8 November 2018

2018- n° 292In the manufacturing industry, business managers have lowered their investment expectations

for 2018 but forecast a rise in 2019 Industrial investment survey - October 2018

8 November 2018

2018- n° 292In the manufacturing industry, business managers have lowered their investment expectations

for 2018 but forecast a rise in 2019 Industrial investment survey - October 2018

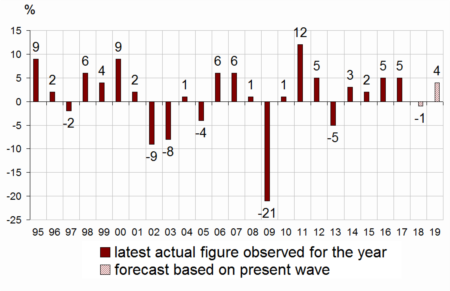

The business managers surveyed in October 2018 forecast that investment in the manufacturing industry will fall back by 1% in 2018 in nominal terms. For 2019, they forecast a 4% rise in their investment spending compared to 2018.

- Investment spending in the sector of transport equipment is set to decline sharply in 2018

- For 2019, investment is expected to grow in the manufacturing industry

- For H1 2019, more business leaders plan an increase in their investment than a decrease

- Investments are stimulated by financing terms and demand outlook

- In 2019, the replacement of equipment remains the first purpose of invesment

The business managers surveyed in October 2018 forecast that investment in the manufacturing industry will fall back by 1% in 2018 in nominal terms. For 2019, they forecast a 4% rise in their investment spending compared to 2018.

Investment spending in the sector of transport equipment is set to decline sharply in 2018

With an expected overall decrease of 1% in investment for 2018, business managers have lowered their July 2018 estimate by 5 points. This downward revision is larger than the average recorded at this time of the year since 2004 (–3 points).

In the sector of transport equipment, investment spending should drop significantly in 2018, whereas in July these businesses anticipated an increase in their investments over the year. In the sector of elecrical and electronic equipment and machinery, investment should increase less sharply than forecast in July. In other sectors business managers have also lowered the anticipated amount of their investment for 2018.

graphiqueGraph 1 – Annual nominal change in investment in the manufacturing industry

- Source: INSEE - Industrial investment survey

For 2019, investment is expected to grow in the manufacturing industry

For 2019, business leaders expect on average an upturn in their investment expenditures compared to 2018. Investment should resume rising in the sector of transport equipment, especially motor vehicle. It should also recover in the agrifood industry.

It should keep growing in the sector of electrical and electronic equipment and machinery, although less rapidly than the previous year.

tableauTable 1 – Annual nominal change in investment in the manufacturing industry by main sector

| NA* : (A17) et [A38] | In 2018 | In 2019 | |

|---|---|---|---|

| forecast Jul.18 | forecast Oct.18 | forecast Oct.18 | |

| C : MANUFACTURING INDUSTRY | 4 | –1 | 4 |

| (C1): Manufacture of food products and beverages | –1 | –6 | 3 |

| (C3): Manufacture of electrical and electronic equipment; Manufacture of machinery | 11 | 6 | 3 |

| (C4): Manufacture of transport equipment | 3 | –8 | 3 |

| [CL1]: Motor vehicles | 3 | –10 | 8 |

| (C5): Other manufacturing | 4 | 2 | 4 |

| Total sectors (C3-C4-C5) | 5 | 0 | 4 |

- How to read this table: In the manufacturing industry, firms surveyed in october 2018 forecast a nominal investment decrease of 1% in 2018 compared with 2017 and a increase of 4% in 2019 compared with 2018.

- * The codes correspond to the level of aggregation (A17) and [A38] of the "NA" aggregate classification based on NAF rev.2

- Source: INSEE - Industrial investment survey

The estimate for 2019 could be revised over the next quarters: on average since 2003, the October estimate has been 4 points lower than the next estimate issued in January of the following year. Nevertheless, it is close to the estimate issued in fine, in July two years later.

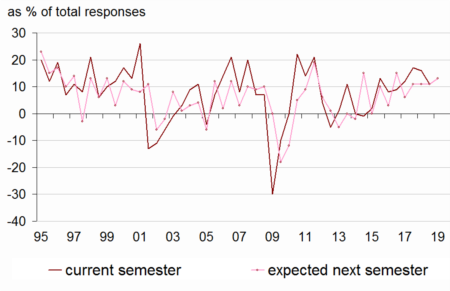

For H1 2019, more business leaders plan an increase in their investment than a decrease

For the second semester 2018, as compared to the first semester, more business managers in industry have reported a rise rather than a drop in their investment. The balance related to invesment change in the current semester (+11) is slightly down as compared to April but stays above its long-term average (+6). For the first semester 2019, business leaders have been also more numerous to anticipate a rise than a drop in their investment. The balance regarding investment in the next semester picks up to +13, above its long-term average (+6).

graphiqueGraph 2 – Opinion of industrials regarding six-month change in investment (first estimation)

- Source: Industrial investment survey - INSEE

Investments are stimulated by financing terms and demand outlook

For 2018 and 2019, the financing terms (cash flow, indebtedness, interest rates, overall financing conditions) have been still considered conducive to investment. The balances of opinion regarding interest rates and financing conditions are markedly above their long-term average. The balances on the influence of domestic and foreign demand outlook have remained also at a high level, above their average. For 2019, the foreign-demand outlook and expected profits have been judged more stimulating than in 2018.

tableauTable 2 – Factors influencing investment decisions

| Average | in 2018 | in 2019 | |

|---|---|---|---|

| 1991-2018 | (observation) | (prediction) | |

| Domestic-demand outlook | 49 | 58 | 59 |

| Foreign-demand outlook | 53 | 58 | 62 |

| Expected profits from new investment | 82 | 75 | 80 |

| Cash flow | 16 | 15 | 17 |

| Indebtedness | –2 | 1 | 4 |

| Interest rates | 9 | 29 | 30 |

| Overall financing conditions | 15 | 32 | 33 |

| Technical factors (1) | 63 | 64 | 66 |

| Other factors (such as tax incentives) | 23 | 26 | 28 |

- (1) Technological developments and need for labor to adjust to these new technologies

- For each factor, the balance of opinion is calculated as the difference between the percentage of stimulating answers and the percentage of limiting answers.

- Source: Industrial investment survey - INSEE

In 2019, the replacement of equipment remains the first purpose of invesment

In 2019, the purposes of investment are set to be similar to those of 2018. Particularly, the share of investment meant for the replacement of equipment should remain stable slightly above its long-term average. The share of investment meant for modernization and streamlining should slightly decrease below its average. The share of investment meant to increase productive capacity should remain stable at its average level.

tableauTable 3 – Share of purposes of investment

| Average | 2018 | 2019 | |

|---|---|---|---|

| 1991-2018 | actual | forecast | |

| Replacement | 27 | 29 | 29 |

| Modernization, streamlining | 24 | 23 | 22 |

| Automation | 11 | 8 | 8 |

| New production methods | 7 | 6 | 5 |

| Energy savings | 6 | 9 | 9 |

| Increase in productive capacity | 16 | 16 | 16 |

| Introduction of new products | 13 | 12 | 12 |

| Other purposes (safety, environment, working conditions…) | 20 | 21 | 22 |

- Source: Industrial investment survey - INSEE

Documentation

Methodology 2017 (pdf,147 Ko)

Pour en savoir plus

Time series : Industry – Investment