Economie et Statistique / Economics and Statistics n° 503-504 - 2018 Housing Benefits and Monetary Incentives to Work: Simulations for France

THE ARTICLE ON ONE PAGE

Key question

Housing benefits schemes aim at helping low-income households cover their housing expenditures. In France, this is primarily achieved through monetary transfers to tenants that are increasing with the price of the rent (benefits-rent linkage) and decreasing with households’ earnings (means-testing). What are the disincentives to work associated with housing benefits means-testing? How do they impact overall monetary incentives to work?

Methodology

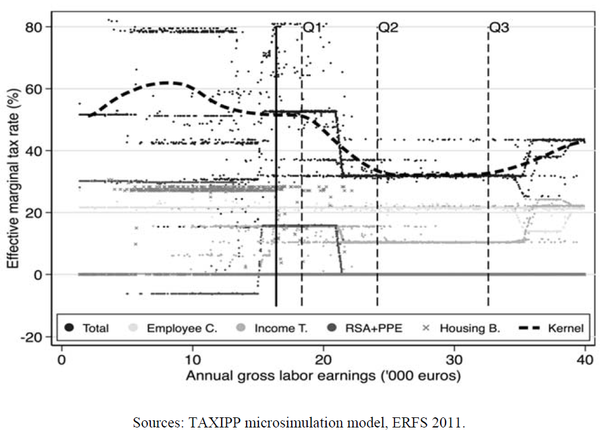

This paper characterizes monetary incentives to work through effective marginal and participation tax rates. These measures are estimated at the individual level for a representative sample of employed childless singles from the 2011 wave of enquête Revenus Fiscaux et Sociaux (ERFS) using TAXIPP microsimulation model and they are decomposed by tax and transfer instruments.

Main results

- A 1-euro increase in labor earnings reduces housing benefits by 27 cents in the phasing-out region of the scheme. Combined with the loss of other transfers (30 cents) and the payment of social contributions (21 cents) this translates into effective marginal tax rates of 80%. This corresponds to the top of the tilde-shape distribution of marginal tax rates with earnings.

- Housing benefits also impose a participation tax of up to 20% (resp. 8%) of labor earnings upon taking a job when individuals are not eligible (resp. eligible) to unemployment benefits when out-of-work. In contrast, the average participation tax rate is 51% (resp. 77%); this reflects an important substitution effect between unemployment benefits and means-tested transfers.

- Results are qualitatively robust to treating unemployment and pension contributions as savings rather than taxes and to assuming employer contributions are shifted to workers.

graphiqueDistribution of Effective Marginal Tax Rates

Message

Housing benefits entail large disincentives to work for low-income individuals. Moreover, since housing benefits seem to be captured by homeowners through increases in rents (benefits-rent linkage), low-income individuals may not effectively receive these benefits even when they effectively face reduced incentives to work. Housing benefits may thus contribute to generating a poverty trap and a reform of the scheme could be very beneficial both to low-income individuals and to the French economy.

Article on one page (pdf, 87 Ko )