3 July 2014

2014- n° 157In the first half of 2014, the financial statement has improved in the industry Cash survey in industry - June 2014

3 July 2014

2014- n° 157In the first half of 2014, the financial statement has improved in the industry Cash survey in industry - June 2014

In the first half of 2014, the cash position and the operating balances are considered by business managers as more favorable in the industry : the corresponding balances have gone up and stand anew at their long-term level.

Manufacturing industry

In the first half of 2014, the cash position and the operating balances are considered by business managers as more favorable in the industry : the corresponding balances have gone up and stand anew at their long-term level.

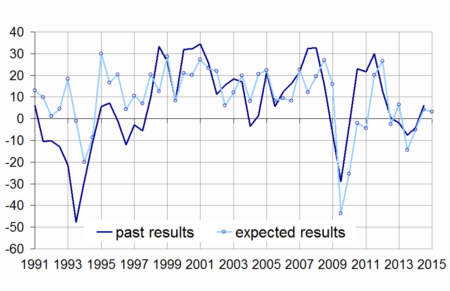

The operating balances have markedly improved

The industrialists consider that the operating balances have clearly improved compared to the second half of 2013 and are more in accordance with the normal level. The improvement of the sales volume, the fall in the financial expenses, the structural factors (restructuration) just as the payroll charges have influenced on this improvement.

The industrialists consider that their cash position is slightly more favourable. The factors of this improvement are a more favourable evolution of the stable external resources (equity, medium and long-term financial assistances including leasing). However the improvement is limited by several unfavourable factors : on the one hand, the inventory changes and on the other hand, the changes of the customer credits. In the second half of 2014, the industrialists intend to use effectively their cash to increase their equipment spending and to drive their selling prices down and to lower their medium and long-term debts.

The method of financing have improved

The industrialists consider that their external equity have sharply increased. In matter of the outstanding loans in the short term on the one hand and the commercial papers volume on the other hand, more indistrialists consider them increasing. As for their debts in medium and long-term, thay have markedly decreased.

Expected improvement in the half of 2014

The industrialists anticipate a sharp improvement of their cash position and a stability of their operating balances in the second half of 2014.

tableautableau1 – Opinion about cash position and operating balance in the industry

| Moy* | June 2013 | Dec. 2013 | June 2014 | |

|---|---|---|---|---|

| Current cash position | –5 | –11 | –9 | –5 |

| Current operating balance | 7 | –7 | –4 | 6 |

| Expected evolution of cash position | 0 | –14 | –8 | 9 |

| Expected evolution of operating balance | 10 | –5 | 4 | 3 |

- * : The average of the balances opinion since June 1990.Cash position in industry

- Source : Cash survey in industry - Insee

graphiqueGraph2 – Operating balance

Sector-based analysis

MAN. OF FOOD PRODUCTS AND BEVERAGES

In the first half of 2014, the cash position and the operating balances are nearly stable in the manufacture of food products and beverages, and are close to their normal level. In the second half, the industrialists of this area predict that their operating balances would improve while the cash position would remain nearly stable.

ELECTRICAL AND ELECTRONIC EQUIPMENT ; MACHINE EQUIPMENT

According to the business leaders of the manufacture of electrical and electronic equipment, machine equipement, their cash position just as their operating balances have slightly gone down but remain close to the long-term average. For the second half of 2014, the business leaders forecast a sharp improvement of their cash position but a slight decrease of their operating balances.

MAN. OF TRANSPORT EQUIPMENT

Man. of motor vehicules, trailers and semi trailers

In the first half of 2014, while the cash position is stable and close to their normal level in the manufacture of motor vehicules, trailers and semi-trailers, the operating balances have sharply improved. Several factors have contributed towards this : increase in the sales volume, decrease in selling prices and financial expenses, and strutural factors (restructuration…). In the second half of 2014, the cash situation and the operating balances are likely stable and industrialists would use effectively their cash to drive selling prices down, to get out of debt and to increase the work force.

Man. of other transport equipment

In the manufacture of other transport equipment (shipbuilding, aircraft manufacturing and railway construction), the operating balances are slightly increasing while the cash position remains below their long-term average. According to the industrialists, while the cash position would improve in the second half of 2014, the operating balances should clearly deteriorate. The industrialists plan to use effectively their cash at first in order to drive their selling prices down.

OTHER MANUFACTURING

In the other manufactures of the manufacturing industry, the cash position as much as the operating balances have improved and are slightly above their long-term average level. For the second half of 2014, the cash position would markedly improve while the operating balances would go slightly down. The industrialists plan to use their cash in order to drive their selling prices down on the one hand and to increase their equipment spending on the other hand.

tableau – Cash position and operating balance in a sector-based approach

| NA* : (A17) et [A 38] | Aver.** | June 2013 | Dec. 2013 | June 2014 |

|---|---|---|---|---|

| (C1) Man. of goods products and beverages | ||||

| Current cash position | –5 | –17 | –9 | –7 |

| Current operating balance | 11 | 1 | 14 | 14 |

| Expected evolution of cash position | 4 | –11 | –8 | –11 |

| Expected evolution of operating balance | 11 | –5 | –3 | 2 |

| (C3) Electrical and electronic equipment; machine equipment | ||||

| Current cash position | –7 | –14 | –11 | –6 |

| Current operating balance | 7 | 2 | 12 | 7 |

| Expected evolution of cash position | 1 | 0 | –13 | 5 |

| Expected evolution of operating balance | 11 | 1 | 10 | 3 |

| (C4) Man. of transport equipment | ||||

| Current cash position | –2 | –9 | –12 | –9 |

| Current operating balance | 7 | –41 | –52 | –3 |

| Expected evolution of cash position | –3 | –45 | 4 | 6 |

| Expected evolution of operating balance | 10 | –25 | 8 | –3 |

| Man. of motor vehicules, trailers and semi-trailers [CL1] | ||||

| Current cash position | –3 | –11 | –10 | –7 |

| Current operating balance | –5 | –77 | –76 | –9 |

| Expected evolution of cash position | 1 | –62 | 2 | 2 |

| Expected evolution of operating balance | 14 | –57 | 1 | 3 |

| Man. of other transport equipment [CL2] | ||||

| Current cash position | –1 | –5 | –16 | –14 |

| Current operating balance | 6 | 31 | –3 | 8 |

| Expected evolution of cash position | –10 | –10 | 7 | 15 |

| Expected evolution of operating balance | 2 | 39 | 21 | –17 |

| (C5) Other manufacturing | ||||

| Current cash position | –7 | –10 | –9 | –2 |

| Current operating balance | 7 | –8 | 6 | 11 |

| Expected evolution of cash position | –2 | –8 | –9 | 7 |

| Expected evolution of operating balance | 9 | –6 | 9 | 3 |

- * NA : agregated nomenclature , based on the NAF rév. 2. The describe of the NA is available in the web-page of this indicator.

- ** : Long-term average of balances.

- Source : Cash survey in industry - Insee

Pour en savoir plus

Time series : Cash flow