25 March 2014

2014- n° 66In March 2014, the business climate gets better in the retail trade and in the trade

and repair of motor vehicles Monthly survey of retailing - March 2014

25 March 2014

2014- n° 66In March 2014, the business climate gets better in the retail trade and in the trade

and repair of motor vehicles Monthly survey of retailing - March 2014

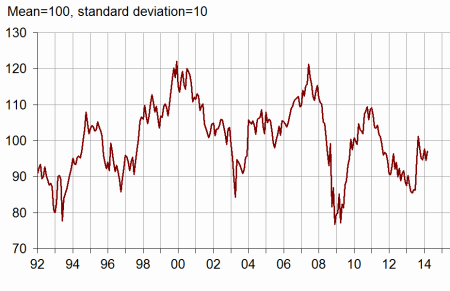

According to the managers surveyed in March 2014, the business climate remains below its average in the retail trade and in the trade and repair of motor vehicles: the composite indicator has increased by two points, still fluctuating below its long-term average level.

According to the managers surveyed in March 2014, the business climate remains below its average in the retail trade and in the trade and repair of motor vehicles: the composite indicator has increased by two points, still fluctuating below its long-term average level.

graphiquegraph_indsynt_en – Business climate synthetic indicator

Drop in past activity

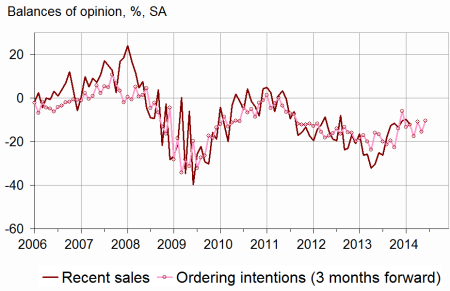

According to managers, past activity has declined again, mainly in retail trade. About forecasts, if the balance corresponding to expected sales has stayed significantly under its average, the ordering intentions balance has got closer its mean level: this progress is attributable to the motor car sector.

Stocks have been considered lower and lower. The balance has gone back to the level of January 2011.

As many business leaders than on the last interview have declared a fall in selling prices over both past and future periods.

Cash-flow situation has been declared difficult.

graphiqueGraph_ventes_ic_en – Recent sales and ordering intentions

tableautab1_en – Global data

| Ave. (1) | Dec. 13 | Jan. 14 | Feb. 14 | March 14 | |

|---|---|---|---|---|---|

| Business climate | 100 | 95 | 98 | 95 | 97 |

| General business outlook | –30 | –35 | –33 | –36 | –36 |

| Recent sales | –7 | –10 | –10 | –12 | –18 |

| Expected sales | –3 | –3 | –9 | –14 | –14 |

| Ordering intentions | –9 | –17 | –11 | –16 | –11 |

| Stocks | 11 | 11 | 12 | 8 | 3 |

| Past selling prices (2) | –6 | –12 | –10 | ||

| Expected selling prices | –3 | 1 | 0 | –10 | –13 |

| Cash position (2) | –15 | –20 | –22 | ||

| Workforce size: recent trend | 0 | –3 | –4 | –5 | –6 |

| Workforce size: future trend | –2 | –6 | –8 | –8 | –7 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Stability in job losses

According to business managers, job losses pace has stabilized over the last and the next few months. Each of the two balances has stayed under its average.

Retail trade

Stil dull past and expected activities

According to the retailers, past activity has declined, the corresponding balance being now sharply under its mean level. Almost as many retailers than over the last month have declared a fall in their expected activity, as expected sales and ordering intentions have showed it.

These trends are due to both specialized and non-specialized trade.

Stocks have been overall estimated lower, significantly under their average yet.

Each of the two balances concerning past and expected prices is stable, but still considerably under its average.

Cash position has been declared more difficult than in January.

Trade and repair of motor vehicles

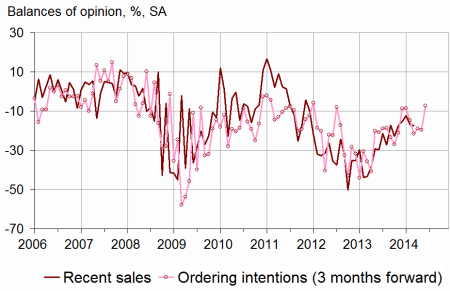

graphiquegraph_ventes_ic_auto_en – Recent sales and ordering intentions in motor vehicles

Progressing ordering intentions

As many vehicle traders than over the previous month have declared a drop in their recent and expected sales, each of the two balances staying under its mean level. However ordering intentions substantially have progressed, the corresponding balance having gone over its average.

The level of stocks has been considered very low. The balance has come back to the July 2011 level.

The balance concerning past selling prices has been increasing and getting up to its mean level, but the expected prices one has remained very low.

Cash-flow situation has been declared normal.

tableautab2_en – Detailed data

| Ave. (1) | Dec. 13 | Jan. 14 | Feb. 14 | March 14 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Recent sales | –5 | –8 | –9 | –10 | –18 |

| Expected sales | 0 | 6 | –11 | –14 | –13 |

| Ordering intentions | –7 | –17 | –12 | –14 | –11 |

| Stocks | 10 | 13 | 15 | 8 | 4 |

| Past selling prices (2) | –8 | –15 | –15 | ||

| Expected selling prices | –4 | –2 | –5 | –12 | –15 |

| Cash position (2) | –13 | –18 | –21 | ||

| Workforce size: recent trend | 1 | –1 | 0 | –2 | –4 |

| Workforce size: future trend | –2 | –4 | –5 | –6 | –4 |

| Non-specialized retail trade | |||||

| Recent sales | –1 | –5 | –6 | –9 | –15 |

| Expected sales | 6 | 18 | –13 | –13 | –11 |

| Ordering intentions | 1 | –13 | –7 | –10 | –6 |

| Stocks | 7 | 13 | 20 | 9 | 4 |

| Past selling prices (2) | –8 | –17 | –21 | ||

| Expected selling prices | –4 | 1 | –7 | –16 | –20 |

| Cash position (2) | –7 | –10 | –13 | ||

| Specialized retail trade | |||||

| Recent sales | –9 | –12 | –12 | –11 | –21 |

| Expected sales | –7 | –5 | –19 | –18 | –19 |

| Ordering intentions | –17 | –22 | –26 | –21 | –20 |

| Stocks | 14 | 14 | 9 | 8 | 4 |

| Past selling prices (2) | –8 | –12 | –7 | ||

| Expected selling prices | –4 | –6 | –2 | –7 | –9 |

| Cash position (2) | –22 | –28 | –29 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Recent sales | –12 | –15 | –12 | –17 | –17 |

| Expected sales | –10 | –19 | –8 | –16 | –15 |

| Ordering intentions | –14 | –22 | –19 | –20 | –7 |

| Stocks | 15 | 7 | 5 | 6 | 0 |

| Past selling prices (2) | 1 | –7 | 1 | ||

| Expected selling prices | 4 | 5 | 2 | –9 | –8 |

| Cash position (2) | –26 | –25 | –24 | ||

| Workforce size: recent trend | –10 | –16 | –18 | –16 | –15 |

| Workforce size: future trend | –8 | –15 | –17 | –14 | –13 |

- (1) Average since 1991 (2003 for trade and repair of motor vehicles and 2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Documentation

Methodology (pdf,129 Ko)