27 September 2013

2013- n° 223At the end of Q2 2013, the Maastricht debt reached 1,912.2 billion euros Debt of the general government according to the Maastricht definition - 2nd Quarter

2013

27 September 2013

2013- n° 223At the end of Q2 2013, the Maastricht debt reached 1,912.2 billion euros Debt of the general government according to the Maastricht definition - 2nd Quarter

2013

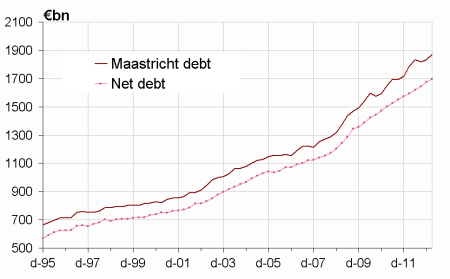

At the end of Q2 2013, the Maastricht debt, which is a gross debt, reached €1,912.2bn, a €41.9bn increase in comparison to Q1 2013. As a percentage of GDP, it peaked at 93.4 %, 1.6 point higher than Q1 2013. At the same time, the net public debt grew by only €18.1bn.

- The Maastricht debt increased by €41.9bn between the first quarter and the second quarter of 2013

- …as a result of the growth of the State debt

- …whereas the local government, social security funds and central agencies debt remained stable

- The public net debt rose less rapidly than Maastricht gross debt

- The value of quoted shares and mutual fund shares slightly increased

Warning: Quarterly debt figures are based on a direct data source less exhaustive than the annual accounts. Results may therefore be updated during several quarters.

Quarterly debt variations alone are not sufficient to forecast the deficit for the current year. To obtain the deficit from the debt, net acquisitions of financial assets and other accounts receivable and payable must also be taken into consideration.

The Maastricht debt increased by €41.9bn between the first quarter and the second quarter of 2013

At the end of Q2 2013, the Maastricht debt, which is a gross debt, reached €1,912.2bn, a €41.9bn increase in comparison to Q1 2013. As a percentage of GDP, it peaked at 93.4 %, 1.6 point higher than Q1 2013. At the same time, the net public debt grew by only €18.1bn.

…as a result of the growth of the State debt

The State’s contribution to the debt went up by €41.8bn in the second quarter. The growth is driven by negotiable debt: the State issued €33.7bn of bonds and €4.4bn of short-term bills. The State also recorded a €4.8bn long-term debt related to loans granted by the EFSF to Eurozone countries (see box below). Conversely, the Trésor deposit liabilities went down by €1.1bn.

…whereas the local government, social security funds and central agencies debt remained stable

Local government units contribution to debt decreased by €0.8bn thanks to the redemption of loans. The contribution to debt of central agencies (central government units other than the State) remained steady.

Social security funds contribution to debt rose by €0.9bn. On the one hand, Cades, MSA and Unedic respectively borrowed €1.5bn, €1.2bn and €1.0bn. On the other hand, Acoss and Cnaf respectively got out of €1.7bn and €0.6bn debt.

graphiqueGraphIR – General government Maastricht debt (% of GDP) (*)

tableauTableauA – General government Maastricht debt by sub-sector and by category

| 2012Q2 | 2012Q3 | 2012Q4 | 2013Q1 | 2013Q2 | |

|---|---|---|---|---|---|

| General Government | 1,832.4 | 1,818.0 | 1,833.8 | 1,870.3 | 1,912.2 |

| %of GDP | 90.8% | 89.7% | 90.2% | 91.8% | 93.4% |

| of which, by sub-sector: | |||||

| State | 1,435.1 | 1,421.2 | 1,439.9 | 1,477.2 | 1,519.0 |

| Central Agencies | 9.7 | 9.8 | 9.9 | 9.9 | 9.9 |

| Local Government | 161.6 | 162.1 | 173.7 | 170.5 | 169.7 |

| Social security funds | 226.0 | 224.9 | 210.3 | 212.7 | 213.6 |

| of which, by category: | |||||

| Currency and deposits | 30.8 | 32.3 | 37.7 | 37.0 | 35.9 |

| Securities other than shares | 1,571.6 | 1,556.5 | 1,546.1 | 1,587.4 | 1,627.6 |

| short-term | 225.7 | 214.1 | 191.6 | 202.7 | 201.6 |

| long-term | 1,345.9 | 1,342.4 | 1,354.4 | 1,384.6 | 1,426.0 |

| Loans | 230.0 | 229.1 | 250.0 | 245.9 | 248.7 |

| short-term | 11.4 | 8.7 | 8.1 | 8.6 | 6.7 |

| long-term | 218.6 | 220.4 | 242.0 | 237.3 | 241.9 |

- (*) Explanations in the box "For more details"

