3 July 2015

2015- n° 164In the first half of 2015, business managers have deemed the operating balances more

satisfactory Cash survey in industry - June 2015

3 July 2015

2015- n° 164In the first half of 2015, business managers have deemed the operating balances more

satisfactory Cash survey in industry - June 2015

Caution: In the publication of June 2015, weights used to aggregate business managers’ answers have been updated. As a result, the value of all results published in this survey have been negligibly modified at the most aggregated level but more significantly in a sector-based approach.

Caution: In the publication of June 2015, weights used to aggregate business managers’ answers have been updated. As a result, the value of all results published in this survey have been negligibly modified at the most aggregated level but more significantly in a sector-based approach.

Industry as a whole

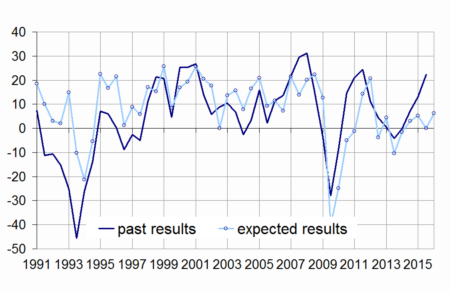

The operating balances have been deemed more satisfactory

In the first half of 2015, more business managers than in the second half of 2014 considered that their operating balances were satisfactory. The corresponding balance of opinion has increased by 9 points, to a level (+22) significantly above the long-term average (+5). The fall in the financial expenses and that in the supply prices were the main factors of this improvement.

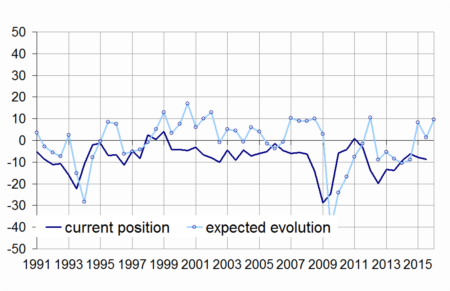

The cash position is nearly stable, at a normal level

By contrast, almost as many industrialists as in the previous six months considered that their cash position is difficult. The corresponding balance of opinion, virtually stable (–9), has stayed very close to its long-term average (–8). A few more industrialists considered that the variation in client credit and the change in inventories have had a negative impact on the cash flow. Conversely, a few more of them have highlighted a positive contribution of capital spending and of financial investments.

A bit less companies have indicated a debt reduction

Less industrialists considered that medium to long-term debt has dropped. Short-term loans outstanding have slightly increased compared to the previous six months. The industrialists considered that their external equity have stabilized and that they have used less commercial papers than in the second half of 2014.

Expected improvement in the second half of 2015

Compared to the previous survey, industrialists anticipate a significant improvement of their cash position and of their operating balances in the second half of 2015. They are now more numerous to expect a rise of equipment spending and of production rates.

tableautableau1 – Opinion about cash position and operating balance in the industry

| Moy* | JUN14 | DEC14 | JUN15 | |

|---|---|---|---|---|

| Current cash position | –8 | –6 | –8 | –9 |

| Current operating balance | 5 | 7 | 13 | 22 |

| Expected evolution of cash position | –1 | 8 | 1 | 10 |

| Expected evolution of operating balance | 8 | 5 | 0 | 6 |

- * : Average of balances of opinion.

- Source: Cash survey in industry - INSEE

graphiqueGraph1_Anglais – Cash position in industry

graphiqueGraph2_Anglais – Operating balance

Sector-based analysis

MAN. OF FOOD PRODUCTS AND BEVERAGES

In the first half of 2015, the balance of opinion on the cash position and that on the operating balances in the manufacture of food products and beverages have increased and stand above the long-term average. However, industrialists of this area remain slightly pessimistic on the expected cash position as they were six months ago.

