Informations Rapides ·

6 January 2023 · n° 5

Informations Rapides ·

6 January 2023 · n° 5 In 2021, leasing exceeded its pre-crisis level Annual financial lease survey - year 2021

In 2021, leasing exceeded its pre-crisis level Annual financial lease survey - year 2021

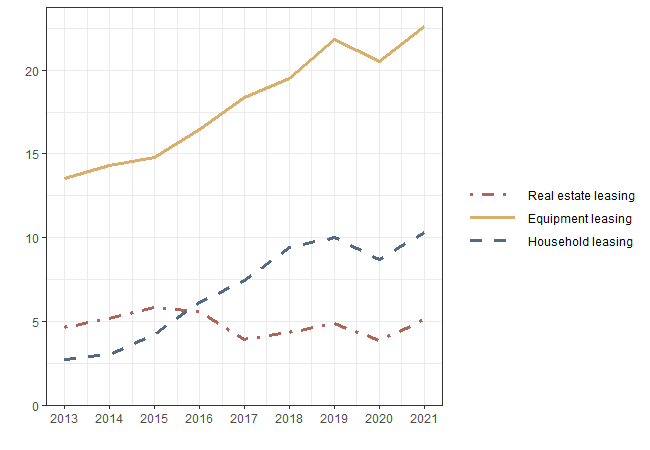

In 2021, the total amount of investments financed by leasing amounted to 38.1 billion euros (€bn). It represented 1.5% of the Gross Domestic Product (GDP) or 6.1% of the gross fixed capital formation of the national economy. It was up by 15.0% over one year (+€5.0 billion) and stood 3.6% above its high point in 2019 (€36.7 billion).

All types of leasing bounced back in 2021. Business equipment leasing rose by 10.2% (i.e. a contribution to the global growth of +6.3 points). Household investments increased by 17.2% (i.e. a contribution of 4.8 points). Real estate leasing rebounded more strongly: +32.6% after -21.3% in 2020 (i.e a contribution of +3.8 points).

- After a decrease in 2020, equipment leasing was boosted by cars

- Equipment leasing was supported by commerce, administrative services and construction businesses

- In 2021, real estate leasing was driven by factories

- Companies revitalized their real estate investments

- Île-de-France: first region in value, last relative to GDP

- For more information

In 2021, the total amount of investments financed by leasing amounted to 38.1 billion euros (€bn). It represented 1.5% of the Gross Domestic Product (GDP) or 6.1% of the gross fixed capital formation of the national economy. It was up by 15.0% over one year (+€5.0 billion) and stood 3.6% above its high point in 2019 (€36.7 billion).

All types of leasing bounced back in 2021. Business equipment leasing rose by 10.2% (i.e. a contribution to the global growth of +6.3 points). Household investments increased by 17.2% (i.e. a contribution of 4.8 points). Real estate leasing rebounded more strongly: +32.6% after -21.3% in 2020 (i.e a contribution of +3.8 points).

graphiqueInvestments financed by type of lease

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2022

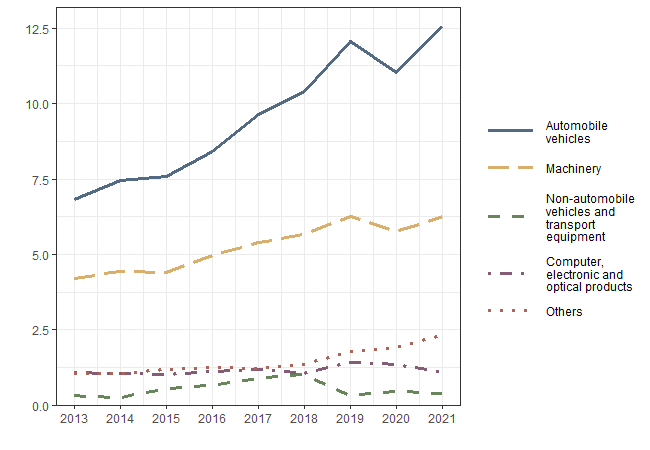

After a decrease in 2020, equipment leasing was boosted by cars

Equipment leasing rose by 10.2% in 2021 after -5.9% in 2020. It continues to be largely used for cars (55.5% in 2021), and machinery (27.7%). Investments in these two types of products were dynamic, they respectively rose by 13.8% and 8.6%. On the other hand, computer, electronic and optical products which had been more resilient to the crisis lost 19.7% of their financing.