- Source: National Accounts 2005 basis - Insee, DGFiP, Banque de France

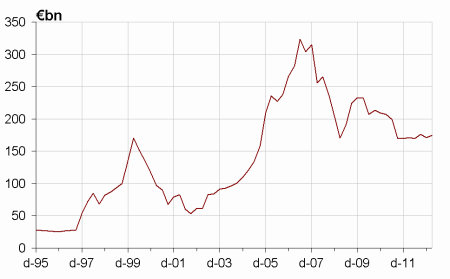

The public net debt rose less rapidly than Maastricht gross debt

At the end of Q2 2013, the net public debt reached €1,715.2bn (equivalent to 83.7 % of GDP as opposed to 83.3 % in the previous quarter), a €18.1bn increase compared to the previous quarter. The €23.8bn gap between changes in net and gross debt is explained by the rise of the State treasury (+€16.1bn) and social security administrations deposits (+€3.7bn). The gap also reflects the impact of the €4.8bn long-term loans to Eurozone countries which increase the State financial assets (see box below), and the sale by the FRR of securities worth €0.9bn.

tableauTableauB – General government net debt by sub-sector

| 2012Q2 | 2012Q3 | 2012Q4 | 2013Q1 | 2013Q2 | |

|---|---|---|---|---|---|

| General government | 1,619.0 | 1,642.9 | 1,675.1 | 1,697.1 | 1,715.2 |

| of which: | |||||

| State | 1,314.5 | 1,330.9 | 1,348.1 | 1,371.0 | 1,391.8 |

| Central Agencies | –3.0 | –3.3 | –2.9 | –3.3 | –3.5 |

| Local government | 151.9 | 152.3 | 163.9 | 160.9 | 160.1 |

| Social security funds | 155.5 | 163.0 | 166.1 | 168.4 | 166.8 |

graphiqueGraph_dette_nette – Maastricht gross debt and net debt

The value of quoted shares and mutual fund shares slightly increased

At the end of Q2 2013, the value of quoted shares and mutual fund shares held by general government units reached €179.2 bn, a €4.2bn rise compared to Q1 2013. The amount of quoted shares went up by €4.7bn due to the appreciation of shares held by State. The value of mutual fund shares slightly decreased by €0.6bn compared to the previous quarter mainly due to a sale by the FRR (-€0.7bn).

tableauTableauC – General government holdings of quoted shares and mutual fund shares

| 2012Q2 | 2012Q3 | 2012Q4 | 2013Q1 | 2013Q2 | |

|---|---|---|---|---|---|

| General government | 170.3 | 176.8 | 170.1 | 175.0 | 179.2 |

| of which: | |||||

| State | 55.6 | 52.7 | 47.9 | 49.8 | 54.9 |

| Central Agencies | 23.4 | 24.5 | 26.1 | 26.9 | 26.6 |

| Local government | 0.6 | 0.7 | 0.6 | 0.6 | 0.6 |

| Social security funds | 90.6 | 99.0 | 95.5 | 97.6 | 97.0 |

graphiqueGraph_F5 – General government holdings of quoted shares and mutual fund shares

Remark: The European Financial Stability Facility (EFSF), settled on June 7th 2010, borrow on financial market to lend to Eurozone countries in turmoil(Greece, Portugal, Ireland). Its bonds issuances are guaranteed by the other Member States, including France. Following Eurostat’s decision of January 27th 2011, all the operations of the EFSF are reincorporated into the public accounts of the guarantor States, proportionally to their commitments. This treatment leaves their net debts unchanged. During Q2 2013, France thus got into €4.8bn of debt in order to lend €3.8bn to Greece, €0.5bn to Ireland and €0.5bn to Portugal through the EFSF.