21 December 2018

2018- n° 339In December 2018, the business climate has strongly deteriorated in retail trade Monthly survey of retailing - December 2018

21 December 2018

2018- n° 339In December 2018, the business climate has strongly deteriorated in retail trade Monthly survey of retailing - December 2018

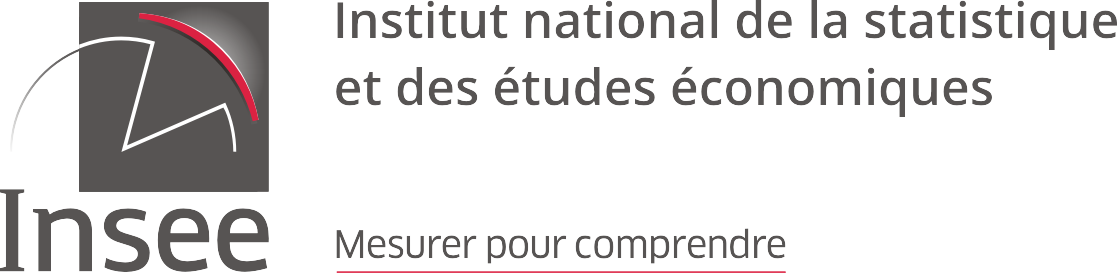

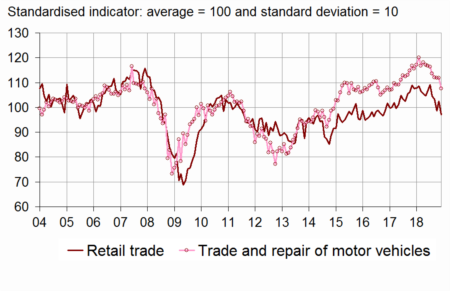

According to the managers in retail trade and in trade and repair of motor vehicles, the business climate has slumped in December 2018. The composite indicator that measures it has lost seven points and has returned to its long-term average (100), that is its lowest level since February 2015

According to the managers in retail trade and in trade and repair of motor vehicles, the business climate has slumped in December 2018. The composite indicator that measures it has lost seven points and has returned to its long-term average (100), that is its lowest level since February 2015

graphiqueChart_1 – Business climate synthetic indicator

The general business outlook have deteriorated sharply

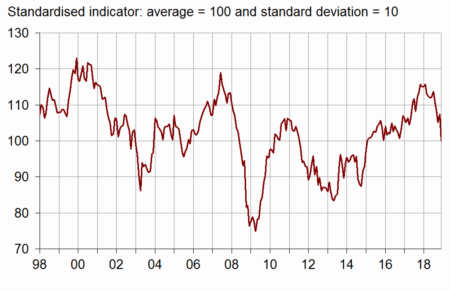

In December, the managers are markedly more pessimistic on the general business outlook for the sector: the corresponding balance has plummeted and has moved below its long-term mean, at its lowest level since January 2015, certainly in link with the “yellow vests” social movement. Many more managers than in November have also anticipated a decrease in their sales for the next three months. The corresponding balance of opinion has slipped back markedly and has moved below its long-term average, at its lowest since November 2016. That on their ordering intentions has declined but remains above its long-term mean. The balance on recent sales is virtually stable, slightly below its mean. The balance on expected prices has risen sharply and has exceeded its average even more, at its highest level since February 2012.

tableauTable_1 – Tendency in retail trade and in trade and repair of motor vehicles

| Ave. (1) | Sep 18 | Oct 18 | Nov 18 | Dec 18 | |

|---|---|---|---|---|---|

| Business climate | 100 | 108 | 105 | 107 | 100 |

| General business outlook | –28 | –15 | –13 | –18 | –36 |

| Recent sales | –6 | –1 | –10 | –8 | –7 |

| Expected sales | –1 | 4 | –1 | 7 | –2 |

| Ordering intentions | –7 | 2 | –5 | 1 | –4 |

| Stocks | 11 | 13 | 11 | 15 | 17 |

| Past selling prices (2) | –6 | –3 | –3 | ||

| Expected selling prices | –3 | –1 | –2 | –1 | 4 |

| Cash position (2) | –15 | –14 | –13 | ||

| Workforce size: recent trend | 1 | –2 | 0 | 4 | 1 |

| Workforce size: future trend | –3 | 0 | –3 | –1 | –4 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in retail trade and in trade and repair of motor vehicles

graphiqueChart_2 – Recent sales and ordering intentions

The opinion on employment has deteriorated

More managers than in November have foreseen a decrease in their staff size: the associated balance hasfallen back in retail trade as well as in trade and repair of motor vehicles. Concerning past employment, the balance of opinion has decreased in retail trade; whereas it has increased in trade and repair of motor vehicles for the second consecutive month. In retail trade, those two balances of opinion have moved below their long-term mean.

