantly higher than in 2019 in campsites (+6.2%). It also exceeded its 2019 level in hotels, but to a lesser extent (+1.3%). Attendance in holiday and other short-stay accommodations (HOSSA) yet remained below its pre-crisis level (-1.0%).

Considering sanitary crisis and the outstanding fall in touristic attendance through 2020 and 2021, quarterly results are compared to the same quarter in 2019.

In the third quarter of 2022, occupancy in collective accommodation, measured in overnight stays, was 3.2% higher than its Q3 2019 level. Attendance was significantly higher than in 2019 in campsites (+6.2%). It also exceeded its 2019 level in hotels, but to a lesser extent (+1.3%). Attendance in holiday and other short-stay accommodations (HOSSA) yet remained below its pre-crisis level (-1.0%).

Hotel occupancy exceeded its pre-crisis level

In the third quarter of 2022, for the first time since the sanitary crisis, hotel occupancy was higher than its 2019 level. It has been supported for more than a year by resident customers. Hotel nights by residents in Q3 2022 were thus 3.2% higher than in Q3 2019, being nearly 1.4 million additional overnight stays. Overnight stays by non-resident customers were slightly below its pre-crisis level (-1.7%, a drop of half a million overnight stays compared to 2019), with the return of almost all international customers.

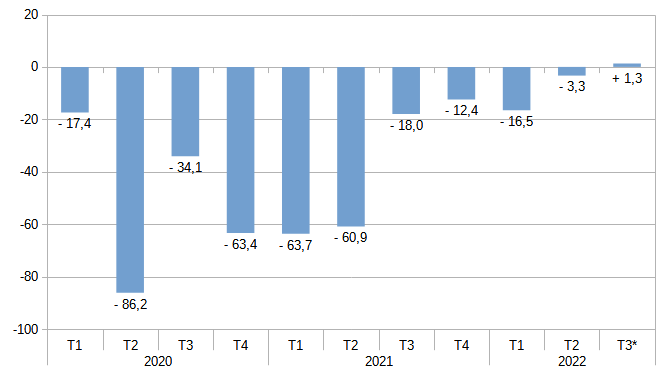

graphiqueQuarterly evolution in hotel overnight stays compared to the same quarters in 2019 *

- * provisional data for September 2022

- Reading note: in the third quarter of 2022, overnight stays in French hotels were 1.3% higher then in the third quarter of 2019

- Reference area: France, including overseas departements (DOM)

- Source : INSEE, in partnership with the Regional Committees of tourism (CRT)

Upscale hotels benefited hotel occupancy's improvement.In the third quarter of 2022, overnight stays rised in 4 and 5 stars hotels (+8.2% compared to the third quarter of 2019) and, to a lesser extent, in 3 stars hotels (+3.9%).On the other hand, attendance still declined in 1 and 2 stars hotels (-7.9%) and unclassified ones (-5.3%).

Attendance by resident customers sharply increased in 4 and 5 stars hotels, compared to 2019. Such hotels may have benefited from stays by residents, who used to travel abroad before crisis and turned to domestic tourism in upscale hotels during summer of 2022.

With nearly 16 million overnight stays, attendance were particularly strong in coastlines hotels (+2.7% compared to 2019). Hotel occupancy came back to its 2019 level in urban areas, in both Île-de-France and provincial urban areas.

Attendance by resident customers was sustained in overseas departments (+9.6% compared to the third quarter of 2019) and ski mountain areas (+7.4%), and more than offsetting the non-resident occupancy decline.

