9 January 2015

2015- n° 3In the second half of 2014, the operating balances have been deemed more satisfactory

in the industry Cash survey in industry - December 2014

9 January 2015

2015- n° 3In the second half of 2014, the operating balances have been deemed more satisfactory

in the industry Cash survey in industry - December 2014

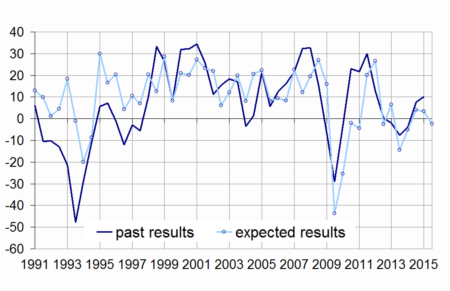

In the second half of 2014, more business managers than in the first half of 2014 considered that their operating balances were satisfactory. The corresponding balance of opinion increased by 2 points to +10, above the normal level (+7). The fall in the financial expenses and that in the supply prices were the main factors of this slight improvement.

Industry as a whole

The operating balances have been deemed more satisfactory in the industry

In the second half of 2014, more business managers than in the first half of 2014 considered that their operating balances were satisfactory. The corresponding balance of opinion increased by 2 points to +10, above the normal level (+7). The fall in the financial expenses and that in the supply prices were the main factors of this slight improvement.

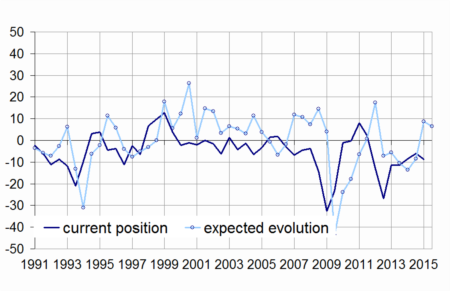

The cash position is considered a little more difficult

By contrast, more industrialists considered that their cash position was difficult. The corresponding balance of opinion has decreased by 3 points to –9, below its long-term average (–5). The investment spending and change in the stable external resources (equity, medium and long-term financial assistances including leasing) had a little more negative impact on the cash flow. However the decrease was limited by the inventory changes and the changes in the customer credits.

The slight decline in the cash position should be reflected in the first half of 2015 by a fall of activity (production, labour volume) and a decrease of equipment and investment spending.

More companies have indicated a debt reduction

The industrialists considered that their external equity (cash contribution) decreased. More industrialists considered that debts in medium and long-term and outstanding loans in the short term went down.

Expected decline in the first half of 2015

Compared to the previous survey, slightly more industrialists anticipate a decline of their cash position and of their operating balances in the first half of 2015. However, the balance of opinion on expected change of cash position remains above its long-term average.

tableautableau1 – Opinion about cash position and operating balance in the industry

| Moy* | DEC13 | JUN14 | DEC14 | |

|---|---|---|---|---|

| Current cash position | –5 | –8 | –6 | –9 |

| Current operating balance | 7 | –4 | 8 | 10 |

| Expected evolution of cash position | 0 | –8 | 9 | 6 |

| Expected evolution of operating balance | 9 | 4 | 3 | –2 |

- * : The average of the balances opinion since June 1990.

- Source: Cash survey in industry - INSEE

graphiqueGraph1 – Cash position in industry

graphiqueGraph2 – Operating balance

Sector-based analysis

MAN. OF FOOD PRODUCTS AND BEVERAGES

In the second half of 2014, the balance of opinion on the cash position and that on the operating balances were nearly stable. The cash position is judged near its normal level whereas the balance of opinion on the operating balances is clearly above its long-term average. The industrialists of this area are less pessimistic on the expected cash position for the first half of 2015 than they were six months ago.

ELECTRICAL AND ELECTRONIC EQUIPMENT ; MACHINE EQUIPMENT

According to the business leaders of the manufacture of electrical and electronic equipment, machine equipment, the cash position just as their operating balances in the second half of 2014 remained close to the long-term average. In December, the business leaders were more pessimistic than in June about the expected cash position and their expected operating balances.

MAN. OF TRANSPORT EQUIPMENT

Man. of motor vehicles, trailers and semi trailers

In the second half of 2014, while the cash position was considered as more difficult and clearly below its normal level, the operating balances were judged more satisfactory than in the previous half of the year. Several factors have contributed to it, mostly the decrease of supply prices and that of financial expenses. For the first half of 2015, the industrialists are more pessimistic about their operating balances compared to the previous months. However, the cash position should sharply improved thanks to the increase of the sales prices.

Man. of other transport equipment

In the manufacture of other transport equipment (shipbuilding, aircraft manufacturing and railway construction), the cash position and the operating balances were judged more difficult than on the long-term average. According to the industrialists, it is likely to improve sharply in the first half of 2015. The current cash position drives the industrialists to forecast a rise of their their debts in medium and long-term.

OTHER MANUFACTURING

In the other sectors of the manufacturing industry, the balance of opinion on the cash position and that on the operating balances have decreased and become below their long-term average. For the first half of 2015, more industrialists anticipate a decline of their cash position and of the operating balances than in last June. The current cash position leads business managers to forecast a decrease of their investment spending and a rise of their debts in medium and long-term.

tableautableau2_IR – Cash position and operating balance in a sector-based approach

| NA* : (A17) et [A 38] | Average** | DEC13 | JUN14 | DEC14 |

|---|---|---|---|---|

| (C1) Man. of goods products and beverages | ||||

| Current cash position | –5 | –9 | –5 | –6 |

| Current operating balance | 11 | 15 | 23 | 25 |

| Expected evolution of cash position | 4 | –8 | –12 | –1 |

| Expected evolution of operating balance | 11 | –4 | 2 | 0 |

| (C3) Electrical and electronic equipment; machine equipment | ||||

| Current cash position | –7 | –10 | –6 | –9 |

| Current operating balance | 7 | 13 | 10 | 8 |

| Expected evolution of cash position | 1 | –13 | 2 | –7 |

| Expected evolution of operating balance | 10 | 10 | 3 | –5 |

| (C4) Man. of transport equipment | ||||

| Current cash position | –2 | –12 | –9 | –11 |

| Current operating balance | 7 | –52 | –6 | 16 |

| Expected evolution of cash position | –2 | 4 | 8 | 48 |

| Expected evolution of operating balance | 10 | 8 | –4 | 0 |

| Man. of motor vehicules, trailers and semi-trailers [CL1] | ||||

| Current cash position | –3 | –10 | –6 | –10 |

| Current operating balance | –4 | –76 | –8 | 25 |

| Expected evolution of cash position | 2 | 2 | 3 | 61 |

| Expected evolution of operating balance | 14 | 1 | 3 | 0 |

| Man. of other transport equipment [CL2] | ||||

| Current cash position | –2 | –16 | –15 | –14 |

| Current operating balance | 6 | –3 | –2 | –3 |

| Expected evolution of cash position | –9 | 7 | 17 | 22 |

| Expected evolution of operating balance | 2 | 21 | –20 | 0 |

| (C5) Other manufacturing | ||||

| Current cash position | –7 | –9 | –4 | –12 |

| Current operating balance | 6 | 6 | 12 | 0 |

| Expected evolution of cash position | –2 | –10 | 7 | –13 |

| Expected evolution of operating balance | 9 | 9 | 4 | 1 |

- *NA :aggregated manufacture , based on the NAF rév. 2.

- ** : Long-term average of balances of opinion.

- Source: Cash survey in industry - INSEE

Pour en savoir plus

Time series : Cash flow