13 June 2013

2013- n° 136In Q1 2013, the labor cost index-total labor costs decreased by 1.9% Labor cost index in industry, construction and services - 1st Quarter 2013

13 June 2013

2013- n° 136In Q1 2013, the labor cost index-total labor costs decreased by 1.9% Labor cost index in industry, construction and services - 1st Quarter 2013

In the first quarter of 2013, the labor cost index (LCI) - wages & salaries for the business economy remained stable (+0.0%) in seasonally adjusted data. In the fourth quarter of 2012 the index had increased by 0.7%. In year-on-year changes, the LCI - wages & salaries increased by 1.7%. Hours worked remained stable (+0.0% in year-on-year change).

Warning: In the first quarter of 2013, the tax credit for encouraging competitiveness and jobs (CICE) is included in the calculation of the hourly labor cost as a subsidy received by the employer. As a result, for business economy (excluding agriculture), the labor cost index – total labour cost is 1.8% lower what it would have been without CICE. The LCI – wages & salaries is not impacted.

The labor cost index - wages & salaries

In the first quarter of 2013, the labor cost index (LCI) - wages & salaries for the business economy remained stable (+0.0%) in seasonally adjusted data. In the fourth quarter of 2012 the index had increased by 0.7%. In year-on-year changes, the LCI - wages & salaries increased by 1.7%. Hours worked remained stable (+0.0% in year-on-year change).

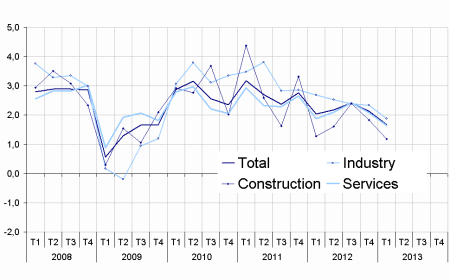

graphiqueGraphSSangl – LCI - wages & salaries : Year-on-year changes

Wages slowed down in industry and decreased in construction

Wages increased by 0.3% in industry after +1.0% in the fourth quarter 2012. They remained stable in manufacturing (+0.1%) but recovered in the gas and electricity sector (+1.8% after –0.4%). In year-on-year changes, wages rised by 1.9% in industry. In the construction sector, they decreased in the first quarter 2013 by 0.6%. In year on year changes, they slowed down (+1.2% after +1.8%).

Wages decreased slightly in services

Wages decreased by 0.1% in services in the first quarter 2013 after +0.6%. Particularly, they remained stable in real estate activities (+0.0% after +1.2%) and fell in finance (-1.4% after +1.2%). In year on year changes, wages slowed down in services (+1.6% after +2.1%).

tableauTableau 1 – LCI - wages & salaries

| Quarterly variations (%) | Annual variations (%) | |||

|---|---|---|---|---|

| Q4-12 | Q1-13 | Q4-12 | Q1-13 | |

| Industry | 1.0 | 0.3 | 2.3 | 1.9 |

| Mining and quarrying | 1.4 | 0.7 | 2.6 | 3.5 |

| Manufacturing | 1.5 | 0.1 | 2.5 | 2.0 |

| Electricity, gas, steam and air conditioning supply | –0.4 | 1.8 | 0.1 | 0.3 |

| Water supply; sewerage, waste management and remediation activities | –0.2 | –0.2 | 1.6 | 0.8 |

| Services | 0.6 | –0.1 | 2.1 | 1.6 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.4 | –0.1 | 2.1 | 1.4 |

| Transportation and storage | 0.6 | 0.6 | 1.5 | 1.6 |

| Accommodation and food service activities | 0.1 | 0.2 | 2.2 | 1.5 |

| Information and communication | 0.2 | 0.0 | 1.9 | 1.4 |

| Financial and insurance activities | 1.2 | –1.4 | 2.8 | 1.9 |

| Real estate activities | 1.2 | 0.0 | 1.6 | 0.7 |

| Professional, scientific and technical activities | 0.4 | 0.1 | 1.9 | 1.4 |

| Administrative and support service activities | 0.2 | –0.1 | 1.5 | 1.4 |

| Construction | 0.8 | –0.6 | 1.8 | 1.2 |

| TOTAL | 0.7 | 0.0 | 2.1 | 1.7 |

Small upward revision

The evolution of wages in the fourth quarter of 2012 is revised upward by 0.1 point in quarterly variation and in year on year variation.