graphiqueEquipment leasing investments : main products

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2022

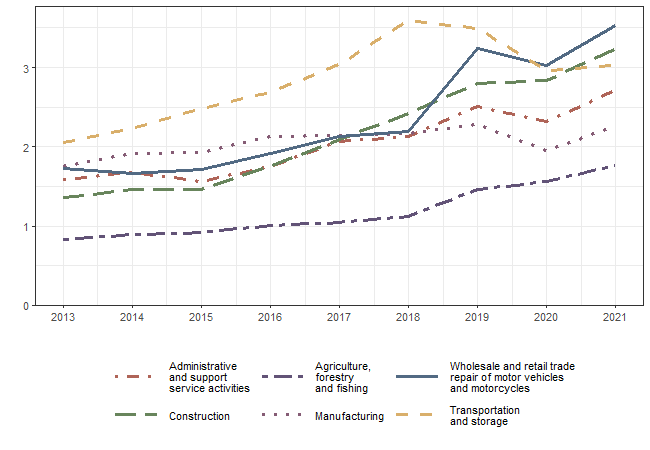

Equipment leasing was supported by commerce, administrative services and construction businesses

In 2021, the increase in investment in equipment leasing (+10.2%) was mostly driven by three sectors of activity : trade businesses (contributing 2.4 points), administrative and support services, and construction (1.9 points each). Together, they account for almost 61% of the rebound in equipment leasing.

Most of the sectors retrieved their pre-crisis level, and some even recovered their dynamism after having diminished their investments in 2020. Agriculture and construction, the two sectors that had slowed down their investments in 2020 but had not reduced them retrieved their pre-crisis pace. On the other hand, businesses specializing in transport and warehousing were the exception in 2021. Although they have long been the main equipment leasing customers, this sector of activity did not rebound and investment remained relatively stable in 2021.

graphiqueEquipment leasing investments : main clients by sector of activity

- Note : Excluding investments made abroad

- Source: INSEE - Annual leasing survey of 2022

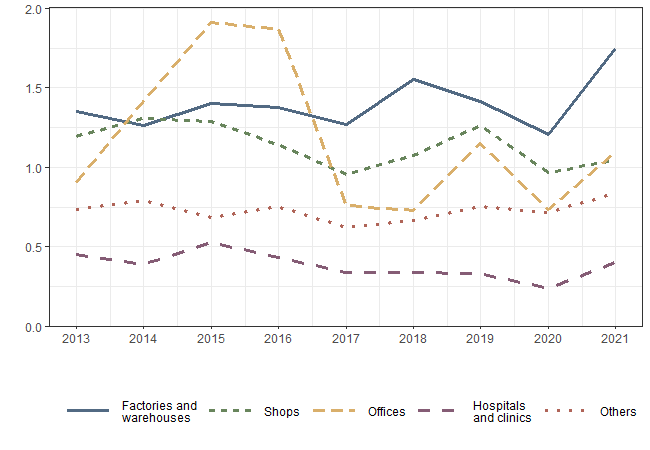

In 2021, real estate leasing was driven by factories

Real estate leasing rebounded in 2021 (+32,6% i.e. +€1.3 billion), being largely driven by investments in factories and warehouses (+45.2%). The financing of office buildings was also on the rise in 2021 (+48.5%), without getting back to its 2019 level. Investments dedicated to clinics and hospitals increased by 69.3%. In contrast, the recovery was much weaker for shops.

