23 September 2015

2015- n° 230In Q2 2015, households' purchasing power and non-financial corporations' profit ratio

were virtually stable Quarterly national accounts - detailed figures - 2nd Quarter 2015

23 September 2015

2015- n° 230In Q2 2015, households' purchasing power and non-financial corporations' profit ratio

were virtually stable Quarterly national accounts - detailed figures - 2nd Quarter 2015

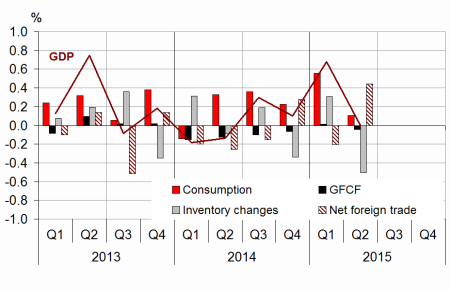

In Q2 2015, French growth domestic product (GDP) in volume terms* was stable, after a 0.7% increase in Q1. The previous release (published on August 14th 2015) is overall unchanged.

In Q2 2015, French growth domestic product (GDP) in volume terms* was stable, after a 0.7% increase in Q1. The previous release (published on August 14th 2015) is overall unchanged.

Household final consumption expenditure decelerated sharply (0.0% after +0.9%). The decline of their housing investment got deeper (–1,5% after –1,2%) while non-financial corporations' gross fixed capital formation (GFCF) increased more slightly (+0.3% after +0.6%). All in all, final domestic demand (excluding changes in inventories) decelerated sharply and contributed for +0.1 points to GDP growth after +0.6 points in Q1.

Exports accelerated (+2.0% after +1.5%) while imports slowed (+0.5% after +2.1%). In fine, the foreign trade balance contributed positively to activity (+0.4 points after –0.2 points). On the contrary, changes in inventories contributed negatively to GDP growth (–0.5 points, after +0.3 points in Q1).

Households' purchasing power was virtually stable (–0.1%)

Households' gross disposable income (GDI) increased less significantly in Q2 (+0.3% after +1.0%). Wages earned by households decelerated (+0.3% after +0.7%), notably because of the slowdown of the average wage per capita paid by non-financial corporations (+0.1% after +0.8%). Taxes on income and wealth, which had markedly dropped in Q1 (–1.5%) following a strong Q4 2014, increased slightly in Q2 (+0.5%).

* This growth rate is seasonally and working-day adjusted; volumes are chain-linked previous-year-prices volumes.

graphiqueGraph1 – GDP and its main components

tableauTab1 – Goods and services:supply and uses chain-linked volumes

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | 2015 (ovhg) | |

|---|---|---|---|---|---|---|

| GDP | 0.3 | 0.1 | 0.7 | 0.0 | 0.2 | 0.9 |

| Imports | 1.5 | 1.8 | 2.1 | 0.5 | 3.9 | 4.8 |

| Household consumption *expenditure | 0.4 | 0.2 | 0.9 | 0.0 | 0.6 | 1.3 |

| General government's *consumption expenditure | 0.5 | 0.5 | 0.4 | 0.4 | 1.5 | 1.4 |

| GFCF | -0.4 | -0.3 | 0.0 | -0.2 | -1.2 | -0.7 |

| *of which Non-financial corporated and unincorporated enterprises | 0.3 | 0.0 | 0.6 | 0.3 | 2.0 | 1.0 |

| Households | -1.1 | -0.8 | -1.2 | -1.5 | -5.3 | -3.8 |

| General government | -2.4 | -0.7 | 0.2 | -0.1 | -6.9 | -2.3 |

| Exports | 1.1 | 2.9 | 1.5 | 2.0 | 2.4 | 5.8 |

| Contributions : | ||||||

| Internal demand excluding inventory changes | 0.3 | 0.2 | 0.6 | 0.1 | 0.5 | 0.9 |

