21 January 2016

2016- n° 19In January 2016, the business climate is practically stable in the retail trade and

in the trade and repair of motor vehicles Monthly survey of retailing - January 2016

21 January 2016

2016- n° 19In January 2016, the business climate is practically stable in the retail trade and

in the trade and repair of motor vehicles Monthly survey of retailing - January 2016

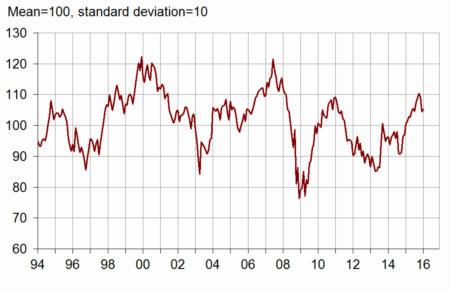

According to the managers surveyed in January 2016, the business climate is practically stable in the retail trade and in the trade and repair of motor vehicles. The composite indicator which measures it, has won one point and stands at 105. It has been above its long term average (100) for a year. The December indicator has been slightly lowered (-1 point), with late answers from businesses which have been taken into account.

According to the managers surveyed in January 2016, the business climate is practically stable in the retail trade and in the trade and repair of motor vehicles. The composite indicator which measures it, has won one point and stands at 105. It has been above its long term average (100) for a year. The December indicator has been slightly lowered (−1 point), with late answers from businesses which have been taken into account.

graphiquegraph_indsynt_en – Business climate synthetic indicator

More managers have declared a rise in their past activity

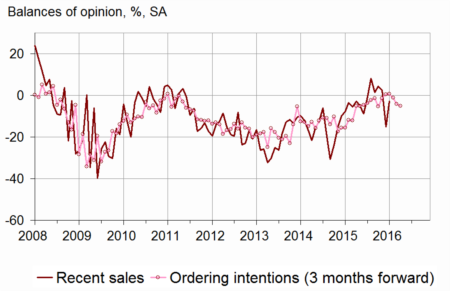

In the retail trade and the trade and repair of motor vehicles, more managers than in December have declared a rise in their past activity. The corresponding balance has recovered after the fall in December. The business prospects have improved: the balance concerning expected sales has gone up significantly, while the general business outlook one has increased more slightly. The ordering intentions balance is almost unchanged. Each of the three balances is above its average from now on.

Stocks are estimated stable, still above their standard level.

Slightly fewer business managers than on the last interrogation have declared decreases in selling prices over the past and the next few months.

The cash position is considered slightly more difficult than in November.

graphiqueGraph_ventes_ic_en – Recent sales and ordering intentions

tableautab1_en – Global data

| Ave. (1) | Oct. 15 | Nov. 15 | Dec. 15 | Jan. 16 | |

|---|---|---|---|---|---|

| Business climate | 100 | 110 | 109 | 104 | 105 |

| General business outlook | –30 | –13 | –11 | –20 | –15 |

| Recent sales | –7 | 4 | 3 | –15 | –3 |

| Expected sales | –3 | 7 | 7 | –4 | 8 |

| Ordering intentions | –9 | 1 | –1 | –4 | –5 |

| Stocks | 10 | 6 | 7 | 15 | 15 |

| Past selling prices (2) | –6 | –6 | –4 | ||

| Expected selling prices | –3 | –4 | –3 | –6 | –3 |

| Cash position (2) | –15 | –15 | –18 | ||

| Workforce size: recent trend | –1 | –2 | –5 | –3 | –2 |

| Workforce size: future trend | –3 | –3 | –5 | –4 | –7 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in the retail trade and in the trade and repair of motor vehicles

Employment forecasts have declined a little

The balance concerning recent trend on workforce size has been practically stable and the future trend one has declined a little. Both have remained below their average.

Retail trade

The balance concerning past activity has rallied more strongly in the non-specialised trade

According to the retailers, the balance concerning activity in the past three months has rallied after its sharp drop in December. In non-specialised trade, the balance has sharply risen and has gone above its average. Conversely, in specialised trade, it has moderately progressed and has remained below its average.