graphiqueReal estate leasing investments : main usages

- Source: INSEE - Annual leasing survey of 2022

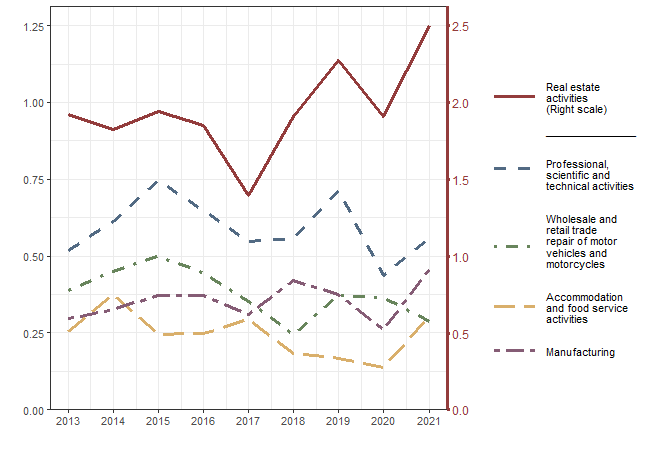

Companies revitalized their real estate investments

In 2021, real estate leasing rebounded in almost all sectors of activity after having fallen in 2020. Almost half (48.8%) of real estate leasing flows correspond to investments in the sector of real estate activities for the purpose of simple rentals. They rebounded strongly in 2021 and exceeded their 2019 level reaching €2.5 billion. In some other sectors investments also rebounded strongly in 2021, in particular manufacturing industry (74.2%) and accommodation and food services activities (+122.1%). Conversely, in the trade sector, real estate leasing decreased (-21.8%).

graphiqueReal estate leasing investments : main clients by sector of activity

- Note : Right scale for real estate activities

- Source: INSEE - Annual leasing survey of 2022

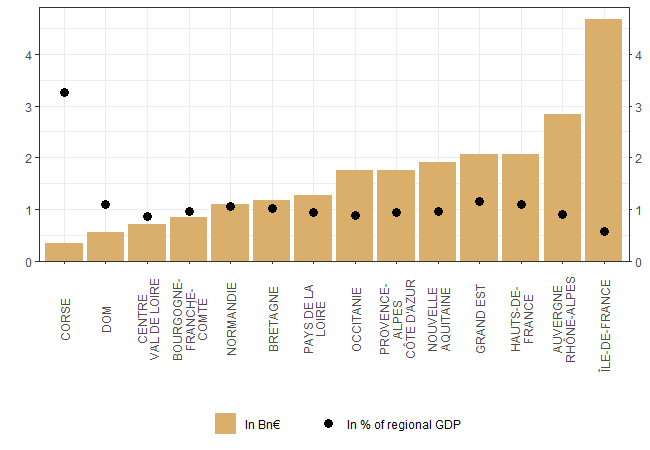

Île-de-France: first region in value, last relative to GDP

Business investments in equipment and real estate leasing were mainly located in Île-de-France (20.2% of the total in 2021) and to a lesser extent in Auvergne-Rhône-Alpes (12.2%). The financing shares of the other regions varied from 1.4% for Corsica to 8.9% for Hauts-de-France.

This ranking is reversed by relating these amounts to the GDP of each region. Companies invested in Corsica the equivalent of 3.3% of the island's GDP. In Auvergne-Rhône-Alpes and Île-de-France, investments in the form of leasing represented less than 1% of the GDP (0.9% and 0.6% respectively).

graphiqueLeasing investments relative to regional GDP

- Note : Excluding land investments

- Source: INSEE - Annual leasing survey of 2022

For more information

The annual financial lease survey measures the breakdown of financial lease contracts by institutional sector and sector of activity, knowledge of which is necessary for the economic analysis of company accounts.

Additional information (simplified and detailed methodology, nomenclatures, etc.) is available through the "Documentation" tab of the web page of this publication.