25 September 2013

2013- n° 217In September 2013, the business climate is reaching its average in the retail trade

and in the trade and repair of motor vehicles Monthly survey of retailing - September 2013

25 September 2013

2013- n° 217In September 2013, the business climate is reaching its average in the retail trade

and in the trade and repair of motor vehicles Monthly survey of retailing - September 2013

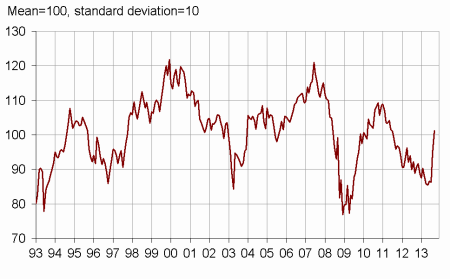

According to the managers, the business climate in the retail trade and in the trade and repair of motor vehicles is recovering again significantly in September 2013: the composite indicator increased by 8 points, after 6 in August. It is reaching reaches its long-term average, for the first time for two years.

According to the managers, the business climate in the retail trade and in the trade and repair of motor vehicles is recovering again significantly in September 2013: the composite indicator increased by 8 points, after 6 in August. It is reaching reaches its long-term average, for the first time for two years.

graphiquegraph_indsynt_en – Business climate synthetic indicator

Much better past and expected activities

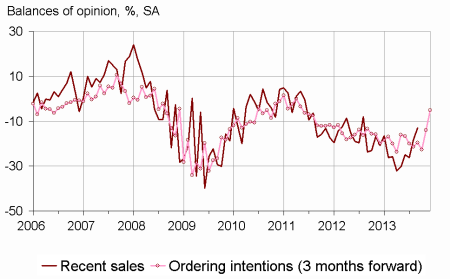

Less business leaders than in August declared a decrease in their past activity: if the corresponding balance went on progressing for two surveys, it remains under its mean level yet. About their expected activity, the business leaders were more optimistc too: each of the three balances concerning expected sales, ordering intentions and general business outlook increased and is now near its long term average.

The level of stocks has been considered lower, significantly under its average.

The balances concerning past and expected prices have been unchanged, and remain near their mean levels.

The cash-flow situation is still declared difficult.

graphiqueGraph_ventes_ic_en – Recent sales and ordering intentions

tableautab1_en – Global data

| Ave. (1) | June 13 | July 13 | Aug 13 | Sept. 13 | |

|---|---|---|---|---|---|

| Business climate | 100 | 86 | 86 | 95 | 101 |

| General business outlook | –30 | –54 | –48 | –36 | –30 |

| Recent sales | –7 | –25 | –26 | –18 | –13 |

| Expected sales | –3 | –19 | –18 | –10 | –4 |

| Ordering intentions | –9 | –20 | –23 | –14 | –5 |

| Stocks | 11 | 11 | 13 | 7 | 5 |

| Past selling prices (2) | –6 | –9 | –7 | ||

| Expected selling prices | –3 | –8 | –2 | –4 | –1 |

| Cash position (2) | –15 | –27 | –23 | ||

| Workforce size: recent trend | 0 | –9 | –10 | –7 | –10 |

| Workforce size: future trend | –2 | –12 | –12 | –9 | –6 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Still unfavourable employment

According to the business managers, employment should keep grim, even though an improvement in the expected balance is perceptible.

Retail trade

Still progressing past and expected activity

Less trade retailers than in August declared a decrease in their past activity. In non-specialized trade, the corresponding balance is now very close to its average, but in specialized trade, it is still low.

Retailers expectations are less pessimistic: each of the two balances concerning expected sales and ordering intentions kept on increasing, becoming close to its mean level.

Stocks were declared lighter again, getting very low under their average.

The past prices balance stabilized at their mean level, the expected prices one rose a little from its average.

The cash-flow situation was considered less difficult than in July.

Trade and repair of motor vehicles

graphiquegraph_ventes_ic_auto_en – Recent sales and ordering intentions in motor vehicles

Uncertain forecasts

Less motor vehicle traders than over the last month declared a fall in their past and expected activity: the balance concerning recent sales remains under its long term average, the ones concerning expected sales reaches it, ordering intentions is getting over it.

Motor vehicle traders think that their stocks are under the mean level.

Comparing to recent surveys, less traders declared a fall in prices, and a little more anticipated it over the next few months.

The cash-flow situation is estimated rather normal.

The recent and future balances concerning workforce size stay very low.

tableautab2_en – Detailed data

| Moy. (1) | June 13 | July 13 | Aug 13 | Sept. 13 | |

|---|---|---|---|---|---|

| Retail trade - Global data | |||||

| Recent sales | –4 | –23 | –28 | –14 | –11 |

| Expected sales | 1 | –18 | –17 | –6 | –2 |

| Ordering intentions | –6 | –19 | –23 | –11 | –3 |

| Stocks | 10 | 11 | 16 | 5 | 2 |

| Past selling prices (2) | –8 | –7 | –7 | ||

| Expected selling prices | –4 | –9 | –2 | –4 | 0 |

| Cash position (2) | –13 | –26 | –21 | ||

| Workforce size: recent trend | 1 | –6 | –6 | –4 | –6 |

| Workforce size: future trend | –1 | –10 | –11 | –7 | –5 |

| Non specialized retail trade | |||||

| Recent sales | –1 | –10 | –24 | –5 | –2 |

| Expected sales | 6 | 0 | –6 | 6 | 7 |

| Ordering intentions | 2 | 0 | –16 | –3 | 14 |

| Stocks | 7 | 4 | 19 | 4 | 3 |

| Past selling prices (2) | –7 | –1 | –3 | ||

| Expected selling prices | –4 | –4 | 4 | –8 | 2 |

| Cash position (2) | –7 | –13 | –6 | ||

| Specialized retail trade | |||||

| Recent sales | –9 | –38 | –34 | –25 | –22 |

| Expected sales | –6 | –34 | –33 | –19 | –12 |

| Ordering intentions | –17 | –39 | –32 | –19 | –24 |

| Stocks | 14 | 19 | 13 | 7 | 1 |

| Past selling prices (2) | –7 | –15 | –12 | ||

| Expected selling prices | –4 | –15 | –9 | 1 | –3 |

| Cash position (2) | –22 | –40 | –38 | ||

| Trade and repair of motor cars and motorcycles | |||||

| Recent sales | –11 | –30 | –21 | –27 | –18 |

| Expected sales | –9 | –25 | –20 | –21 | –10 |

| Ordering intentions | –14 | –23 | –27 | –21 | –9 |

| Stocks | 16 | 12 | 7 | 12 | 10 |

| Past selling prices (2) | 1 | –13 | –6 | ||

| Expected selling prices | 5 | –4 | –1 | –3 | 0 |

| Cash position (2) | –26 | –31 | –28 | ||

| Workforce size: recent trend | –9 | –16 | –21 | –17 | –20 |

| Workforce size: future trend | –7 | –18 | –20 | –15 | –14 |

- (1) Average since 1991 (2004 for recent and expected sales and ordering intentions, and for trade and repair of motor vehicles).

- (2) Bi-monthly question (odd-numbered months).

- Source: monthly survey in the retail trade and in the trade and repair of motor vehicles - INSEE

Documentation

Methodology (pdf,129 Ko)