Business attendance, less significant in summertime, partially recovered from sanitary crisis. Business overnight stays were thus down 3.2% in the third quarter of 2022 compared to the same period in 2019. The drop remained particularly significant in Île-de-France (-13.8%, or 1.1 million business nights fewer).

tableauOvernight stays in tourist collective accommodation in Q3 2022 *

| Nights of the quarter | Year-on-year evolution (%) (Q3 2022/Q3 2019) | ||||

|---|---|---|---|---|---|

| Total nights (millions) | % of non-resident nights | Total | Residents | Non-residents | |

| Total | 209.1 | 29.3 | 3.2 | 5.0 | -1.0 |

| Hotels | 70.6 | 37.1 | 1.3 | 3.2 | -1.7 |

| Unclassified | 8.4 | 26.0 | -5.3 | -4.8 | -6.7 |

| 1 and 2 stars | 14.1 | 27.5 | -7.9 | -7.7 | -8.3 |

| 3 stars | 27.8 | 36.0 | 3.9 | 5.2 | 1.8 |

| 4 and 5 stars | 20.3 | 49.7 | 8.2 | 19.5 | -1.3 |

| Ile-de-France | 19.2 | 60.0 | 0.1 | 0.1 | 0.1 |

| Coastlines | 15.6 | 31.0 | 2.7 | 6.7 | -5.2 |

| Ski mountain area | 2.4 | 23.8 | 7.4 | 11.6 | -4.1 |

| Provincial urban area | 24.6 | 29.6 | -0.1 | 1.0 | -2.6 |

| Other metropolitan area | 7.7 | 23.7 | 3.1 | 3.7 | 1.3 |

| DOM (overseas departements) | 1.1 | 9.7 | 9.6 | 12.7 | -13.1 |

| Campsites | 102.2 | 28.6 | 6.2 | 8.1 | 1.5 |

| Unclassified | 4.2 | 27.1 | 2.8 | 5.3 | -3.4 |

| 1 and 2 stars | 10.5 | 25.7 | -6.8 | -6.7 | -7.2 |

| 3 stars | 28.1 | 28.6 | -3.5 | -3.5 | -3.6 |

| 4 and 5 stars | 59.4 | 29.2 | 14.7 | 18.7 | 6.0 |

| Bare pitches | 46.3 | 38.0 | -1.8 | -0.8 | -3.5 |

| Pitches with rental accomodation | 55.9 | 20.7 | 13.8 | 14.8 | 10.1 |

| Coastlines | 58.7 | 25.2 | 7.0 | 7.1 | 6.7 |

| Except coast | 43.5 | 33.1 | 5.1 | 9.8 | -3.3 |

| Holiday and other short-stay accomodation | 36.3 | 16.5 | -1.0 | 0.8 | -8.8 |

| Tourism residences | 25.3 | 18.8 | -1.2 | 2.1 | -13.6 |

| Other | 11.0 | 11.3 | -0.3 | -2.0 | 15.6 |

| Ile-de-France | 3.3 | 33.5 | 6.1 | 11.5 | -3.3 |

| Coastlines | 14.2 | 15.7 | -3.1 | -2.3 | -7.0 |

| Ski mountain area | 6.3 | 10.0 | -2.4 | -0.6 | -15.8 |

| Provincial urban area | 6.1 | 17.7 | 0.0 | 3.1 | -12.1 |

| Other area | 6.4 | 14.9 | 1.1 | 3.4 | -10.2 |

- * provisional data for September 2022

- Reading note: in coastlines areas hotels, overnight stays from resident customers were 6.7% higher then in Q3 2019

- Reference area: France including overseas departements (DOM) for hotels, Metropolitan France for campsites and HOSSA

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT)

European customers boosted hotel attendance

Overnight stays by non-resident customers have been fewer in metropolitan hotels since sanitary crisis (-1.7%). Although still below its pre-crisis level, attendance in the third quarter of 2022 confirmed the return of british (-6.0% compared to 2019) and american (-2.3%) customers. In addition, tourists from countries within driving distance returned to hotels. This is particularly the case for tourists from Germany, whose overnight stays increased by 10.3% compared to 2019, from Belgium (+5.8%) and especially from the Netherlands (+40.8%). Customers from Northern and Eastern Europe probably traveled more to Western tourist destinations such as France, in a context of war in Ukraine and Eastern Europe concerns. On the other hand, the drop in non-European country's attendance (excluding the United States of America) remained significant, specially from Asia, as travel restrictions lasted all summer in several Far Eastern countries, such as China and Japan.