In retail trade, the business climate has darkened significantly

In retail trade, the business climate has sharply deteriorated: in December, the composite indicator that measures it has lost six points. Standing at 97, it has fallen to its lowest level since November 2016 and has returned below its long-term average (100). Retailers are far more pessimistic than in November on the general business outlook: the corresponding balance has dropped below its mean. The balance of opinion on ordering intentions has also decreased, due to non-specialised trade but remains above its mean. Many more retailers than in November have anticipated a decrease in their sales: the corresponding balance on opinion has declined, at its lowest level since November 2016, and has passed below its mean. That on recent sales has increased again slightly but remains below its long-term mean. Non-specialised retailers have indicated high levels of stocks. Many more of them intend to rise their prices for the next few months: the corresponding balance has jumped, at its highest level since December 2007.

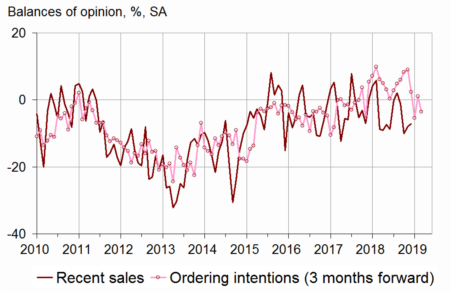

In trade and repair of motor vehicles, the business climate has weakened but remains at a relatively high level

In trade and repair of motor vehicles and motorcycles, the business climate has lost four points but remains at a relatively high level (108). It has been above its long-term average (100) since January 2015. The balance of opinion concerning general business outlook has fallen back sharply, that on expected sales and ordering intentions have also declined. The balance on opinion on past sales has decreased for the fifth consecutive month. Those four balances of opinion remain above their long-term mean. Stocks are estimated rather high. The balance of opinion on expected prices has slightly decreased and has returned to its mean.

graphiqueChart_3 – Recent sales and ordering intentions in trade and repair of motor vehicles

graphiqueChart_4 – Business climate synthetic indicator in retail trade and in trade and repair of motor vehicles

tableauTable_2 – Detailed data

| Ave. (1) | Sep 18 | Oct 18 | Nov 18 | Dec 18 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Business climate | 100 | 103 | 99 | 103 | 97 |

| Gener. busin. outlook | –29 | –19 | –16 | –21 | –38 |

| Recent sales | –6 | –6 | –16 | –12 | –10 |

| Expected sales | 0 | 2 | 0 | 9 | –2 |

| Ordering intentions | –6 | 2 | –9 | 0 | –4 |

| Stocks | 10 | 10 | 10 | 11 | 16 |

| Past selling prices (2) | –8 | –4 | 0 | –4 | 0 |

| Expected selling prices | –5 | –2 | –3 | –5 | 2 |

| Cash position (2) | –13 | –14 | –14 | ||

| Workforce size: recent trend | 2 | –2 | –1 | 2 | –1 |

| Workforce size: future trend | –2 | –1 | –5 | –2 | –6 |

| Non-specialised retail trade | |||||

| Recent sales | –2 | 5 | –10 | –5 | 1 |

| Expected sales | 7 | 14 | 8 | 27 | 15 |

| Ordering intentions | 2 | 13 | –1 | 15 | 6 |

| Stocks | 7 | 7 | 6 | 8 | 20 |

| Past selling prices (2) | –8 | 2 | –1 | ||

| Expected selling prices | –5 | 1 | 1 | 1 | 18 |

| Cash position (2) | –7 | –8 | –8 | ||

| Specialised retail trade | |||||

| Recent sales | –12 | –18 | –24 | –20 | –22 |

| Expected sales | –8 | –10 | –8 | –7 | –20 |

| Ordering intentions | –16 | –10 | –17 | –16 | –18 |

| Stocks | 13 | 11 | 14 | 12 | 13 |

| Past selling prices (2) | –8 | –9 | –8 | ||

| Expected selling prices | –5 | –5 | –8 | –11 | –16 |

| Cash position (2) | –22 | –20 | –20 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Business climate | 100 | 112 | 112 | 112 | 108 |

| Gener. busin. outlook | –25 | –3 | 0 | –6 | –20 |

| Recent sales | –6 | 10 | 4 | 1 | –2 |

| Expected sales | –5 | 9 | –4 | 4 | 0 |

| Ordering intentions | –9 | 4 | 5 | 6 | 1 |

| Stocks | 15 | 20 | 15 | 24 | 22 |

| Past selling prices (2) | 1 | –2 | 0 | ||

| Expected selling prices | 4 | 4 | 5 | 5 | 4 |

| Cash position (2) | –23 | –13 | –14 | ||

| Workforce size: recent trend | –8 | 3 | 1 | 4 | 6 |

| Workforce size: future trend | –6 | 3 | 2 | 6 | 3 |

- (1) Average since 1991 (2003 for trade and repair of motor vehicles and 2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: INSEE - monthly survey in retail trade and in trade and repair of motor vehicles

Documentation

Methodology (pdf,46 Ko)