MACHINERY AND EQUIPMENT GOODS

According to the business leaders of the manufacture of machinery and equipment goods, the cash position and the operating balances have deteriorated in the first half of 2015. The corresponding balances of opinion have become inferior to the long-term average. However, the business leaders were more optimistic than in the previous half-year about the expected cash position and the expected operating balances.

MAN. OF TRANSPORT EQUIPMENT

Man. of motor vehicles, trailers and semi trailers

In the first half of 2015, the cash position in the manufacture of motor vehicles, trailers and semi trailers, has improved, recovering to a level close to normal The operating balances were judged much more satisfactory than in the previous half- year, with a balance of opinion significantly higher than its mean level. The decrease of supply prices and that of wage contributions are the main factors of this increase. For the second half of 2015, the industrialists are less optimistic about their cash position, however, the corresponding balance stays above the long-term average. They judged, in particular that their investment expenditure will rise and that their selling prices will fall. Nevertheless, the operating balances should , with better business prospects.

Man. of other transport equipment

In the manufacture of other transport equipment (shipbuilding, aircraft manufacturing and railway construction), the cash position has deteriorated during the first half of 2015; nonetheless, the operating balances were deemed more satisfactory than the average. According to the industrialists, cash position is likely to decrease in the second half of 2015. They have forecasted an increase of production rates and the operating balances are expected to keep improving.

OTHER MANUFACTURING

In the other sectors of the manufacturing industry, the balance of opinion on the cash position and that on the operating balances, virtually stable, are close to or slightly higher than their long-term average. For the second half of 2015, industrialists anticipate an improvement of their cash position, despite an increase of investment expenditure, leading to a decrease of medium to long-term debt. Slightly fewer industrialists than in the previous survey have forecasted a progress of operating balance..

tableautableau2_IR – Cash position and operating balance in a sector-based approach

| NA* : (A17) et [A 38] | Average** | JUN14 | DEC14 | JUN15 |

|---|---|---|---|---|

| (C1) Man. of food products and beverages | ||||

| Current cash position | -6 | -5 | -8 | 1 |

| Current operating balance | 9 | 22 | 26 | 29 |

| Expected evolution of cash position | 3 | -11 | -1 | -2 |

| Expected evolution of operating balance | 10 | 4 | 0 | 0 |

| (C3) Machinery and equipment goods | ||||

| Current cash position | -8 | -6 | -13 | -15 |

| Current operating balance | 7 | 7 | 12 | 6 |

| Expected evolution of cash position | 0 | 2 | -10 | 8 |

| Expected evolution of operating balance | 11 | 2 | -1 | 4 |

| (C4) Man. of transport equipment | ||||

| Current cash position | -6 | -13 | -12 | -11 |

| Current operating balance | 7 | -5 | 12 | 38 |

| Expected evolution of cash position | -3 | 7 | 36 | 1 |

| Expected evolution of operating balance | 8 | -8 | 4 | 17 |

| Man. of motor vehicules, trailers and semi-trailers [CL1] | ||||

| Current cash position | -8 | -12 | -14 | -6 |

| Current operating balance | -3 | -7 | 17 | 59 |

| Expected evolution of cash position | 0 | -1 | 46 | 9 |

| Expected evolution of operating balance | 9 | 0 | -2 | 11 |

| Man. of other transport equipment [CL2] | ||||

| Current cash position | -4 | -14 | -10 | -16 |

| Current operating balance | 5 | -2 | 7 | 16 |

| Expected evolution of cash position | -9 | 17 | 26 | -6 |

| Expected evolution of operating balance | 4 | -20 | 10 | 23 |

| (C5) Other manufacturing | ||||

| Current cash position | -10 | -5 | -9 | -10 |

| Current operating balance | 3 | 8 | 6 | 6 |

| Expected evolution of cash position | -3 | 6 | -12 | 5 |

| Expected evolution of operating balance | 7 | 6 | 4 | 2 |

- *NA :aggregated classification , based on the NAF rév. 2.

- ** : Long-term average of balances of opinion.

- Source: Cash survey in industry - INSEE

Pour en savoir plus

Time series : Cash flow