8 August 2017

2017- n° 209In Q2 2017, tourist nights jumped (+10.2% y-o-y) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - second quarter 2017

8 August 2017

2017- n° 209In Q2 2017, tourist nights jumped (+10.2% y-o-y) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - second quarter 2017

In the second quarter of 2017, throughout metropolitan France, the number of overnight stays in tourist collective accomodation took off (+10.2% compared to the same period in 2016). This increase was much sharper than that in the previous two quarters and more than offset the significant decline recorded a year earlier (−5.3%) during the post-terrorist period. Thus, the number of overnight stays exceeded by more than 4% that of the second quarter 2015. This upswing related to both French customers and foreign ones.

The increase was particularly pronounced in the agglomeration of Paris (+12.6% in hotels and +27.6% in holiday and other short-stay accomodation). Furthermore, campsites occupancy in the beginning of season reached a historic peak (+18.7%).

The increase in tourist nights speeded up sharply in metropolitan France

In the second quarter of 2017, throughout metropolitan France, the number of overnight stays in tourist collective accomodation took off (+10.2% compared to the same period in 2016). This increase was much sharper than that in the previous two quarters and more than offset the significant decline recorded a year earlier (−5.3%) during the post-terrorist period. Thus, the number of overnight stays exceeded by more than 4% that of the second quarter 2015. This upswing related to both French customers and foreign ones.

The increase was particularly pronounced in the agglomeration of Paris (+12.6% in hotels and +27.6% in holiday and other short-stay accomodation). Furthermore, campsites occupancy in the beginning of season reached a historic peak (+18.7%).

The return of foreign customers in hotels

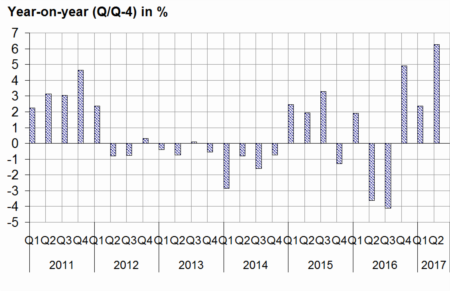

In the second quarter of 2017, the overnight stays in hotels increased for the third consecutive quarter and this rise strengthened (+6.3% year-on-year after +2.4% in Q1). It was driven by the return of foreign customers (+10.0%). In particular, overnight stays of foreign customers increased considerably in the agglomeration of Paris (+16.5%) and reached a similar level to that recorded in 2015. Hotels in coastlines also recorded an excellent start to the season (+7.0%). Occupancy increased to a lesser extent in other areas. This influx of tourists resulted in a increase of 2.4 points year-on-year of the occupation rate which stood at 63.5%.

graphiqueGraph1 – Overnight stays in hotels

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

tableauTable2 – Average length of stay and occupancy

| Average length of stay (days) | Occupancy rate ** in % | |||

|---|---|---|---|---|

| 2016 | 2017 | 2016 | 2017 | |

| Q2 | Q2 * | Q2 | Q2 * | |

| Hotels | 1.8 | 1.8 | 61.1 | 63.5 |

| HOSSA | 3.6 | 3.6 | 53.2 | 57.7 |

| Campsites | 3.7 | 3.8 | 17.4 | 20.3 |

| bare pitches | 3.1 | 3.1 | 12.3 | 15.0 |

| pitches with rental accommodation | 4.2 | 4.4 | 28.4 | 30.9 |

- * provisional data

- ** The occupancy rate is calculated for hotels in rooms. in pitches for campsites and in lodging units (rooms. apartments. dormitories) for holliday and other short-stay accommodation

- Source: INSEE. in partnership with the Regional Committees of tourism (CRT) and DGE

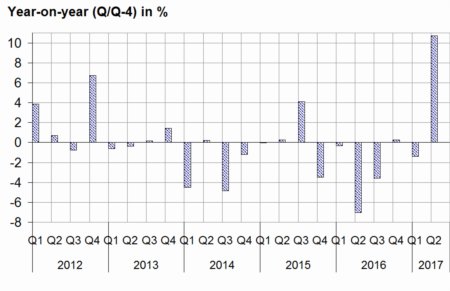

Holiday and other short-stay accomodation also benefited from the upturn

In HOSSA, the rebound in occupancy was even more buoyant, for both French and foreign customers. There also, the improvement was very strong in the agglomeration of Paris and on coastlines. The growth in overnight stays in mountain and urban areas of the province was also brisk. On the other hand, tourist nights fell back in rural area. The increase in French customers was particularly sharp in the agglomeration of Paris (+42.6%), while in mountains, non-residents (+43.4%) pulled up the occupancy. These good results increased the occupancy rate by 4.5 points over one year to 57.7%.