About activity over the next three months, retailers have regained some confidence: the balance concerning expected sales has recovered and has nearly reached the level of November 2015. The ordering intentions one is almost unchanged, below its long term average.

Stocks are estimated above their standard level in non-specialised trade, below it in specialised trade.

In both non-specialised and specialised trade, fewer retailers have foreseen to diminish their prices over the next few months.

Slightly more retailers than in November have estimated that their cash position has been more difficult, especially in specialised trade.

Trade and repair of motor vehicles

Activity balances remain above their average

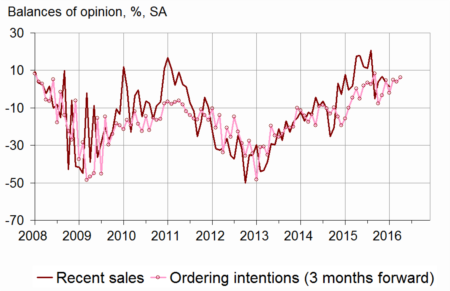

Slightly fewer motor vehicles business leaders than in December have noted a rise in their past sales. On the opposite, they have been more optimistic concerning their expected sales and their ordering intentions. These balances still remain above their long term average.

graphiquegraph_ventes_ic_auto_en – Recent sales and ordering intentions in motor vehicles

Stocks are still estimated higher than the standard level.

The balance on past prices has increased and gone above its average, while the one on expected prices has declined and has deviated from its average.

The cash-flow situation is considered a little more deteriorated than in November.

tableautab2_en – Detailed data

| Ave. (1) | Oct. 15 | Nov. 15 | Dec. 15 | Jan. 16 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Recent sales | –6 | 5 | 1 | –23 | –4 |

| Expected sales | 0 | 8 | 7 | –6 | 6 |

| Ordering intentions | –7 | 2 | –3 | –9 | –10 |

| Stocks | 9 | 4 | 4 | 13 | 14 |

| Past selling prices (2) | –8 | –9 | –8 | ||

| Expected selling prices | –5 | –6 | –4 | –10 | –7 |

| Cash position (2) | –13 | –15 | –16 | ||

| Workforce size: recent trend | 1 | –1 | –5 | –2 | –1 |

| Workforce size: future trend | –2 | –2 | –7 | –5 | –7 |

| Non-specialised retail trade | |||||

| Recent sales | –2 | 17 | 7 | –26 | 4 |

| Expected sales | 6 | 19 | 24 | –3 | 10 |

| Ordering intentions | 1 | 11 | 4 | –4 | –10 |

| Stocks | 7 | 4 | 3 | 15 | 17 |

| Past selling prices (2) | –9 | –7 | –9 | ||

| Expected selling prices | –5 | –4 | –3 | –10 | –6 |

| Cash position (2) | –7 | –7 | –8 | ||

| Specialised retail trade | |||||

| Recent sales | –11 | –10 | –6 | –19 | –14 |

| Expected sales | –8 | –5 | –11 | –12 | –4 |

| Ordering intentions | –17 | –11 | –12 | –14 | –12 |

| Stocks | 13 | 4 | 5 | 12 | 9 |

| Past selling prices (2) | –8 | –11 | –10 | ||

| Expected selling prices | –5 | –7 | –7 | –11 | –7 |

| Cash position (2) | –23 | –23 | –26 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Recent sales | –10 | 4 | 7 | 3 | 1 |

| Expected sales | –8 | 6 | 3 | 6 | 10 |

| Ordering intentions | –12 | –2 | 5 | 4 | 6 |

| Stocks | 15 | 10 | 14 | 18 | 19 |

| Past selling prices (2) | 1 | 0 | 4 | ||

| Expected selling prices | 4 | 4 | 1 | 0 | –3 |

| Cash position (2) | –25 | –19 | –21 | ||

| Workforce size: recent trend | –9 | –8 | –11 | –11 | –11 |

| Workforce size: future trend | –7 | –4 | –3 | –4 | –7 |

- (1) Average since 1991 (2003 for trade and repair of motor vehicles and 2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in the retail trade and in the trade and repair of motor vehicles

Documentation

Methodology (pdf,129 Ko)