8 August 2018

2018- n° 207In Q2 2018, tourist collective accommodation attendance slowed down (+2,1 % over

one year, after +7,4 % in the previous quarter) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - second quarter 2018

8 August 2018

2018- n° 207In Q2 2018, tourist collective accommodation attendance slowed down (+2,1 % over

one year, after +7,4 % in the previous quarter) Tourism occupancy in hotels, campsites and holiday and other short-stay accommodation

in metropolitan France - second quarter 2018

In Q2 2018, throughout metropolitan France, the number of overnight stays in tourist collective accommodation was up by 2.1% compared to the same period of 2017. This increase reached 7.4% the revious quarter. Thus, after the strong catch up in 2016 in the period post terrorist attacks, then the clear dynamics of 2017, attendance returned to a moderate growth pace. The number of overnight stays was about 9% higher than the 2014/2015 average. Growth was driven by non-resident (+4.5%) and by a dynamic attendance in Île-de-France.

- Tourist numbers in metropolitan France continued to grow but more modestly

- In hotels, non-resident customers numbers remained dynamic

- Holiday and other short-stay accommodation in Île-de-France : a much requested destination

- Occupancy in campsites was driven by pitches with rental accomodations

- A good occupancy in May

- Revisions

Tourist numbers in metropolitan France continued to grow but more modestly

In Q2 2018, throughout metropolitan France, the number of overnight stays in tourist collective accommodation was up by 2.1% compared to the same period of 2017. This increase reached 7.4% the revious quarter. Thus, after the strong catch up in 2016 in the period post terrorist attacks, then the clear dynamics of 2017, attendance returned to a moderate growth pace. The number of overnight stays was about 9% higher than the 2014/2015 average. Growth was driven by non-resident (+4.5%) and by a dynamic attendance in Île-de-France.

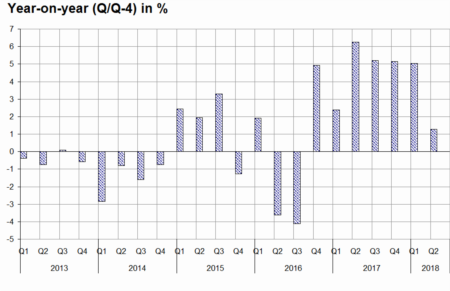

In hotels, non-resident customers numbers remained dynamic

In Q2 2018, attendance in hotels increased by 1.3% compared to the same quarter of 2017. The rise was marked in the high-end (+4.2%). In the bottom of the range (1 or 2 stars or unclassified hotels), the park globally dwindled about 3% and the overnight stays was globally stable. Furthermore, some hotels did not reiterated their request of classification Atout France, hence the strong growth of unclassified hotels.

Attendance by non-residents remained dynamic (+5.6% after +13.5%), particularly in Île-de-France. Residents fell back (−1.3%), after a year and a half up. Occupancy continued to grow in Île-de-France (+3.9%) and « other spaces » (+1.7%). It held steady in provincial urban area and decreased compared to the previous year in ski mountain area and in coastlines.

graphiqueGraph1 – Overnight stays in hotels

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

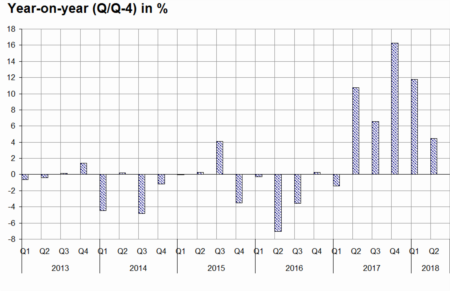

Holiday and other short-stay accommodation in Île-de-France : a much requested destination

Attendance at holiday and other short stay accomodation (HOSSA) increased by 4.4% compared to the same quarter of 2017 (+11.8% in the previous quarter).

Occupancy increased sharply in Île-de-France while the end of the winter season was poor in the ski montain area (–11.9% over one year). Resident customer grew faster than non-resident (respectively +4.8% et +2.9%). This rise in the number of customers living in France remained very strong in urban areas, more in Île-de-France (+25.8%) than in the provinces (+11.3%).

graphiqueGraph2 – Overnight stays in HOSSA

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

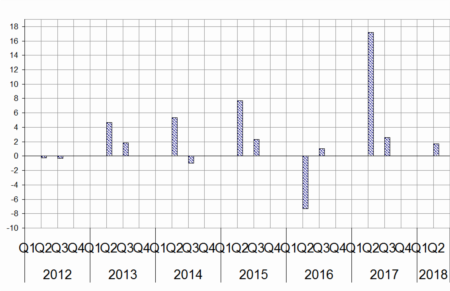

Occupancy in campsites was driven by pitches with rental accomodations

Attendance in campsites increased by 1.7% over one year, mainly due to non-resident customers (+2.7%). Growth was driven by 3 stars campsites (+4.6%) and more moderately by 4 and 5 stars (+2.6%) and essentially concerned pitches with rental accomodation. Occupancy in coastlines (+2.2%) benefitied from mild weather conditions.

