30 September 2010

2010- n° n°xx The public debt reached 1591.5 billion euros Debt of the general government according to the Maastricht definition - 2nd Quarter

30 September 2010

2010- n° n°xx The public debt reached 1591.5 billion euros Debt of the general government according to the Maastricht definition - 2nd Quarter

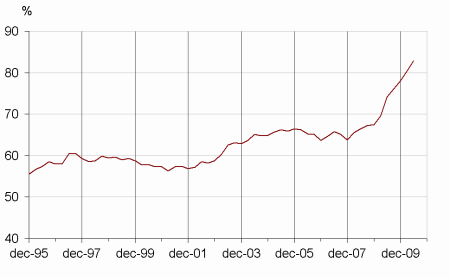

At the end of the second quarter of 2010, the public debt, which is a gross debt, reached 1591.5 billion euros, a 56.0 billion euros rise compared to Q1 2010. As a percentage of GDP, the debt amounted approximately to 82.9%, +2.5 points compared to Q1 2010. The growth of the general governement net debt (*) was lower and represented approximately 73.9% of the GDP, +1.2 point compared to Q1 2010.

A 56.0 billion euros increase of the public debt

At the end of the second quarter of 2010, the public debt, which is a gross debt, reached 1591.5 billion euros, a 56.0 billion euros rise compared to Q1 2010. As a percentage of GDP, the debt amounted approximately to 82.9%, +2.5 points compared to Q1 2010. The growth of the general governement net debt (*) was lower and represented approximately 73.9% of the GDP, +1.2 point compared to Q1 2010.

graphiqueGraphIR_EN – Debt of the general government according to the Maastricht definition (% of GDP)

tableauTableau1 – The debt of the general government according to the Maastricht definition at the end of Q2 2010 by sub-sector and by instrument category

| Q2 2009 | Q3 2009 | Q4 2009 | Q1 2010 | Q2 2010 | |

|---|---|---|---|---|---|

| General government | 1428.6 | 1457.3 | 1489.0 | 1535.5 | 1591.5 |

| % of GDP | 74.2% | 76.2% | 78.1% | 80.4% | 82.9% |

| of which, by sub-sector : | |||||

| State | 1134.6 | 1158.0 | 1162.6 | 1206.0 | 1249.6 |

| Central agencies | 109.2 | 108.2 | 115.3 | 112.6 | 119.6 |

| Local government | 142.3 | 142.8 | 156.8 | 154.0 | 151.4 |

| Social security funds | 42.4 | 48.3 | 54.3 | 63.0 | 70.9 |

| of which, by category : | |||||

| Currency and deposits | 19.0 | 19.7 | 20.3 | 19.3 | 19.0 |

| Securities other than shares | 1223.5 | 1248.0 | 1261.5 | 1301.3 | 1350.1 |

| of which : | |||||

| Short-term securities | 227.0 | 264.7 | 261.1 | 258.9 | 259.7 |

| Long-term securities | 996.5 | 983.3 | 1000.5 | 1042.4 | 1090.4 |

| Loans | 186.0 | 189.6 | 207.1 | 215.0 | 222.4 |

| of which : | |||||

| Short-term loans | 23.6 | 26.2 | 24.2 | 39.2 | 47.5 |

| Long-term loans | 162.4 | 163.5 | 182.9 | 175.7 | 174.9 |

- Source : National accounts - Insee, DGFiP, Banque de France

(*) The public net debt is defined as the difference between the public debt according to the Maastricht definition and the deposits, loans and securities other than shares held by the general government over the other sectors. Those assets are accounted in their nominal value.