| Inventory changes | 0.2 | -0.3 | 0.3 | -0.5 | 0.2 | -0.2 |

| Net foreign trade | -0.2 | 0.3 | -0.2 | 0.4 | -0.5 | 0.2 |

tableauTab2 – Sectoral accounts

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | 2015 (ovhg) | |

|---|---|---|---|---|---|---|

| Profit ratio of NFC* (level) | 29.5 | 29.8 | 31.2 | 31.1 | 29.5 | |

| Household purchasing power | 0.5 | 0.0 | 1.1 | -0.1 | 1.1 | 1.4 |

- *NFC: non-financial corporations

tableauTab3 – Production, consumption and GFCF: main components

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | 2015 (ovhg) | |

|---|---|---|---|---|---|---|

| Production of branches | 0.5 | 0.1 | 0.8 | -0.1 | 0.7 | 1.1 |

| Goods | 1.0 | -0.5 | 1.4 | -0.8 | 0.1 | 0.9 |

| Manufactured Industry | 1.0 | -0.1 | 1.2 | -0.7 | 0.3 | 1.0 |

| Construction | -0.8 | -0.7 | -0.8 | -1.1 | -2.2 | -2.8 |

| Market services | 0.6 | 0.4 | 0.8 | 0.3 | 1.2 | 1.6 |

| Non-market services | 0.3 | 0.3 | 0.4 | 0.4 | 1.3 | 1.1 |

| Household consumption | 0.4 | 0.2 | 0.9 | 0.0 | 0.6 | 1.3 |

| Food products | 0.0 | 0.2 | 0.2 | 0.8 | 0.2 | 1.1 |

| Energy | 0.5 | -1.7 | 3.7 | -2.1 | -5.7 | 1.6 |

| Engineered goods | 0.5 | 0.5 | 1.7 | -0.1 | 1.8 | 2.2 |

| Services | 0.2 | 0.1 | 0.3 | 0.2 | 0.7 | 0.6 |

| GFCF | -0.4 | -0.3 | 0.0 | -0.2 | -1.2 | -0.7 |

| Manufactured goods | 0.1 | -0.2 | 1.0 | -0.1 | 1.3 | 0.8 |

| Construction | -1.2 | -0.7 | -1.0 | -1.2 | -3.4 | -3.4 |

| Market services | 0.2 | 0.3 | 0.9 | 1.1 | 0.4 | 2.2 |

tableauTab4 – Households' disposable income and ratios of households' account

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | 2015 (ovhg) | |

|---|---|---|---|---|---|---|

| HDI | 0.4 | -0.1 | 1.0 | 0.3 | 1.1 | 1.4 |

| Household purchasing power | 0.5 | 0.0 | 1.1 | -0.1 | 1.1 | 1.4 |

| HDI by cu* (purchasing power) | 0.4 | -0.1 | 1.0 | -0.2 | 0.7 | 1.0 |

| Adjusted HDI (purchasing power) | 0.5 | 0.1 | 1.0 | 0.0 | 1.3 | 1.4 |

| Saving rate (level) | 15.2 | 15.0 | 15.2 | 15.2 | 15.1 | |

| Financial saving rate (level) | 6.1 | 6.0 | 6.4 | 6.4 | 6.0 |

- *cu: consumption unit

tableauTab5 – Ratios of non-financial corporations' account

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | |

|---|---|---|---|---|---|

| Profit share | 29.5 | 29.8 | 31.2 | 31.1 | 29.5 |

| Investment ratio | 23.1 | 23.0 | 22.7 | 22.8 | 23.1 |

| Savings ratio | 17.4 | 18.3 | 19.3 | 19.5 | 17.4 |

| Self-financing ratio | 75.3 | 79.9 | 85.1 | 85.3 | 75.2 |

tableauTab6 – Expenditure, receipts and net borrowing of public administrations

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2014 | |

|---|---|---|---|---|---|

| In billions of euros | |||||

| Total expenditure | 307.1 | 307.5 | 309.9 | 312.1 | 1226.5 |

| Total receipts | 285.8 | 286.8 | 289.4 | 289.8 | 1142.6 |

| Net lending (+) or borrowing (-) | -21.3 | -20.7 | -20.5 | -22.4 | -83.9 |

| In % of GDP | |||||

| Net lending (+) or borrowing (-) | -4.0 | -3.9 | -3.8 | -4.1 | -3.9 |

Consumption prices bounced back in Q2 2015 (+0.4% after –0.1%), which amplified the slowdown in households' purchasing power: the latter was virtually stable (–0.1% after +1.1%). Measured per consumption unit, it even declined slighly: –0.2% after +1.0%.

As households' consumption increased in volume terms at a pace close to their purchasing power, their saving ratio was stable in Q2, at 15.2%.

Non-financial corporations' profit ratio was almost stable

In Q1 2015, non-financial corporations' profit ratio had markedly increased (+1.4 points, from 29.8% to 31.2%), due to the decrease in social contributions and the increase in the rate of the tax credit for encouraging competitiveness and jobs (CICE). In Q2, their profit ratio was almost stable (–0.1 points, at 31.1%) because wages paid by non-financial corporations increased barely more than their added value.

General government net borrowing increased by 0.3 points of GDP in Q2, and reached 4.1% after 3.8%. The receipts decelerated sharply (+0.1% after +0.9% in Q1) notably due to lower receipts from corporate taxes. By contrast, expenditures increased at a rate close to the previous quarter (+0.7% after +0.8%): government debt servicing accelerated, while social benefits and other transfers (including CICE) decelerated.