graphiqueGraph2 – Overnight stays in HOSSA

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

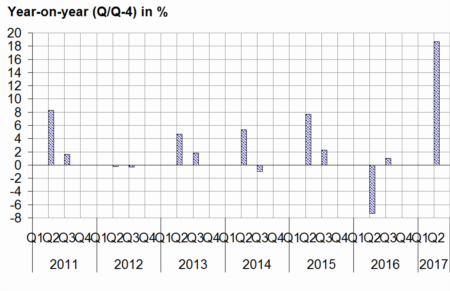

A record start season for the campsites

Overnight stays in campsites jumped by 18.7% in one year, buoyed by the high demand from French customers (+22.5%) and to a lesser extent from foreign customers (+11.3%). It was driven by the high-end campsites (+24.2% for 4-5 stars) and related to both bare pitches and pitches with rental accommodation. Occupancy in coastlines (+21.9%) benefitted from very favorable weather conditions.

graphiqueGraph3 – Overnight stays in campsites

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

April and June rose to historically high levels

Overnight stays in April were exceptional, thanks to a favorable school calendar for the main foreign customers (spring break in April in 2017 instead of March in 2016) and to the presence of Eastern Monday in April (instead of March in 2016). In June, occupancy was buoyed by good weather conditions, especially on coastlines. Finaly, May 2017 was also more favourable for leisure customers than May 2016 that had been whithout bank holidays whith extra days off.

tableauTable1 – Overnight stays in Q2 2017 *

| Nights of the quarter | Year-on-year (%) (Q/Q-4) | ||||

|---|---|---|---|---|---|

| Total nights (millions) | % of foreign nights | Total | Foreign | French | |

| Total | 107.1 | 32.1 | 10.2 | 10.4 | 10.1 |

| Hotels | 56.6 | 37.1 | 6.3 | 10.0 | 4.2 |

| Unclassified | 5.9 | 26.0 | 23.1 | 26.5 | 21.9 |

| 1 and 2 stars | 15.1 | 25.2 | –2.7 | 2.9 | –4.5 |

| 3 stars | 21.4 | 37.0 | 5.7 | 8.0 | 4.4 |

| 4 and 5 stars | 14.3 | 54.2 | 11.7 | 13.0 | 10.2 |

| hotel chain | 28.5 | 37.1 | 6.8 | 10.8 | 4.5 |

| independent hotel | 28.2 | 37.1 | 5.7 | 9.1 | 3.8 |

| Agglo. of Paris | 17.8 | 59.1 | 12.6 | 16.5 | 7.6 |

| coastlines | 10.7 | 30.0 | 7.0 | 3.5 | 8.6 |

| mountain | 6.2 | 25.0 | 1.9 | 8.7 | –0.2 |

| other urban area | 18.4 | 27.0 | 2.2 | 3.5 | 1.8 |

| other rural area | 3.7 | 21.6 | 3.5 | 2.5 | 3.8 |

| Holiday and other short-stay accomodation | 22.0 | 19.2 | 10.7 | 10.9 | 10.7 |

| Tourism residences | 16.4 | 21.9 | 10.9 | 9.1 | 11.4 |

| Holiday villages | 4.7 | 9.1 | 10.4 | 21.8 | 9.4 |

| Other | 0.9 | 22.3 | 8.6 | 22.9 | 5.1 |

| Agglo. of Paris | 2.6 | 34.6 | 27.6 | 6.3 | 42.6 |

| coastlines | 8.0 | 13.6 | 10.9 | 0.8 | 12.7 |

| mountain | 4.6 | 21.9 | 11.8 | 43.4 | 5.3 |

| other urban area | 4.0 | 19.5 | 9.5 | 5.7 | 10.5 |

| other rural area | 2.9 | 16.1 | –1.4 | 1.2 | –1.8 |

| Campsites | 28.5 | 32.2 | 18.7 | 11.3 | 22.5 |

| Unclassified | 1.2 | 39.0 | 4.2 | –0.1 | 7.2 |

| 1 and 2 stars | 3.4 | 29.0 | 9.6 | 5.9 | 11.2 |

| 3 stars | 8.8 | 33.0 | 15.6 | 13.6 | 16.6 |

| 4 and 5 stars | 15.1 | 31.8 | 24.2 | 12.3 | 30.7 |

| bare pitches | 11.6 | 48.0 | 17.6 | 12.1 | 23.1 |

| pitches with rental accommodation | 16.9 | 21.3 | 19.4 | 10.1 | 22.2 |

| coastlines | 16.0 | 27.5 | 21.9 | 15.6 | 24.4 |

| except coast | 12.5 | 38.2 | 14.8 | 7.6 | 19.8 |

- Reference area : Metropolitan France

- * provisional data

- Source: INSEE. in partnership with the Regional Committees of tourism (CRT) and DGE

Revisions

Compared to the previous publication, the overall variation in the number of overnight stays in Q1 2017 has been unchanged. It has been raised by 0.1 points in hotels (+2.4% instead of +2.3%) and lowered by 0.3 points in HOSSA (−1.4% instead of −1.1%).

Pour en savoir plus

Time series: Tourism