tableauOvernight stays by customer’s country of origin *

| Hotels | Campsites | |||

|---|---|---|---|---|

| Q3 2022 (millions) | Year-on-year evolution (%) (Q3 2022/Q3 2019) | Q3 2022 (millions) | Year-on-year evolution (%) (Q3 2022/Q3 2019) | |

| Resident overnight stays | 43.4 | 3.0 | 73.0 | 8.1 |

| Non-resident overnight stays | 26.1 | -1.7 | 29.2 | 1.5 |

| European overnight stays (including EU) | 18.9 | 6.4 | 29.2 | 1.6 |

| including Germany | 2.8 | 10.3 | 7.0 | 15.7 |

| including Belgium | 2.3 | 5.8 | 4.1 | 4.4 |

| including Netherlands | 1.9 | 40.8 | 9.9 | 1.4 |

| including United-Kingdom | 3.1 | -6.0 | 3.4 | -20.5 |

| Overnight stays from the United States | 3.1 | -2.3 | 0.0 | -24.6 |

| Other non-resident overnight stays | 4.1 | -27.0 | 0.0 | -28.0 |

| Nuitées totales | 69.5 | 1.2 | 102.2 | 6.2 |

- * provisional data for September 2022

- Reference Area : Metropolitan France

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT)

Attendance in holiday and other short-stay accommodations remained down

Domestic customer's comeback was not enough to restore pre-crisis attendance in holiday and other short-stay accommodations. Overnight stays remained slightly down in the third quarter of 2022 (-1.0% compared to the third quarter of 2019). Specially in tourist residences, the increase in resident attendance (+2.1%) did not offset the disaffection of non-resident customers (-13.6%).

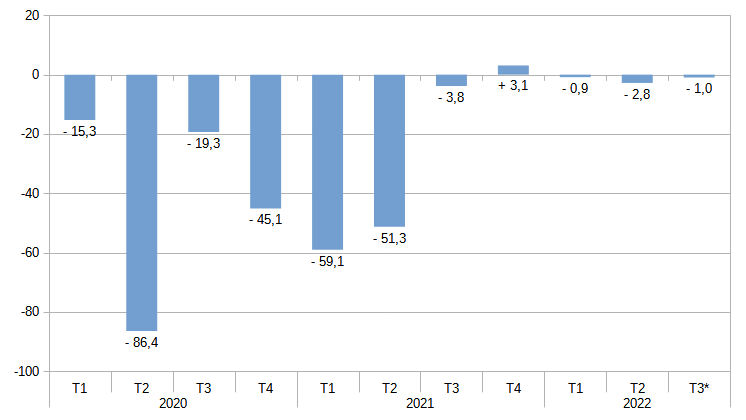

graphiqueQuarterly evolution in HOSSA’s overnight stays, compared to the same quarters in 2019 *

- * provisional data for September 2022

- Reading note: in Q3 2022, overnight stays in HOSSA were 1.0% lesser then in Q3 2019

- Reference area: Metropolitan France

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT)

Campsite attendance increased

Following two years of sanitary crisis disappointing attendances (-15.6% in the third quarter of 2020 and -0.8% in the third quarter of 2021, compared to the third quarter of 2019), French campsites exceeded by 6.2% their pre-crisis attendance level in the third quarter of 2022. This represented 102 million overnight stays between July and September 2022. Campsites mostly benefited from a sharp increase in attendance by resident tourists (+8.1%), and to a lesser extent, from more significant non-resident tourism than in 2019 (+1.5%).

With nearly 59 million overnight stays in campsites, the coastlines remained the main destination for this type of accommodation, and attendance by both residents and non-residents rised sharply. Campsites further from the coastlines also benefited from a sustained return from resident customers.

For more information

Revision of series concerning hotels and holiday and other short-stay accommodations (HOSSA): since 1 January 2019, data from non-responding hotels are imputed using a new method, based on their characteristics. This new method of imputing non-response tends to slightly reduce the total number of overnight stays (−0.9% in the fourth quarter of 2018) but has no impact on quarterly trends. This method was also implemented for HOSSA in 2020. The data used in this publication for the year 2019 were re-calculated in order to make comparisons on a constant basis.

Next publication: February 2023.

Pour en savoir plus

Time series: Tourism