graphiqueGraph3 – Overnight stays in campsites

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

A good occupancy in May

A part of the slowdown in the second quarter of 2018 was due to a calendar effect. Indeed, the Eastern weekend was in march this year instead of mid-April in 2017. However, the month of May 2018 benefited from the last week of Easter holidays and the presence of Whit Monday.

Finally, in campsites, the beginning of the summer season was even more dependent on the weather and calendar than for other types of accommodation. The decline in April 2018 (–26% compared to an exceptional month of April 2017) was more than offset by a sharp rise in May (+41%). In June, the gloomy weather and the strikes in transport seem to have penalized tourist occupancy.

Revisions

Compared to the previous publication, the overall variation in the number of overnight stays in Q1 2018 has been unchanged. It has been lowered in HOSSA (+11.8% instead of +12.1%).

tableauTable1 – Overnight stays in Q2 2018*

| Nights of the quarter | Year-on-year (%) (Q/Q-4) | ||||

|---|---|---|---|---|---|

| Total nights (millions) | % of foreign nights | Total | Foreign | French | |

| Total | 109.0 | 32.8 | 2.1 | 4.5 | 0.9 |

| Hotels | 57.4 | 38.6 | 1.3 | 5.6 | –1.3 |

| Unclassified | 7.4 | 28.6 | 25.9 | 40.4 | 20.9 |

| 1 and 2 stars | 13.5 | 27.2 | –10.6 | –3.0 | –13.1 |

| 3 stars | 21.6 | 38.0 | 0.9 | 3.5 | –0.7 |

| 4 and 5 stars | 14.9 | 54.7 | 4.2 | 5.2 | 3.1 |

| hotel chain | 28.5 | 38.8 | 0.1 | 5.0 | –2.8 |

| independent hotel | 28.9 | 38.4 | 2.5 | 6.3 | 0.3 |

| Ile de France | 18.9 | 60.3 | 3.9 | 8.1 | –1.9 |

| Provincial urban area | 20.9 | 27.3 | 0.3 | 4.0 | –1.0 |

| Coastlines | 10.6 | 31.2 | –0.9 | 3.5 | –2.8 |

| Ski mountain area | 1.3 | 32.0 | –2.2 | –10.0 | 1.9 |

| Other area | 5.6 | 22.9 | 1.7 | 3.5 | 1.2 |

| Holiday and other short-stay accomodation | 23.0 | 18.9 | 4.4 | 2.9 | 4.8 |

| Tourism residences | 17.3 | 20.9 | 5.7 | 0.8 | 7.1 |

| Other | 5.7 | 13.0 | 0.9 | 14.9 | –0.9 |

| Ile de France | 3.2 | 33.8 | 21.0 | 12.8 | 25.8 |

| Provincial urban area | 5.1 | 16.0 | 7.8 | –7.5 | 11.3 |

| Coastlines | 8.2 | 13.6 | 2.2 | 2.6 | 2.1 |

| Ski mountain area | 2.3 | 30.0 | –11.9 | –6.8 | –13.9 |

| Other area | 4.2 | 15.2 | 4.7 | 16.2 | 2.9 |

| Campsites | 28.6 | 32.4 | 1.7 | 2.7 | 1.2 |

| Unclassified | 1.2 | 40.1 | –2.1 | –0.3 | –3.3 |

| 1 and 2 stars | 3.0 | 30.9 | –8.4 | –4.1 | –10.3 |

| 3 stars | 8.7 | 33.4 | 4.6 | 8.8 | 2.5 |

| 4 and 5 stars | 15.7 | 31.6 | 2.6 | 1.0 | 3.4 |

| bare pitches | 11.3 | 49.6 | –0.3 | 3.7 | –4.0 |

| pitches with rental accommodation | 17.3 | 21.2 | 3.1 | 3.1 | 3.6 |

| coastlines | 16.2 | 27.8 | 2.2 | 3.3 | 1.8 |

| except coast | 12.4 | 38.5 | 1.1 | 2.2 | 0.4 |

- Reference area : Metropolitan France

- *provisional data

- Source: INSEE, in partnership with the Regional Committees of tourism (CRT) and DGE

Pour en savoir plus

Time series: Tourism