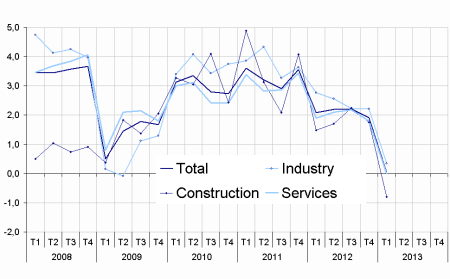

The labor cost index – total labour cost

From the 1st January of 2013, date where it was implemented, the tax credit for encouraging competitiveness and jobs (CICE) is taken into account in the calculation of the LCI – total labour cost as a subsidy received by the employer. In the first quarter of 2013, when incorporating the CICE, the labor cost index (LCI) – total labour cost for the business economy decreased by 1.9% (seasonally adjusted data) after +1.0% in the fourth quarter of 2012.

In annual variation, the labor cost index (LCI) – total labour cost remained stable (+0.0%). Without the CICE, it would have increased by 1.8% in year on year change.

graphiqueGraphSCangl – LCI - total labor cost: Year-on-year changes

Small revision of the Q4 index

The evolution of the labor cost index (LCI) – total labour cost in the fourth quarter of 2012 is revised upward by 0.1 point in year on year variation and remained unchanged in quarterly variation.

tableauTableau 8 – LCI - total labor cost

| Quarterly variations (%) | Annual variations (%) | |||

|---|---|---|---|---|

| Q4-12 | Q1-13 | Q4-12 | Q1-13 | |

| Industry | 1.4 | –1.6 | 2.2 | 0.3 |

| Mining and quarrying | 1.9 | –1.4 | 2.5 | 1.8 |

| Manufacturing | 2.0 | –1.9 | 2.4 | 0.3 |

| Electricity, gas, steam and air conditioning supply | –0.3 | 0.7 | 0.2 | –0.7 |

| Water supply; sewerage, waste management and remediation activities | 0.7 | –2.7 | 1.3 | –1.1 |

| Services | 0.9 | –2.0 | 1.8 | 0.0 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 1.0 | –2.5 | 1.8 | –0.6 |

| Transportation and storage | 1.0 | –1.4 | 1.2 | –0.4 |

| Accommodation and food service activities | 0.5 | –2.8 | 1.9 | –0.9 |

| Information and communication | 0.3 | –1.1 | 1.7 | 0.4 |

| Financial and insurance activities | 1.4 | –2.5 | 2.7 | 0.9 |

| Real estate activities | 2.0 | –2.2 | 1.3 | –0.8 |

| Professional, scientific and technical activities | 0.5 | –1.2 | 1.7 | 0.2 |

| Administrative and support service activities | 0.1 | –2.4 | 0.7 | –1.0 |

| Construction | 1.2 | –2.8 | 1.7 | –0.8 |

| TOTAL | 1.0 | –1.9 | 1.9 | 0.0 |

- Sources: Acoss, Dares, Insee

tableauTableau 9 – LCI - total labor cost without CICE

| Quarterly variations (%) | Annual variations (%) | |

|---|---|---|

| Q1-13 | Q1-13 | |

| Industry | –0.1 | 2.0 |

| Mining and quarrying | 0.3 | 3.7 |

| Manufacturing | –0.3 | 2.1 |

| Electricity, gas, steam and air conditioning supply | 1.7 | 0.3 |

| Water supply; sewerage, waste management and remediation activities | –0.9 | 0.9 |

| Services | –0.4 | 1.7 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | –0.7 | 1.4 |

| Transportation and storage | 0.4 | 1.6 |

| Accommodation and food service activities | –0.2 | 1.7 |

| Information and communication | –0.1 | 1.4 |

| Financial and insurance activities | –1.6 | 1.9 |

| Real estate activities | –0.7 | 0.8 |

| Professional, scientific and technical activities | –0.1 | 1.4 |

| Administrative and support service activities | –0.2 | 1.4 |

| Construction | –0.6 | 1.4 |

| ENSEMBLE | –0.3 | 1.8 |

- Sources: Acoss, Dares, Insee